USDJPY: the yen is temporarily strengthening, with consumer spending decreasing

The USDJPY price forecast completed a correction on 5 July 2024 following the release of Japan’s household spending index. The central bank is facing a challenging situation and is about to decide on an interest rate change.

USDJPY trading key points

- Japan’s household spending index (y/y): currently at -1.8% compared to the previous reading of 0.5%

- Japan’s household spending index (m/m): currently at -1.3% compared to the previous reading of -1.2%

- US Federal Reserve’s monetary policy report

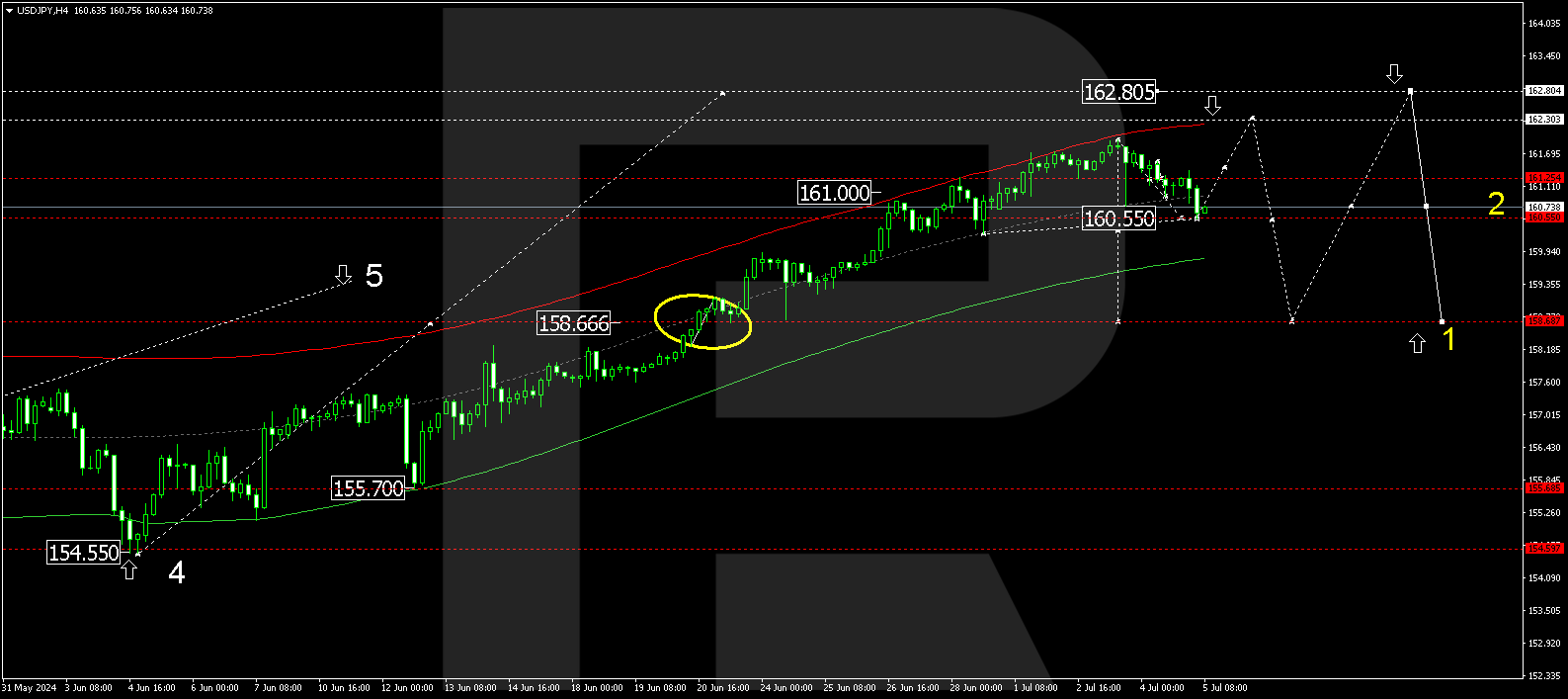

- USDJPY price forecast levels: 159.75, 162.30

Fundamental analysis

Following the release of Japan’s June year-over-year and month-over-month household spending indices, the USDJPY rate continued to correct. The data shows a 1.8% decrease in June’s household spending. High prices for goods limit buyers’ options and create certain challenges for the Bank of Japan in deciding to raise the interest rate. Companies suggest raising wages this year to solve the current situation of diminishing purchasing power. Wages are planned to increase by approximately 5.1%, and the government offers subsidies on energy costs for private households.

In case of positive data, the US Federal Reserve’s monetary policy report may help the USDJPY pair complete the correction and continue its upward trajectory to new all-time highs.

USDJPY technical analysis

On the USDJPY H4 chart analysis, a consolidation range has formed around 161.25. Today, 5 July 2024, it expanded to 160.55. The USDJPY price forecast suggests a rise to 161.25 (testing from below). With an upward breakout of the range, it could expand to 162.30. With a downward breakout, the correction could extend to 159.75, potentially continuing the trend to 158.60. Once the correction is complete, another growth wave could follow, aiming for 162.80.

Summary

Decreasing household spending confirms technical analysis for today’s USDJPY forecast, which suggests a correction with a target at 159.75. The US Federal Reserve’s report may propel the USDJPY pair further to the 162.30 target.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.