EUR is declining ahead of the Eurogroup meeting

Today’s EURUSD forecast appears pessimistic as the news landscape may confirm the technical analysis conclusion about the pair’s decline.

EURUSD is poised for a further decline due to upcoming news

The Eurogroup meeting and a speech by ECB representative Philip R. Lane are scheduled for Wednesday. They might provide insights into the future trajectory of the eurozone’s monetary policy.

The US will release data, including May 2024 new home sales, building permits, and crude oil stocks.

If these indicators exceed forecasts and previous readings, they may collectively support the US dollar, which will be considered in today’s EURUSD forecast.

By the end of the business day, the US will publish the results of bank stress tests the Federal Reserve conducted on 34 of the largest US banks to evaluate their ability to increase dividends and buy back shares. Although such tests are rare, their results may affect the US dollar by contributing to its strengthening or weakening, which will cause increased volatility in the market.

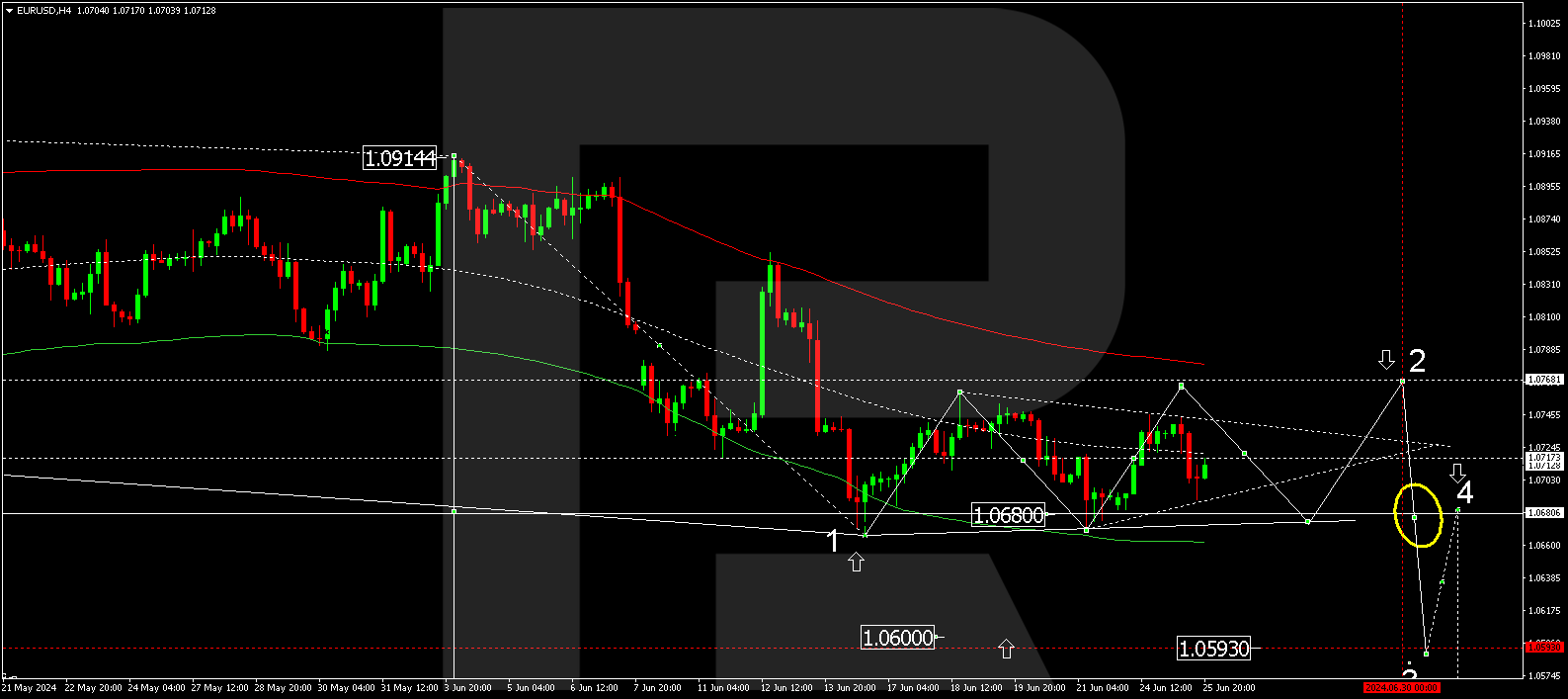

EURUSD technical analysis

On the H4 chart, EURUSD is currently in a consolidation phase around the 1.0717 level without any clear trend. With an upward breakout of the range, a correction might continue to 1.0760. After reaching this level, the price could decline to 1.0680. Subsequently, another corrective structure might develop, aiming for 1.0770 as the main target for correction. Once the correction is complete, a new decline wave is expected to start, targeting 1.0680, a crucial level for the EURUSD forecast for 26 June 2024. A breakout of this level will open the potential for a decline to 1.0610, possibly continuing to 1.0570, the estimated local target.

EURUSD technical analysis 26.06.2024

The Elliott Wave structure and a wave matrix with a pivot point at 1.0680 technically confirm this scenario. This level is considered crucial for a downward wave in the EURUSD rate. The market has breached the Envelope’s centre and is consolidating below the 1.0717 level. The wave could decline to its lower boundary today.

Summary

The EURUSD technical analysis suggests a further decline towards the 1.0680 and 1.0570 targets following the correction. The news factor may contribute to this scenario.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.