Trump takes the lead, but the USD remains hesitant: all eyes on politics

The EURUSD pair is consolidating. Investors need to assess crucial changes in the US political race.

EURUSD trading key points

- The US dollar must evaluate political changes

- The odds of Trump’s victory support the USD

- EURUSD price targets: 1.0860, 1.0820, and 1.0777

Fundamental analysis

The EURUSD pair stopped at 1.0888 on Monday. The market is extremely cautious as the weekend brought unexpected news that needs to be analysed and weighed.

The incumbent US President, Joe Biden Jr., announced his decision to drop out of the 2024 presidential campaign. He supported Vice President Kamala Harris as his replacement. However, it is still unclear whether Harris can gain the required support as the new Democratic nominee. Former US President Donald Trump, the Republican nominee, is far ahead.

Although Harris can be a strong politician and a presidential nominee, the question remains whether this is enough to change the results of preliminary surveys.

It is too early to talk about the US dollar’s reactions. Nevertheless, there is no denying that Trump leads the race, supporting the USD position.

Conversely, a reduction in the odds of Trump’s victory could weaken the US dollar.

EURUSD technical analysis

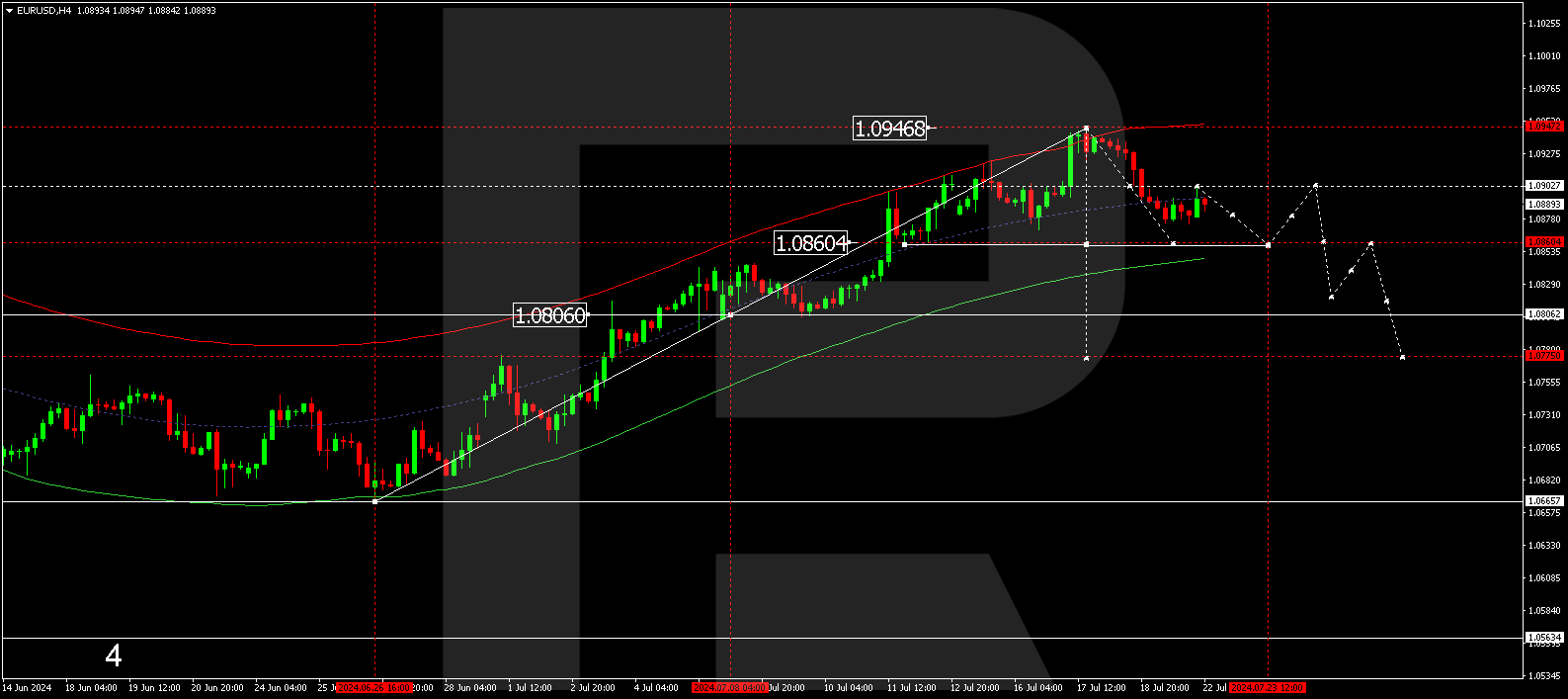

On the H4 chart, the EURUSD pair has reached the decline wave’s local target of 1.0875. Today, 22 July 2024, a correction was formed, aiming for 1.0902 (testing from below). The decline wave is expected to continue to 1.0860, representing the first estimated target. After reaching this target, the price could rise to 1.0900. Subsequently, another decline wave could develop, aiming for 1.0820 and potentially continuing to 1.0777.

Summary

The EURUSD pair has become the centre of US political news. Technical indicators suggest a further corrective wave, with a target at 1.0777.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.