Gold (XAUUSD) weekly forecast: explosive rally fuelled by dollar weakness

Gold (XAUUSD) remains near all-time highs around 5,450–5,550 USD per ounce following a strong momentum-driven rally. The precious metal is supported by US dollar weakness and ongoing geopolitical and economic uncertainty.

Investors are focused on signals from the Federal Reserve regarding the potential timing of monetary policy easing, US dollar dynamics, and the sustainability of the uptrend following the breakout to record highs. Let us examine the key factors that may influence gold’s performance during the week of 2–6 February 2026.

XAUUSD forecast for this week: quick overview

- Weekly dynamics: gold (XAUUSD) hit a new all-time high, soaring above 5,500 USD per ounce. The rally was driven by US dollar weakness and persistent economic and geopolitical uncertainty. Momentum increased following President Donald Trump’s statements, which the market interpreted as tolerance for a weaker dollar amid tariff risks and criticism of Fed independence. Additional support came from fiscal concerns, central bank purchases, and steady ETF inflows

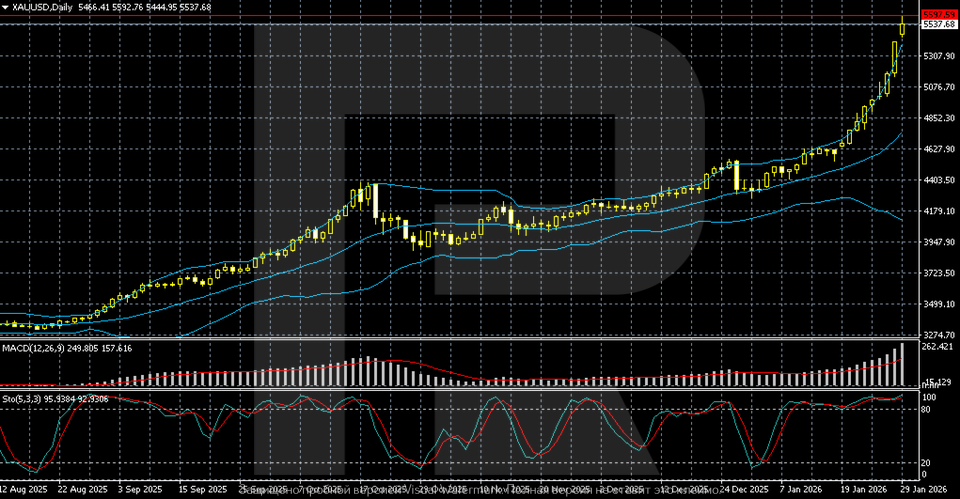

- Support and resistance: gold remains in a strong uptrend. Prices are moving along the upper Bollinger Band, while MACD stays in positive territory. The Stochastic Oscillator in the overbought zone suggests the possibility of a short-term pause. The nearest support level is at 5,200–5,150 USD. As long as prices remain above this range, the bullish structure is intact

- Fundamentals and outlook: the Federal Reserve kept rates unchanged at 3.50–3.75%, noting continued economic resilience despite inflationary pressure. The decision increased expectations of policy easing later this year. The base case for the week is consolidation or a moderate correction, with the potential for further highs as long as the support level above 5,150 USD holds

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) reached a new all-time high, rising above 5,500 USD per ounce. The rally continues amid persistent US dollar weakness and uncertainty in the economic and geopolitical landscape.

Momentum was reinforced by President Donald Trump’s remarks, which downplayed the dollar’s fall to a near four-year low. Markets interpreted this as a signal of acceptance for a weaker currency amid ongoing tariff threats and renewed criticism of the Federal Reserve's independence.

At its recent meeting, the Federal Reserve kept the interest rate in the 3.50–3.75% range, citing economic resilience and early signs of labour market stabilisation. At the same time, the Fed acknowledged that inflation remains elevated and the economic outlook is highly uncertain.

The decision, which saw two FOMC members advocating for an immediate rate cut, heightened expectations that policy easing may begin later this year.

Gold also benefited from fears of asset value erosion amid fiscal risks. Investors continue to reduce exposure to currencies and bonds while increasing positions in safe-haven assets. Demand is further supported by active central bank buying and robust ETF inflows backed by gold.

XAUUSD technical analysis

On the daily chart, XAUUSD maintains a strong bullish momentum. Prices continue to set higher highs, while corrections remain shallow and are quickly reversed. The rally accelerated in January, signalling a phase of momentum-driven gains.

Prices are hovering above the middle Bollinger Band and moving along the upper boundary, confirming buyer dominance and increased volatility. MACD remains in positive territory and continues to rise, showing no signs of weakening momentum. The Stochastic Oscillator is in overbought territory, raising the likelihood of a short-term pause or moderate correction without breaking the trend.

The nearest support zone has shifted to 5,200–5,150 USD. As long as prices hold above this area, the base case remains bullish, with the potential for new highs after possible stabilisation.

XAUUSD trading scenarios

The fundamental outlook for gold remains positive. XAUUSD hit a new all-time high, rising above 5,500 USD per ounce, driven by US dollar weakness and ongoing economic and geopolitical risks.

Momentum was amplified by President Donald Trump’s statements, which the market took as a green light for a weak dollar amid tariff tensions and criticism of the Federal Reserve’s independence. Additional support comes from fiscal risk concerns, central bank gold purchases, and strong ETF inflows. The Fed held the rate steady at 3.50–3.75%.

From a technical perspective, gold remains in a strong uptrend. Prices continue to reach new highs, with corrections remaining shallow and short-lived. Quotes are hovering above the middle Bollinger Band and moving along the upper boundary. MACD remains in positive territory, while the Stochastic Oscillator indicates overbought conditions, signalling the risk of a pause without trend reversal. The nearest support has shifted to 5,200–5,150 USD.

- Buy scenario

Long positions are appropriate if prices stay above 5,150 USD. After stabilisation, a new bullish wave with higher highs is possible.

- Sell scenario

Short positions become relevant if quotes fall below 5,150 USD, implying a deeper correction in an overheated market.

Conclusion: the baseline scenario is consolidation or a moderate correction, with the bullish medium-term trend intact.

Summary

Gold (XAUUSD) ended the week around 5,500 USD per ounce, near all-time highs. The rally is driven by US dollar weakness and elevated economic and geopolitical uncertainty. Momentum increased following President Donald Trump’s remarks, interpreted as tolerance for a weaker dollar amid tariff threats. Additional demand stems from fiscal concerns, central bank purchases, and inflows into gold ETFs.

Technically, the picture remains bullish. XAUUSD is in a momentum-driven rally phase; corrections are shallow and quickly reversed. The nearest support is at 5,200–5,150 USD. Holding this range preserves the potential for further record highs, while overbought conditions increase the likelihood of a short-term pause without breaking the trend.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.