AUDUSD at a 16-month high: the rally is not stopping yet

The AUDUSD pair rose to 0.6836, with the Aussie supported by solid domestic data. Discover more in our analysis for 23 January 2026.

AUDUSD forecast: key takeaways

- Market focus: the market relies on strong economic data

- Current trend: the AUDUSD pair continues to rise and reaches a 16-month high

- AUDUSD forecast for 23 January 2026: 0.6880

Fundamental analysis

The AUDUSD rate is trading near 0.6836 at the end of the week, with the Australian dollar remaining close to 16-month highs. The currency received support from strong labour market data and solid business activity indicators, which increased expectations of an imminent rate hike.

According to preliminary data, the composite PMI rose to 55.5 points in January, marking the 16th consecutive month in expansion territory and the highest reading since April 2022. Growth was driven by accelerating activity in manufacturing, which expanded for the third consecutive month, and a sharp improvement in the service sector, the strongest since early 2022. Additional support came from the labour market, as the unemployment rate unexpectedly fell to a seven-month low in December.

Against this backdrop, amid persistent inflationary pressure and increasingly hawkish signals from the Reserve Bank of Australia, markets are more actively pricing in policy tightening.

Interest rate swaps now assess the probability of a rate hike in February at 55.7%, up from 26.5% previously. The likelihood of a move by May exceeds 80%. Quarterly inflation data remains in focus, as this is the regulator's key benchmark.

The AUDUSD outlook is positive.

Technical outlook

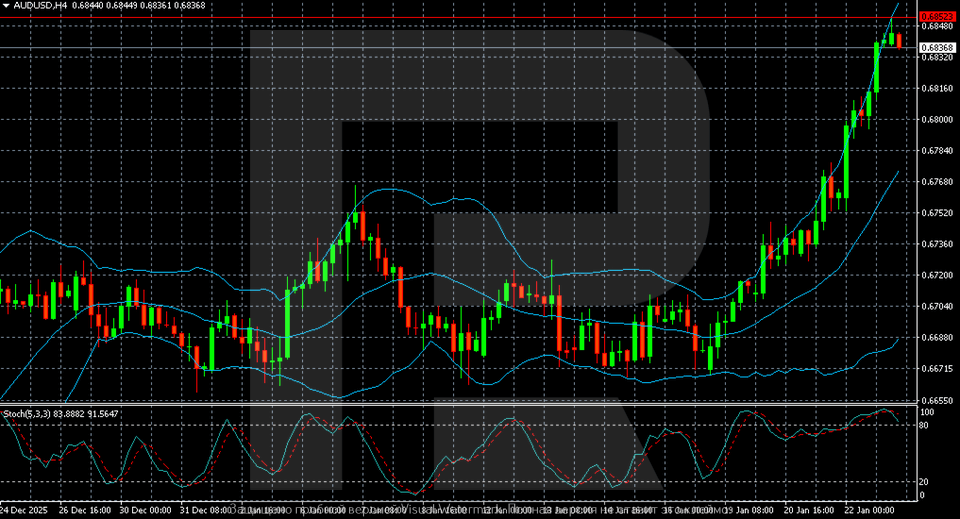

The AUDUSD H4 chart shows a pronounced upward momentum. After an extended consolidation in the 0.6670–0.6720 range, the pair began to accelerate upwards in the second half of the week. Buyers are consistently reaching new local highs, while the price structure is forming a sequence of higher lows and higher highs.

The price has confidently moved above the middle Bollinger Band and is trading along the upper boundary, signalling strong momentum and dominance of bullish sentiment. The Bollinger Bands are expanding, indicating rising volatility and confirming the strength of the current move. Prices are currently approaching a local resistance level.

The Stochastic Oscillator has settled in overbought territory above 80 and is starting to slow, which points to a possible short-term pause or correction, but without signs of a trend reversal. Corrections remain shallow and are quickly bought up.

The nearest support level has shifted to the 0.6800–0.6780 area, with stronger support at 0.6735–0.6720, where the impulsive rally began. As long as the price holds above these levels, the baseline scenario remains bullish, with potential for further gains after a possible consolidation phase.

AUDUSD overview

- Asset: AUDUSD

- Timeframe: H4 (Intraday)

- Trend: uptrend

- Key resistance levels: 0.6880 and 0.6920

- Key support levels: 0.6800 and 0.6735

AUDUSD trading scenarios for today

Main scenario (Buy Stop)

A breakout and consolidation above 0.6880 will confirm continued impulsive upward movement after a consolidation phase and indicate market readiness to extend gains. The scenario is supported by strong Australian macroeconomic data and rising expectations of a rate hike by the Reserve Bank of Australia.

The risk-to-reward ratio is approximately 1:3. Potential profit upon reaching the target is around 90 pips, while risk is limited to about 30 pips.

- Buy Stop: 0.6880

- Take Profit: 0.6970

- Stop Loss: 0.6850

Alternative scenario (Sell Stop)

A correction scenario becomes possible if the price breaks and consolidates below 0.6800, signalling weakening short-term momentum and a transition to a deeper correction after overbought conditions.

- Sell Stop: 0.6795

- Take Profit: 0.6735

- Stop Loss: 0.6845

Risk factors

Key risks for the bullish scenario include weak inflation data in Australia, which could reduce expectations of a rate hike, as well as a general deterioration in global risk appetite and a strengthening US dollar driven by macroeconomic or geopolitical factors.

Summary

The AUDUSD pair continues to rise and shows no signs of slowing. The AUDUSD forecast for today, 23 January 2026, suggests further growth towards 0.6880.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.