NZDUSD declines again: the primary reason is the strong US dollar

The NZDUSD pair is falling, facing strong pressure from the US dollar and reaching mid-May lows.

Although this month has been unsuccessful for the NZDUSD pair, it is closing the quarter with gains

The New Zealand dollar-to-US dollar rate continues to decline with regular intervals for consolidation, but the overall trend is steady and quick. The NZDUSD pair is falling to 0.6059.

The current values are the lowest since mid-May.

The market is preparing for the evening’s US releases. In particular, it is interested in core PCE data, one of the most significant inflation reports for the Federal Reserve. The figures may provide insight into the Fed’s future actions on interest rates, which is currently offering strong support for the USD. As for news from New Zealand, it remains relatively neutral. The Reserve Bank of New Zealand’s stance remains unchanged: it will maintain a stable monetary policy at least until mid-2025 due to ongoing inflation growth risks.

However, investors believe that the RBNZ will lower interest rates in November.

Although the NZD rate declined by 1.2% in June, the Kiwi dollar gained 1.5% over the quarter.

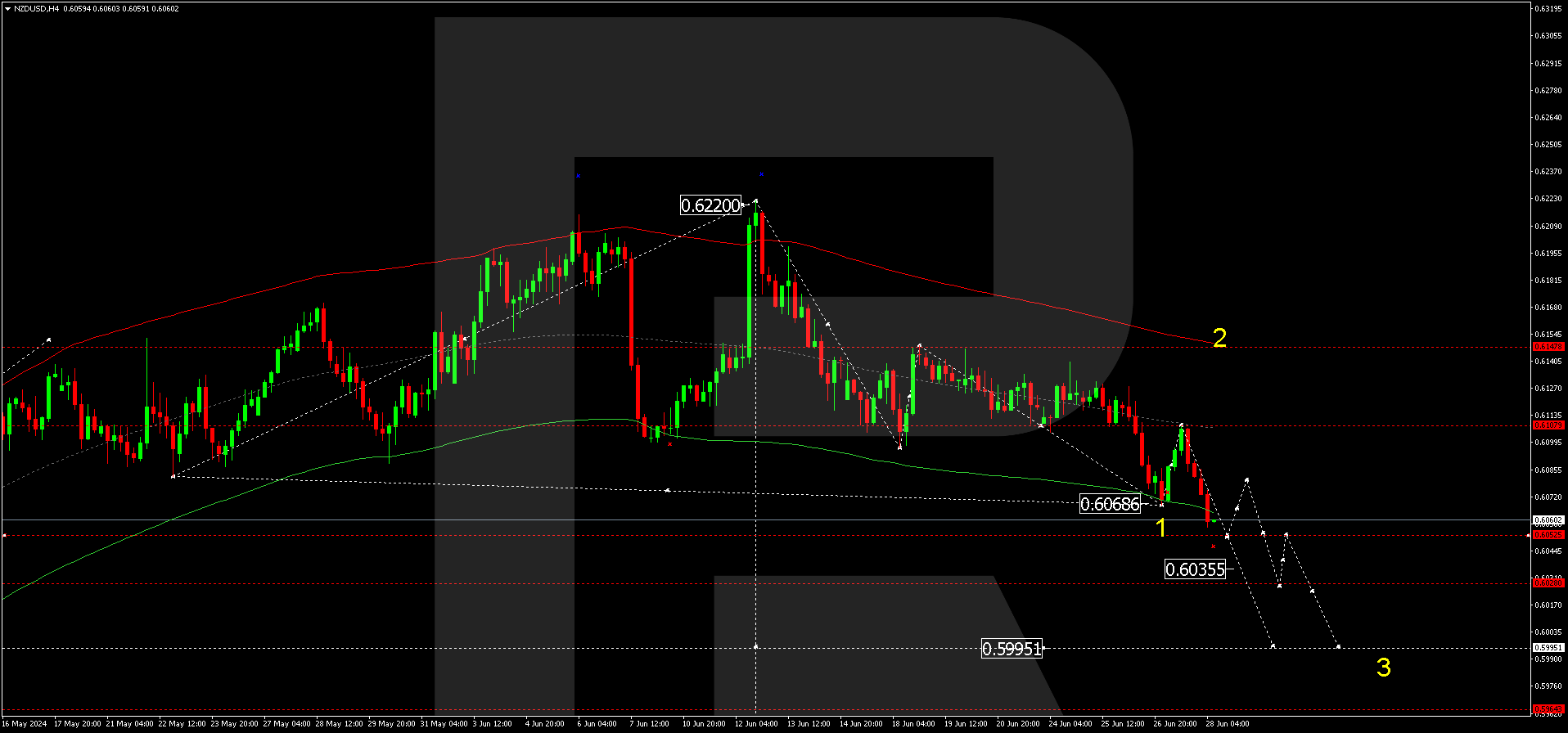

NZDUSD technical analysis

On the H4 chart, NZDUSD has completed the first decline wave towards 0.6068 and corrected to 0.6108. Subsequently, the price is expected to fall to the local target of 0.6038. A consolidation range might form around 0.6073, a crucial level for the NZDUSD forecast for 28 June 2024. A downward breakout of this level will open the potential for a decline in the NZDUSD quotes to 0.6038, potentially continuing to 0.5995, the estimated target.

The Elliott Wave structure and a wave matrix with a pivot point at 0.6070 technically confirm this scenario. The market has reached the first target of the decline wave near the Envelope’s lower boundary at 0.6068 and then undergone a correction towards its centre at 0.6108. Today, the market is under pressure to fall to 0.6038. If this level breaks, the price might decline to the Envelope’s lower boundary at 0.5995.

Summary

The NZDUSD technical analysis suggests that the downtrend continues, targeting 0.6038 and 0.5995. The news factor may collectively contribute to this scenario, with pressure from the US dollar making it the primary one.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.