Gold weekly forecast (XAUUSD): correction is logical, overall trend remains bullish

Gold (XAUUSD) is trading near all-time highs in the 4,750–4,900 USD area, pulling back after a sharp rally. The pressure on prices is driven by a partial reduction of the geopolitical risk premium following softer US rhetoric towards Europe. However, demand for gold as a safe-haven asset remains strong amid trade uncertainty, fiscal risks in Japan, and expectations surrounding upcoming Federal Reserve decisions.

Investors are focused on the Federal Reserve meeting on 28 January, US durable goods orders data, and the sustainability of the uptrend after record highs were reached. Let us examine the key factors that may shape gold’s dynamics during the week of 26–30 January 2026.

XAUUSD forecast for this week: quick overview

- Weekly performance: gold (XAUUSD) ended the week near 4,780 USD per ounce, correcting from record highs. Pressure emerged after the US softened its rhetoric. Donald Trump abandoned tariff threats against Europe related to Greenland and ruled out the use of force, which reduced the geopolitical premium and triggered profit-taking. However, uncertainty surrounding EU–US trade relations and fiscal risks in Japan continue to support demand for safe-haven assets

- Support and resistance: gold remains within an ascending channel, with the nearest support level at 4,750–4,700, key medium-term support at 4,600–4,550, and resistance at 4,880–4,900 (all-time highs)

- Fundamentals and outlook: markets are awaiting US durable goods orders data and the Fed meeting on 28 January. The baseline scenario is consolidation or a moderate correction. As long as prices stay above 4,700, the uptrend remains intact. A breakout above 4,900 would reinforce bullish momentum, while a drop below 4,700 would increase the risk of a deeper correction

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) ended the week correcting from all-time highs, hovering near 4,780 USD per ounce. Pressure intensified after the US softened its rhetoric towards Europe: Donald Trump abandoned tariff threats related to Greenland and ruled out the use of force, stating that an agreement was approaching. This reduced the geopolitical premium and triggered profit-taking after the sharp rally.

At the same time, demand for safe-haven assets has not completely disappeared. European lawmakers suspended the approval of the EU–US trade agreement, maintaining uncertainty. Additional support for gold came from a sell-off in Japanese government bonds amid election-related tax cut promises, which increased concerns about Japan’s fiscal sustainability.

The focus for the coming week is on US durable goods orders (November) and the Federal Reserve meeting on 28 January.

Overall, gold remains in a medium-term uptrend. The current price action appears to be a technical correction after record highs rather than a trend reversal.

XAUUSD technical analysis

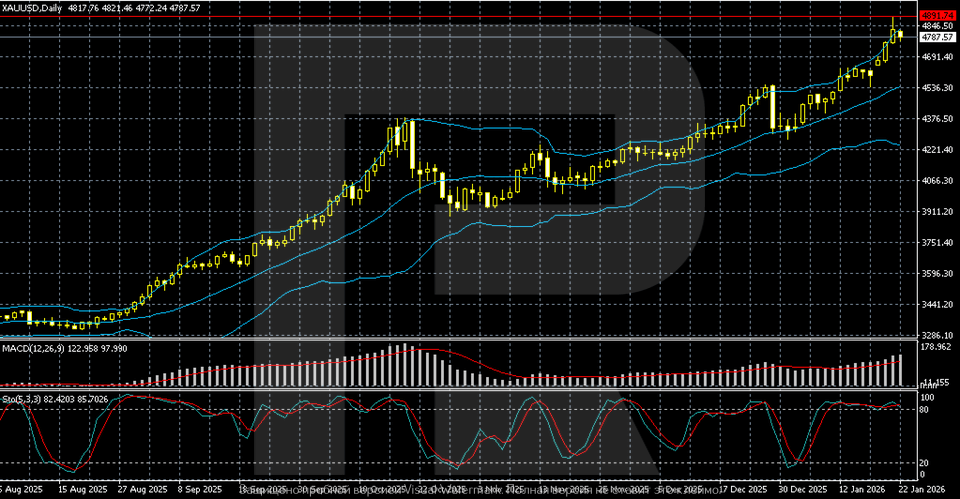

The daily timeframe shows a strong uptrend. Gold continues to post higher highs, moving within a well-defined ascending channel. Current prices are hovering near 4,880–4,890, which is in the all-time high area.

The advance is developing smoothly, without sharp pullbacks, while maintaining a structure of higher lows. Prices are holding firmly above the middle Bollinger Band, and the bands are expanding and pointing upwards, confirming trend strength and strong buying interest.

Indicators signal overheating but no reversal signs. MACD remains in positive territory and continues to rise, reflecting sustained momentum. The Stochastic Oscillator is near overbought levels, increasing the likelihood of a short-term pause or moderate correction, but not signaling a trend reversal.

The nearest support zone lies at 4,750–4,700, followed by the more significant 4,600–4,550 area, where previous consolidations formed. As long as prices remain above these levels, the bullish scenario remains dominant, with the potential for further highs after stabilisation.

XAUUSD trading scenarios

The fundamental outlook for gold remains moderately positive. Gold (XAUUSD) ended the week near 4,780 USD per ounce, correcting from all-time highs. The key driver was softer US rhetoric towards Europe: Donald Trump abandoned tariff threats linked to Greenland and ruled out the use of force, reducing the geopolitical premium and triggering profit-taking. Nevertheless, uncertainty around EU–US trade relations and the sell-off in Japanese government bonds amid fiscal concerns continue to support safe-haven demand. The key events next week are US durable goods orders and the Fed meeting on 28 January.

From a technical perspective, gold remains in an uptrend. The current movement looks like a technical correction after record highs. Prices holding above 4,750–4,700 support the bullish scenario. Indicators point to overheating, increasing the likelihood of a short-term pause, but without reversal signals.

- Buy scenario

Long positions are appropriate if prices hold above 4,700. A breakout above 4,880–4,900 would open the way to new all-time highs.

- Sell scenario

Short positions may be considered if prices break below 4,700, with targets at 4,600–4,550.

Conclusion: the baseline scenario is consolidation or a moderate correction while maintaining the medium-term bullish trend.

Summary

Gold (XAUUSD) ended the week near 4,780 USD per ounce, correcting from all-time highs. Pressure increased after softer US rhetoric towards Europe, reducing the geopolitical premium and prompting profit-taking. However, demand for gold as a safe-haven asset remains supported by EU–US trade uncertainty, fiscal risks in Japan, and anticipation of key macroeconomic data and the upcoming Federal Reserve meeting.

The technical picture remains bullish. XAUUSD is moving within an ascending channel, and the current decline appears to be a technical correction. The nearest support level lies at 4,750–4,700; a breakout below this zone would increase the risk of a decline towards 4,600–4,550. Resistance is concentrated at 4,880–4,900; a breakout above this area would pave the way to new all-time highs without disrupting the medium-term uptrend.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.