RBA’s hawkish comments support AUDUSD

The AUDUSD rate is rising on Thursday morning; buyers are testing the resistance area. For a more detailed AUDUSD analysis, read our report dated 8 August 2024.

AUDUSD trading key points

- The Reserve Bank of Australia left the interest rate unchanged at 4.35% for the sixth consecutive time

- The Australian dollar reached a two-week high against the US dollar

- RBA Governor Michele Bullock stated a readiness to raise interest rates further to combat inflation

- The regulator dismissed the likelihood of an interest rate cut in the next six months

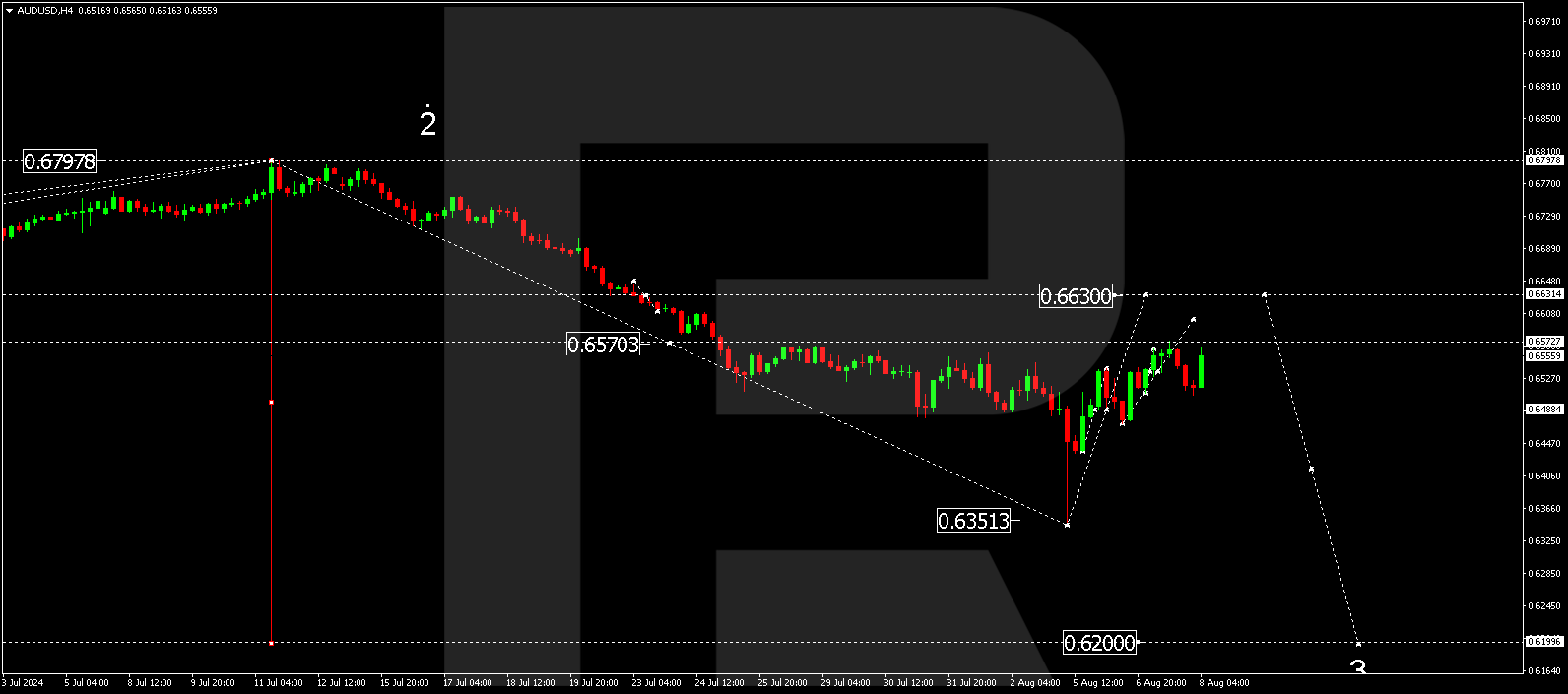

- AUDUSD forecast for 8 August 2024: 0.6630 and 0.6200

AUDUSD Forecast 2024

The AUDUSD forecast for 8 August 2024 points to key levels at 0.6630 and 0.6200. With the ongoing monetary tightening by the Reserve Bank of Australia, the AUDUSD trend could experience both upward and downward movements. The AUD to USD forecast incorporates the potential for market shifts as traders analyze RBA policies and broader global economic conditions.

Fundamental analysis

The Australian dollar reached a two-week high, rising to 0.6560. This growth was driven by hawkish comments from Reserve Bank of Australia Governor Michele Bullock, who emphasized the central bank’s readiness to raise interest rates further to address inflation. The AUDUSD outlook for 2024 remains influenced by the RBA's stance, with the AUD forecast for 2024 indicating potential bullish momentum, particularly if inflationary pressures persist.

The RBA maintained the interest rate at 4.35%, noting that tight monetary policy is essential to bringing inflation down to the target range of 2.00-3.00%. The regulator’s chief also ruled out the possibility of lowering rates in the next six months, dispelling investor hopes for a relaxation of RBA monetary policy. Consequently, AUDUSD investing strategies should remain cautious as the central bank continues its fight against inflation.

The AUDUSD rate was further bolstered by expectations that the Federal Reserve might lower interest rates in the coming months amid signs of economic weakness in the US. This could impact AUDUSD investing strategies, especially for those watching for shifts in the AUD/USD forecast.

AUDUSD technical analysis

The H4 chart shows that the AUDUSD pair has completed a corrective wave, reaching 0.6572. The AUDUSD technical analysis for today, 8 August 2024, suggests a consolidation range forming around 0.6535, with potential upward movement towards 0.6630. However, after reaching this level, another downward wave is expected, targeting the local level of 0.6200. This aligns with the AUDUSD forecast for tomorrow, where continued volatility is anticipated as traders adjust their positions.

AUDUSD prediction and outlook

The AUDUSD prediction for 2024 reflects a mixed outlook, with potential for both gains and corrections depending on central bank actions. The AUD/USD forecast for 2024 will closely follow shifts in monetary policy from both the RBA and the Federal Reserve. The AUDUSD trend is likely to be influenced by these macroeconomic factors, with the AUD outlook for 2024 indicating that the currency pair could see fluctuations as global economic conditions evolve.

Summary

The Reserve Bank of Australia’s hawkish comments have propelled the AUDUSD pair to a two-week high, while market expectations of a potential interest rate cut in December could support further growth. Technical indicators suggest a possible correction in the AUDUSD rate to 0.6630 today. Subsequently, the AUDUSD trend is expected to extend downward to 0.6200, as reflected in the latest AUD to USD forecast. Investors in AUDUSD should keep a close eye on ongoing economic developments and central bank decisions, which will continue to shape AUDUSD predictions and the broader investing landscape for 2024.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.