AUDUSD falls along with the rest: external backdrop leaves no options

The AUDUSD pair has fallen to 0.6232 as investors avoid risk. Find more details in our analysis for 4 April 2025.

AUDUSD forecast: key trading points

- The AUDUSD pair declined sharply due to the worsening external background

- The market is risk-averse as key Australian trading partners may suffer from US tariffs

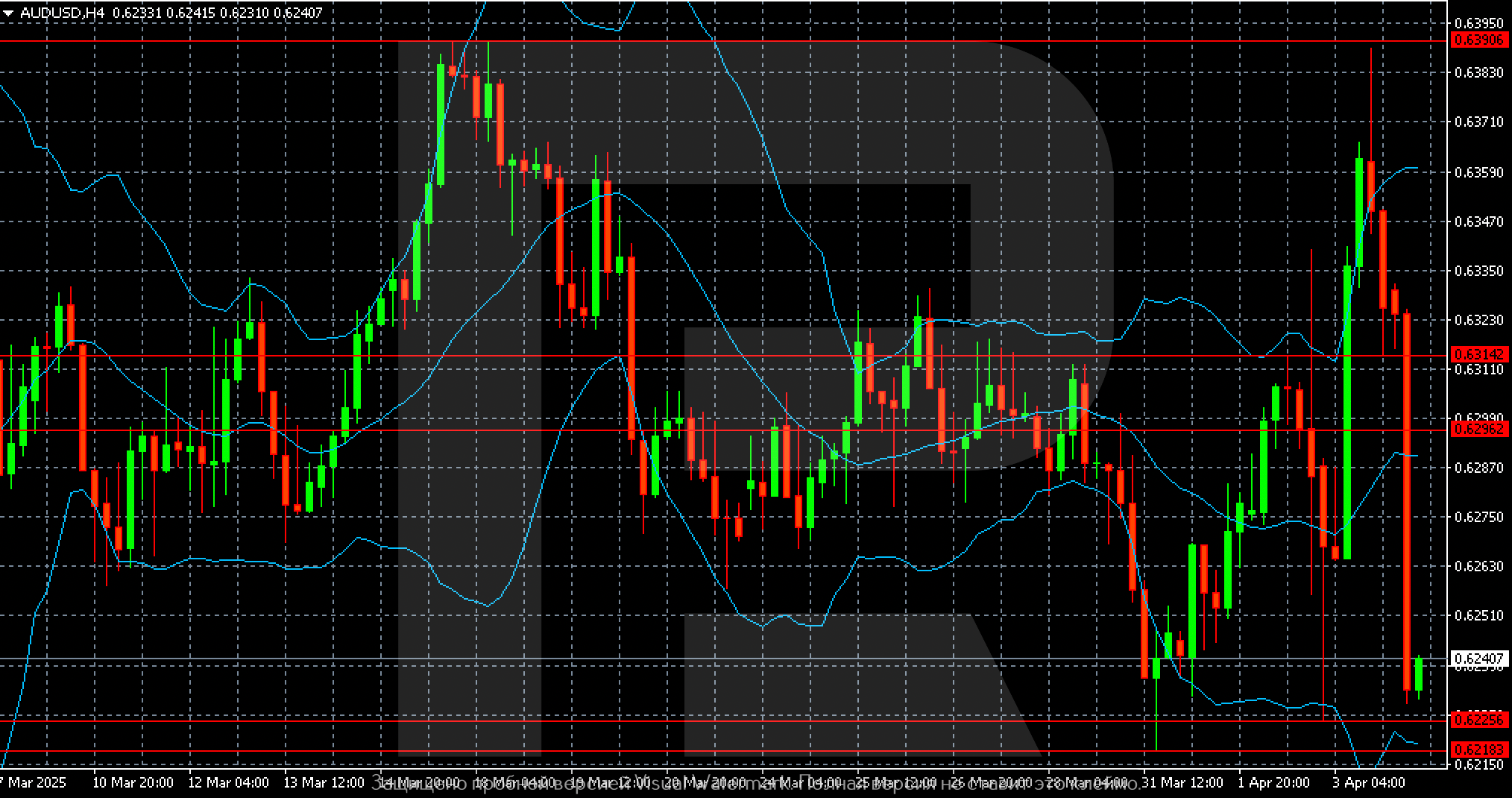

- AUDUSD forecast for 4 April 2025: 0.6225 and 0.6218

Fundamental analysis

The AUDUSD rate plunged to 0.6232.

The main trigger behind the sell-off is the surge in risk aversion across financial markets amid growing fears of a global recession driven by US tariffs. US President Donald Trump introduced a 10% tariff on Australian imports, among other measures. Australian Prime Minister Anthony Albanese ruled out retaliatory measures, noting that the US accounts for less than 5% of Australia’s exports.

At the same time, US tariffs also targeted Australia’s key trading partners – China, Japan, and South Korea. This significantly weakens the broader outlook for global trade and economic growth.

As a result, markets have rapidly revised expectations for the Reserve Bank of Australia’s monetary policy. The baseline forecast now expects a 100-basis-point rate cut, up from 75 basis points earlier this week. The next cut is expected in May, with July and August seen as likely options.

The AUDUSD forecast appears bearish.

AUDUSD technical analysis

On the H4 chart, the AUDUSD pair shows potential for a continued decline towards 0.6218, with an intermediate support level at 0.6225.

Summary

The AUDUSD pair has dropped significantly amid investors’ risk aversion and overall bearish market sentiment. The AUDUSD forecast for today, 4 April 2025, expects the selling wave to continue to 0.6218 after a brief correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.