GBP continues to strengthen following a decline

The GBPUSD pair is strengthening its position following the release of the house price indices. It is likely to undergo a correction ahead of a further decline.

GBPUSD trading key points

- The UK’s Nationwide House Price Index (y/y) in June 2024 increased by 0.2%

- The UK’s Nationwide House Price Index (m/m) in June 2024 decreased by 0.2%

- The GBPUSD targets: 1.2600, 1.2500

GBPUSD fundamental analysis

The UK released its year-on-year and month-on-month house price indices for June 2024 on Monday, 1 July 2024. The figure increased slightly by 0.2% year-on-year and declined by 0.2% month-on-month, which did not prevent the pound from strengthening against the US dollar.

The consumer and mortgage lending figures will also be published today. However, given their low importance, the data will not significantly impact the GBPUSD rate.

US manufacturing PMI data is due during the second half of the European trading session. While the forecast suggests growth, the actual data release will confirm this, which may exert significant pressure on the GBPUSD rate.

GBPUSD technical analysis

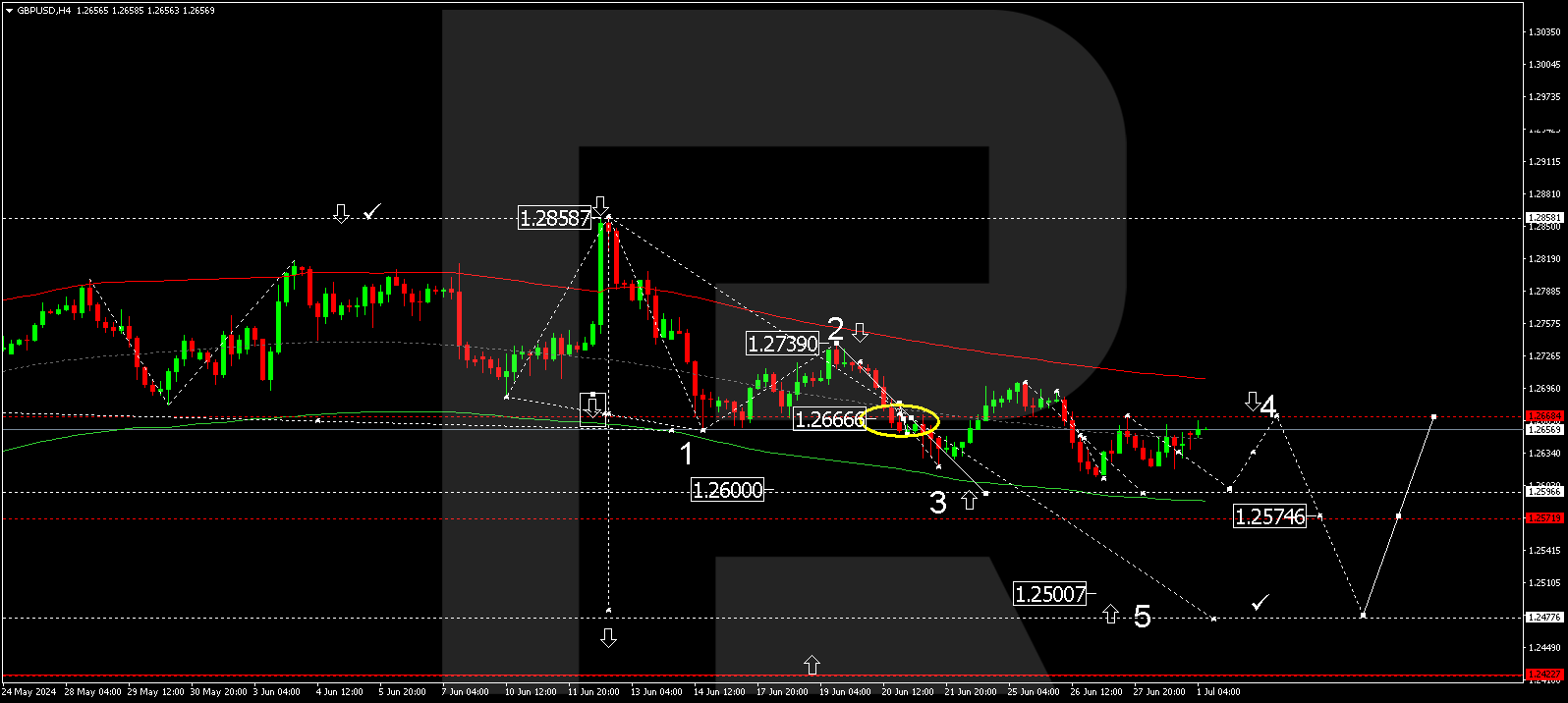

Based on the analysis results as of 1 July 2024, GBPUSD is developing another decline wave towards the local target of 1.2600. Subsequently, the price might rise to 1.2666 (testing from below). On the H4 chart, a consolidation range has practically formed around the 1.2666 level, which is crucial for this decline wave. With a downward breakout of the range, the wave might develop to 1.2500, representing the main target.

Summary

Upcoming industrial and speculative data will play a vital role in market performance, potentially confirming current technical forecasts. The GBPUSD will maintain its downward momentum, with decline targets at 1.2600 and 1.2500.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.