JPY loses ground again despite positive news

The yen is retreating despite the favourable news landscape. Investor sentiment remains sceptical.

The prospects of new USDJPY highs are realistic

The yen continues to lose ground against the US dollar on Friday, 28 June 2024.

The following data was released this morning:

• The Core consumer Price index (CPI) was projected to be 2%, but the index rose slightly from the previous 1.9% to 2.1%

• Industrial production volume was forecasted at 2.0% but increased to 2.8% from the previous negative level of - 0.9%

• The unemployment rate in May remained unchanged at 2.6%, aligning with the forecast

• CFTC JPY net speculative positions, with the previous value of 147.8 thousand

Following the data release, the USDJPY rate hit another high, testing the 161.26 level.

A set of data will be published at the opening of the US trading session, which may exert additional pressure on the JPY. If the news landscape in the US is favourable, the USDJPY rate has the potential to reach new highs again and continue its upward momentum.

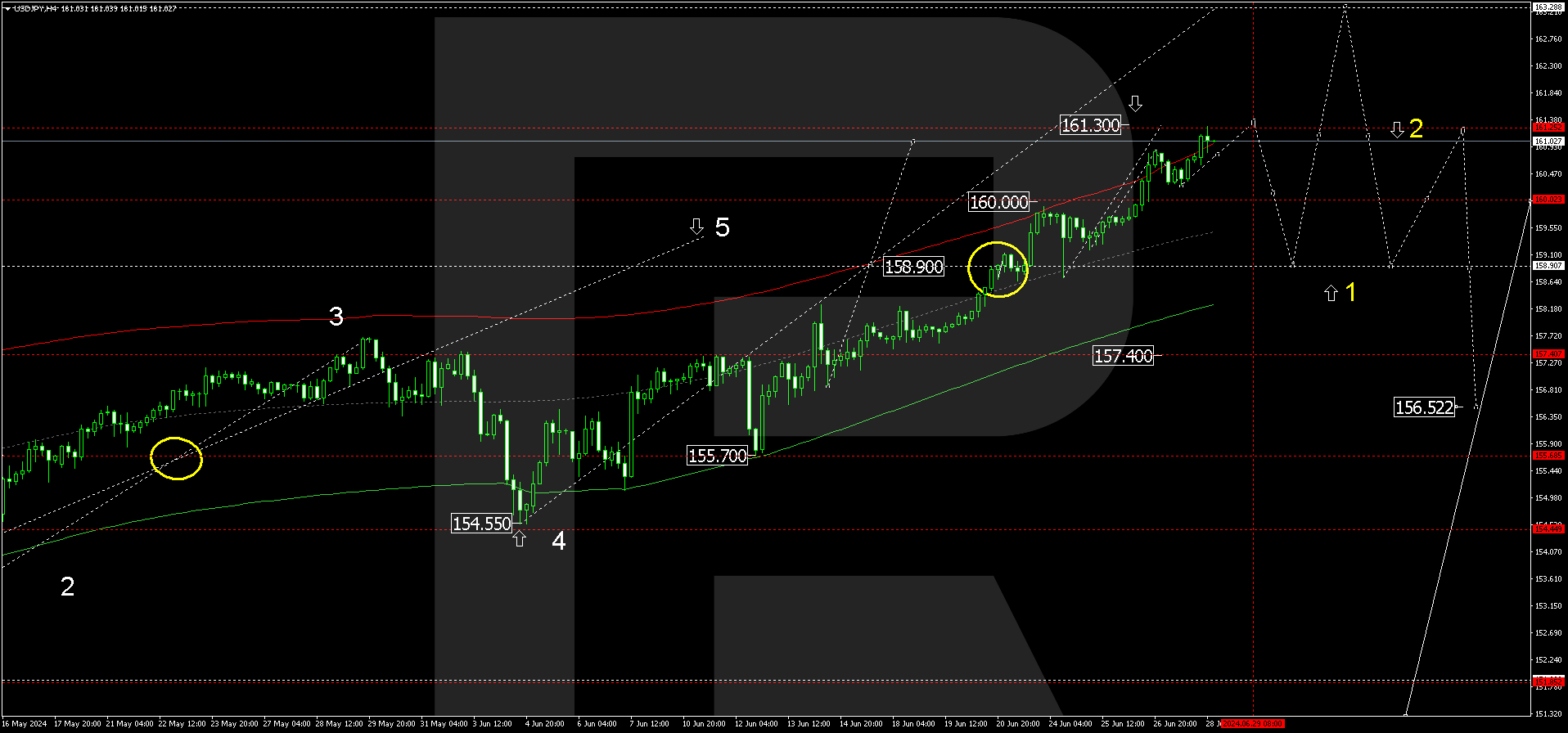

USDJPY technical analysis

On the H4 chart, USDJPY has completed a growth wave, reaching 161.30. Today, 28 June 2024, a corrective phase is possible, targeting 160.00. A consolidation range is expected to develop within these levels. An upward breakout of the range will open the potential for a growth wave towards 163.33. With a downward breakout, a correction might begin, aiming for 158.90.

The Elliott Wave structure and a wave matrix with a pivot point at 158.90 technically confirm this scenario. The market received support at the Envelope’s central line and rose to its upper boundary at 161.30. A decline wave is expected to start, aiming for its centre at 160.00, with a subsequent consolidation range forming around this level. With an upward breakout, the wave could extend to 163.30. A decline wave might start only after the price reaches this level, targeting the Envelope’s lower boundary at 158.90.

Summary

The favourable news landscape does not help strengthen the yen. The USDJPY technical analysis confirms this, suggesting a further growth wave to 163.30, followed by a decline to the 158.90 and 157.40 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.