Gold (XAUUSD) weekly forecast: growth confirmed

Gold (XAUUSD) prices are hovering near all-time highs in the 4,430–4,620 USD per ounce range following a moderate correction. The market is supported by expectations of monetary policy easing by the Federal Reserve amid weak inflation data in the US and ongoing macroeconomic uncertainty.

Investor focus remains on the future trajectory of US interest rates and the technical structure of the market. Let us examine what to expect during the week of 19–23 January 2026.

XAUUSD forecast for this week: quick overview

- Weekly dynamics: gold (XAUUSD) ended the week near 4,610, close to all-time highs. Prices were supported by weak US producer inflation data and expectations of multiple Fed rate cuts, with concerns over the Fed’s independence driving additional demand. The easing of geopolitical tensions regarding Iran only partially cooled demand for safe-haven assets

- Support and resistance: gold is trading within an ascending channel, with the nearest support level at 4,475–4,430 and key medium-term support at 4,275. Resistance is concentrated in the 4,580–4,620 zone, which corresponds to all-time highs

- Fundamentals: US producer inflation for November was weaker than expected, confirming slowing price pressure. Markets are pricing in multiple Fed rate cuts, despite cautious commentary from some policymakers. Gold was also supported by statements from global central banks defending Federal Reserve Chairman Jerome Powell amid pressure from US President Donald Trump’s administration

- Outlook: baseline scenario suggests consolidation or mild correction within the 4,430–4,620 range. As long as prices stay above 4,430, the uptrend remains in force. A breakout above 4,620 would strengthen the bullish momentum, while a move below 4,430 would open the path to 4,275

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) prices corrected towards 4,610 USD per ounce by the end of the week but remained near all-time highs. The market continues to evaluate the potential scale of monetary easing in the US amid persistent global uncertainty.

November producer inflation data, both headline and core, came in weaker than expected, reinforcing the signals from December’s CPI report. This has strengthened expectations that the Federal Reserve has the flexibility to implement multiple rate cuts throughout the year. At the same time, some Fed officials maintain a cautious stance, citing the risk of more persistent inflation.

An additional factor supporting gold this week was concern over the Fed's independence. Major global central banks publicly voiced support for Fed Chair Jerome Powell following statements from the Trump administration suggesting possible criminal prosecution – which bolstered demand for safe-haven assets.

Geopolitical tensions slightly eased, as Trump indicated he may postpone active measures against Iran. This reduced fears of imminent US military involvement and partially cooled gold’s safe-haven appeal. However, this did not trigger a significant price correction, with gold remaining near record levels by week’s end.

XAUUSD technical analysis

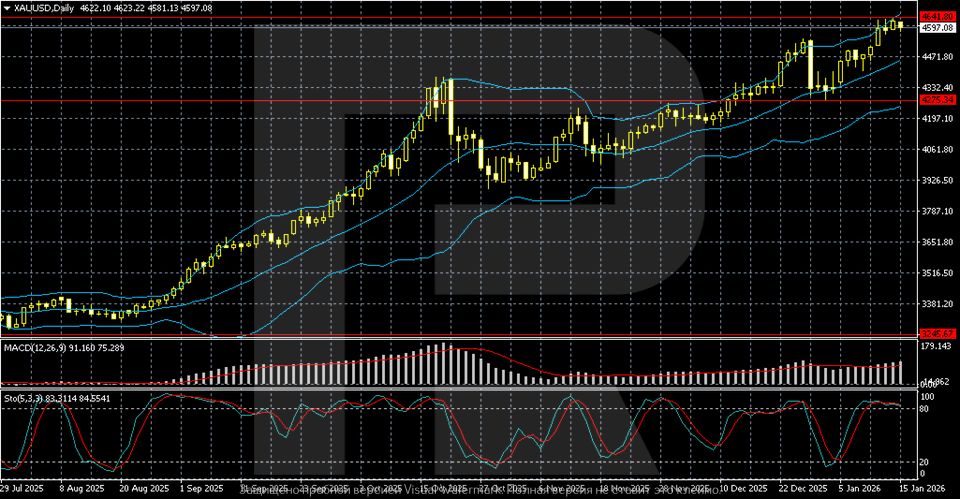

The daily gold (XAUUSD) chart shows a stable uptrend. Gold continues to reach new highs within an expanding ascending channel. After a deep correction in October, the price quickly rebounded above the key 4,275 zone, now serving as a major medium-term support. Recent candlesticks have formed near all-time highs in the 4,580–4,620 area, confirming strong buying interest.

Prices are confidently holding above the midline of the Bollinger Bands, and the channel structure remains upward, confirming the dominance of the bullish trend. The lower Bollinger Band is gradually rising, indicating increasing base-level support. Corrections remain shallow and are quickly bought up, indicating strong demand even on local pullbacks. Indicators confirm the strength of the trend but also point to overheating.

The Stochastic Oscillator is in overbought territory, while MACD remains in positive territory with a rising histogram – although momentum is slowing, increasing the likelihood of short-term consolidation or a mild correction. As long as the price stays above 4,475–4,430, the overall bullish scenario remains the priority.

XAUUSD trading scenarios

The fundamental outlook for gold remains positive. Gold (XAUUSD) ended the week near 4,610, close to all-time highs. The market was supported by weak US producer inflation data and expectations that the Federal Reserve could implement several rate cuts during the year. Demand was further fuelled by concerns about Fed independence after statements by the Trump administration, despite a partial easing of geopolitical tensions with Iran.

From a technical perspective, gold maintains strong upward momentum. Prices are moving within an expanding ascending channel and hovering above the 4,475–4,430 area, which serves as the nearest support. Trading occurs near the all-time highs of 4,580–4,620, indicating continued strong buying interest. Indicators are signalling overheating, increasing the likelihood of short-term consolidation.

- Buy scenario

Long positions remain valid if prices stay above 4,430. A breakout and consolidation above 4,620 will open the path to new all-time highs.

- Sell scenario

Short positions are possible if quotes move below 4,430. In that case, targets shift to the 4,275 area.

Conclusion: baseline scenario suggests consolidation in the 4,430–4,620 range with a subsequent attempt to resume growth. The medium-term trend for gold remains bullish.

Summary

Gold (XAUUSD) ends the week near 4,610 per ounce, close to all-time highs. The market continues to price in Fed policy easing amid weak inflation data and elevated macroeconomic and political uncertainty. Demand for gold as a safe-haven asset remains intact, despite a partial easing in geopolitical tensions.

The technical outlook remains bullish, with XAUUSD trading within an ascending channel and holding above the 4,475–4,430 support zone. Resistance is concentrated in the 4,580–4,620 area – a breakout here would reinforce the upward momentum. A move below 4,430 would increase the risk of a correction towards 4,275, without breaking the medium-term uptrend.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.