Gold (XAUUSD) weekly forecast: consolidation and high sensitivity

Gold (XAUUSD) enters the week of 16–20 February in a consolidation phase after pulling back to 5,050 USD per ounce. Pressure on prices increased due to strong US labour market data and a shift in expectations for the Federal Reserve rate cut from June to July. At the same time, gold remains above 5,000 USD, supported by central bank demand and geopolitical uncertainty.

Investors focus on further US macroeconomic data, Fed rhetoric, and the US dollar’s dynamics. The market is assessing whether the current pause will develop into a recovery towards 5,300–5,500, or whether the correction will deepen towards the 4,850–4,900 support level. The base case is movement within a wide range with elevated volatility and high sensitivity to rate-related signals.

XAUUSD forecast for this week: quick overview

- Weekly performance: gold (XAUUSD) corrected towards 5,050 USD per ounce after rising in the middle of last week. Pressure intensified amid strong US labour market data: employment in January grew at the fastest pace in more than a year, while unemployment declined. This confirmed the economy’s resilience and shifted expectations for the Fed’s next rate cut from June to July. Despite the pullback, gold remains above 5,000 USD and has already recovered about half of the recent 13% drop

- Support and resistance: the long-term uptrend remains intact. After the peak in the 5,500–5,550 area, a sharp correction followed, after which the market moved into stabilisation within the 5,000–5,100 range. Prices are hovering above the middle Bollinger Band, with volatility easing. The key support level is 4,850–4,900, while resistance levels are located at 5,300–5,500. Indicators point to weakening momentum while the bullish structure remains intact

- Fundamentals and outlook: central bank demand and geopolitical uncertainty continue to bolster gold prices. The baseline scenario is consolidation above 5,000 with attempts to recover towards 5,300, while short-term correction risks remain

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) quotes fell to 5,050 USD per ounce, correcting the rise that occurred in the middle of last week. Pressure on prices increased after the release of strong US labour market data.

In January, employment increased at the fastest pace in more than a year, while the unemployment rate unexpectedly declined. The statistics confirmed the resilience of the US economy at the start of 2026 and reinforced the Fed’s cautious stance. The market shifted expectations for the next rate cut from June to July.

Despite the pullback, gold remains above 5,000 USD per ounce. Prices have already recovered about half of the sharp 13% decline that occurred earlier this month in just two sessions. Additional support comes from steady central bank demand and geopolitical uncertainty.

XAUUSD technical analysis

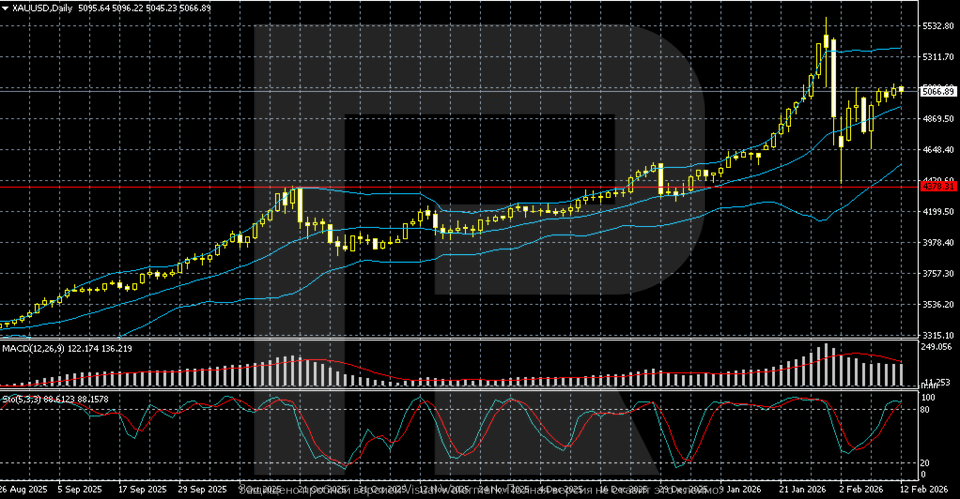

On the daily timeframe, gold (XAUUSD) has maintained a pronounced uptrend since August, with the series of higher lows and higher highs remaining intact. After accelerating in January, prices hit a new peak around 5,500–5,550, followed by a sharp correction with long wicks and elevated volatility.

Currently, quotes have stabilised in the 5,000–5,100 zone and remain above the middle Bollinger Band. The bands are gradually narrowing after expanding, indicating a consolidation phase after the impulse move.

Although MACD remains in positive territory, the histogram is declining – the bullish momentum is weakening. The Stochastic Oscillator is moving back into overbought territory again, suggesting a short-term correction.

The overall picture is as follows: the long-term trend remains upward, but the market has shifted into a redistribution phase after the extreme rise. The key support level is located in the 4,850–4,900 area, while resistance levels are within 5,300–5,500.

XAUUSD trading scenarios

The fundamental backdrop for gold remains mixed. Gold (XAUUSD) underwent a correction towards 5,050 USD per ounce after rising in the middle of last week. Pressure increased amid strong US labour market data, which confirmed economic resilience and shifted expectations for the Fed’s rate cut from June to July. At the same time, gold remains above 5,000 USD, bolstered by central bank demand and geopolitical uncertainty.

From a technical perspective, the long-term uptrend remains intact, but the market has moved into a redistribution phase after the extreme rise to 5,500–5,550. Prices are now stabilising in the 5,000–5,100 zone, hovering above the middle Bollinger Band, while volatility is declining. MACD remains in positive territory, but momentum is losing strength; the Stochastic Oscillator indicates the risk of a short-term correction. The key support level is located at 4,850–4,900, with resistance at 5,300–5,500.

- Buy scenario

Long positions are possible if prices hold above 5,000, targeting a recovery towards 5,300 within the ongoing uptrend.

- Sell scenario

A breakout below 4,850–4,900 would increase the risk of a deeper correction and a wider trading range.

Conclusion: the base case is consolidation above 5,000 with elevated volatility and an ongoing search for balance after the impulse move.

Summary

Gold (XAUUSD) retreated to 5,050 USD per ounce after rising in the middle of last week. Strong US labour market data added to pressure, with January employment rising at the fastest pace in more than a year, unemployment declining, and expectations for the Federal Reserve rate cut shifting from June to July. Gold remains above 5,000 USD, driven by central bank demand and geopolitical uncertainty. Volatility remains elevated.

The technical picture has shifted from a momentum-driven uptrend to a consolidation phase. After peaking around 5,500–5,550, prices are stabilising in the 5,000–5,100 zone. While the long-term trend remains bullish, the market has moved into redistribution. The key support level lies at 4,850–4,900, with resistance at 5,300–5,500. The base case is range trading with high sensitivity to the dollar and Fed signals.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.