GBPUSD may weaken by year-end amid the BoE policy

The GBPUSD is falling for the second consecutive session. Read in the analysis for 24 July 2024 how the upcoming Bank of England’s decision may affect the pound.

GBPUSD trading key points

- The BoE may have three interest rate cuts in 2024

- The first decision on interest rates will be announced at the Monetary Policy Committee meeting on 1 August 2024

- Traders believe that monetary policy easing will push the pound further down

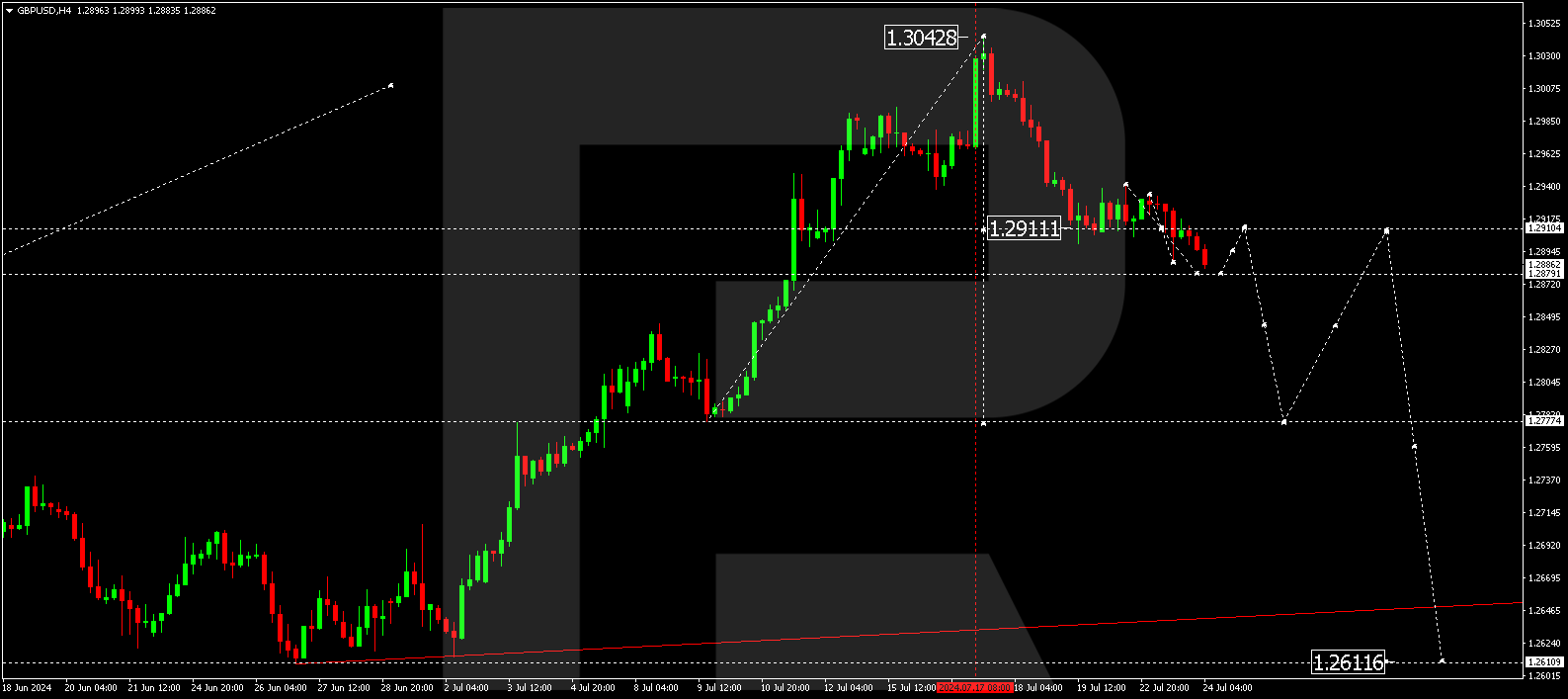

- GBPUSD forecast for 24 July 2024: 1.2879, 1.2850, and 1.2777

Fundamental analysis

UK retail sales unexpectedly decreased by 1.2% in June, significantly exceeding the projected 0.4% decline. Combined with slowing wage growth and inflation reaching the Bank of England’s 2.0% target, this drop increases the likelihood of an interest rate cut in August. Expectations of such action already exert pressure on the GBPUSD rate as an interest rate cut typically weakens the national currency.

Unexpectedly robust service inflation data have supported the sterling pound rate for some time, forcing the Bank of England to postpone an interest rate cut, making UK bonds more appealing to investors. However, Chris Turner, global head of markets at ING, believes the pound could weaken by year-end since the BoE will likely lower the rate.

Analysts predict that the Bank of England may have three interest rate cuts this year, but only if the UK’s economic situation is favourable. The first decision is expected to be announced at a Monetary Policy Committee meeting on 1 August 2024. According to traders, easing the monetary policy will push down the pound sterling.

GBPUSD technical analysis

Analysis for 24 July 2024 shows that the GBPUSD pair is forming a consolidation range around 1.2911, which is expected to extend down to 1.2879 today. Subsequently, the price could rise to 1.2911 (testing from below) before the decline wave likely continues to 1.2777, representing the first target.

Summary

Today’s GBPUSD forecast shows that the likelihood of a decline in the British pound persists due to the Bank of England’s potential monetary policy easing measures. Technical indicators suggest a fall in the GBPUSD rate to the 1.2879, 1.2850, and 1.2777 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.