USDCHF continues to recover after falling, with Biden being no obstacle to this

After declining, the US dollar attempts to recoup its losses against the Swiss franc and restore its lost position.

USDCHF trading key points

- M3 monetary aggregate: previously at 1,135.6B, currently at 1,138.1B

- USDCHF price targets: 0.8761 and 0.9000

Fundamental analysis

The news landscape is scarce on Monday, 22 July 2024, with the USDCHF pair recovering from last weekend’s developments.

The M3 monetary aggregate will show data about the population’s liquid financial assets. While this news is not significant, it can help investors make decisions.

The incumbent US President, Joe Biden Jr., announced that he would withdraw from the presidential race. This did not have a massive impact on the USDCHF rate, as investors had expected this move for a long time and the US dollar continued to recover.

This week brings extremely little news about the CHF, so the focus shifts to US data. Although heightened volatility is unlikely, the odds of a rise in the USDCHF pair remain.

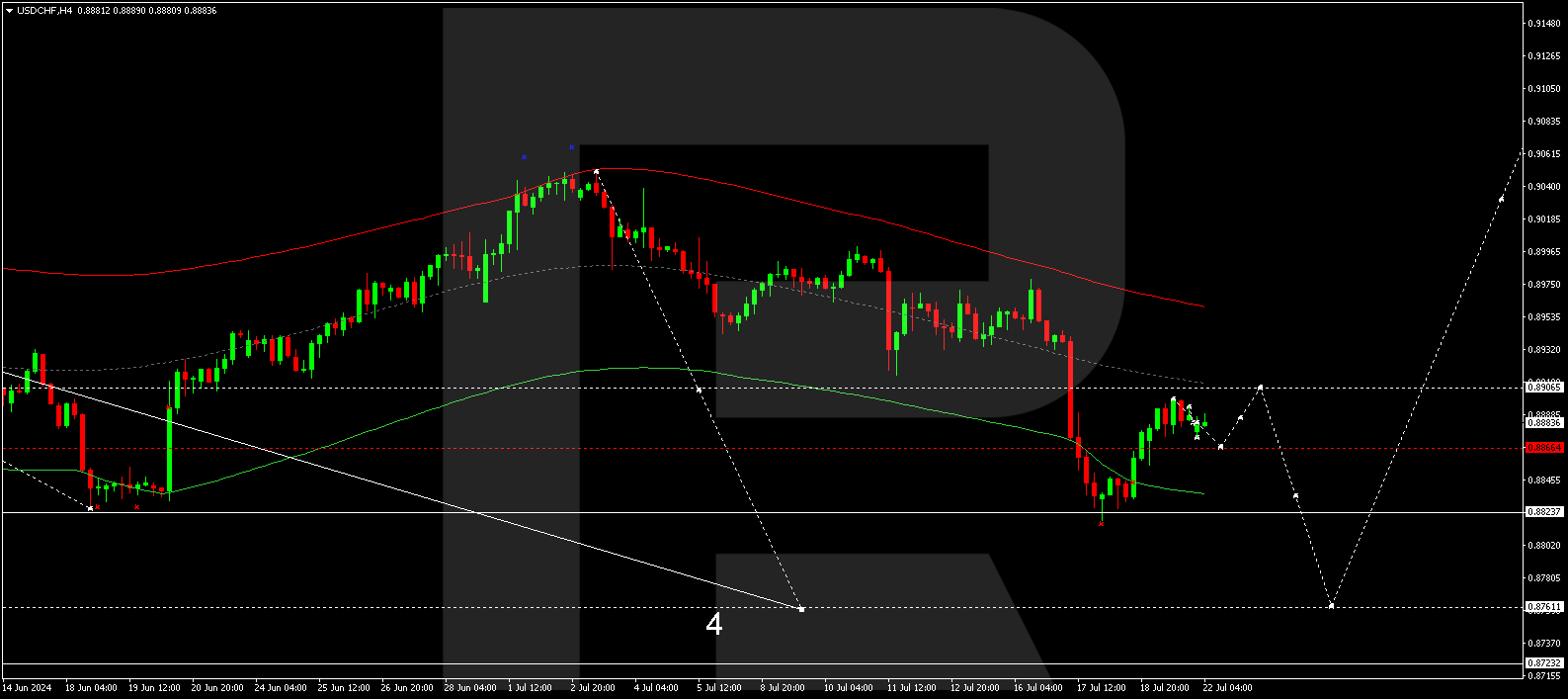

USDCHF technical analysis

Technical analysis of the USDCHF pair on the H4 chart as of 22 July 2024 indicates a further correction towards 0.8906. Once the correction is complete, a new decline wave could start, aiming for 0.8761. Subsequently, the price might rise to 0.9000, with the trend potentially continuing to the local target of 0.9040.

Summary

Amid scarce news, there is nothing left to do but rely on the USDCHF technical analysis, suggesting a decline wave towards the 0.8761 target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.