AUDUSD declined to 0.6200

The AUDUSD pair edges lower, gradually reaching the 0.6200 support level. The current downtrend remains, with the pair likely to decline further. Discover more in our analysis for 27 December 2024

AUDUSD forecast: key trading points

- The AUDUSD pair is trading within a stable downtrend

- Market participants expect the RBA to lower the cash rate in February 2025

- AUDUSD forecast for 27 December 2024: 0.6200 and 0.6275

Fundamental analysis

The AUDUSD rate continues to decline within the current downtrend, with prices falling to two-year lows near 0.6200. The pair is under pressure due to an anticipated Reserve Bank of Australia rate cut in 2025, while the US Federal Reserve may pause its monetary policy easing cycle.

The minutes from the RBA’s December meeting revealed that inflation risks in Australia have subsided despite a slowdown in economic activity in interactions with foreign partners. Market participants expect the RBA to lower its benchmark interest rate by 25 basis points in February next year.

AUDUSD technical analysis

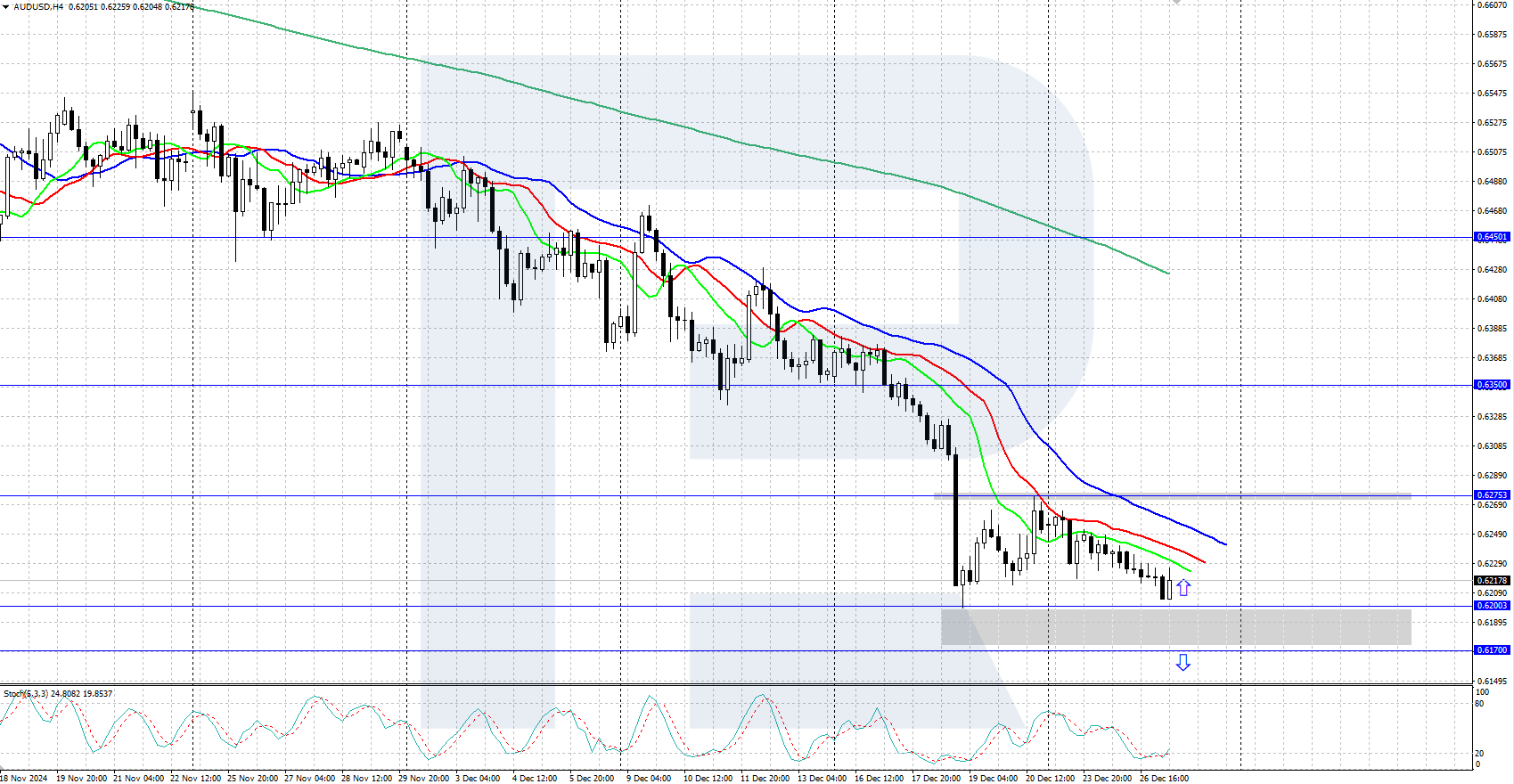

On the H4 chart, the AUDUSD pair continues to trade within the downtrend, with the alligator indicator above the price chart and pointing downwards, confirming the current trend. Today, the price declined to a strong support area between 0.6170 and 0.6200, where it encountered demand from buyers and reversed upwards.

The short-term AUDUSD price forecast suggests that if bulls can hold above the 0.6170-0.6200 support area, an upward correction may follow, targeting the 0.6275 resistance level. However, the decline could continue if bears firmly establish control below this support zone.

Summary

The AUDUSD pair plunged to a two-year low of 0.6200, pressured by expectations of a Reserve Bank of Australia rate cut in 2025.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.