EURUSD: employment market risks prompt the Fed to lower interest rates

The EURUSD rate slightly declines following two trading sessions of growth. Find out more in our analysis dated 20 August 2024.

EURUSD forecast: key trading points

- The EURUSD pair corrects after two trading sessions of growth and reaching a 33-week high

- Investors refrain from making aggressive investment decisions ahead of a speech by Federal Reserve Chair Jerome Powell

- Analysts suggest the Federal Reserve may lower interest rates by 25 or 50 basis points in September

- EURUSD forecast for 20 August 2024: 1.0980, 1.0933, and 1.0880

Fundamental analysis

After the EURUSD pair reached a 33-week high, its growth slowed. Investors preferred to refrain from making significant bets ahead of Federal Reserve Chair Jerome Powell’s speech expected on Friday.

Traders are eagerly awaiting the release of the latest FOMC minutes scheduled for Wednesday as they should provide insight into further monetary policy actions. Analysts believe that the regulator may reduce interest rates as early as September. However, it is still unclear whether this will be a 25 or 50-basis-point cut. The market has probably already priced in a 25-basis-point cut, while a stronger tightening could drive a surge in the EURUSD rate.

Meanwhile, Federal Reserve Bank of Minneapolis President Neel Kashkari said on Monday it was appropriate to discuss a September interest rate cut due to increasing employment market risks. Federal Reserve Bank of San Francisco President Mary Daly and Federal Reserve Bank of Chicago President Austan Goolsbee supported this opinion in their statements, hinting at a potential move as early as next month. Today’s EURUSD forecast shows that such statements exert pressure on the US dollar.

EURUSD technical analysis

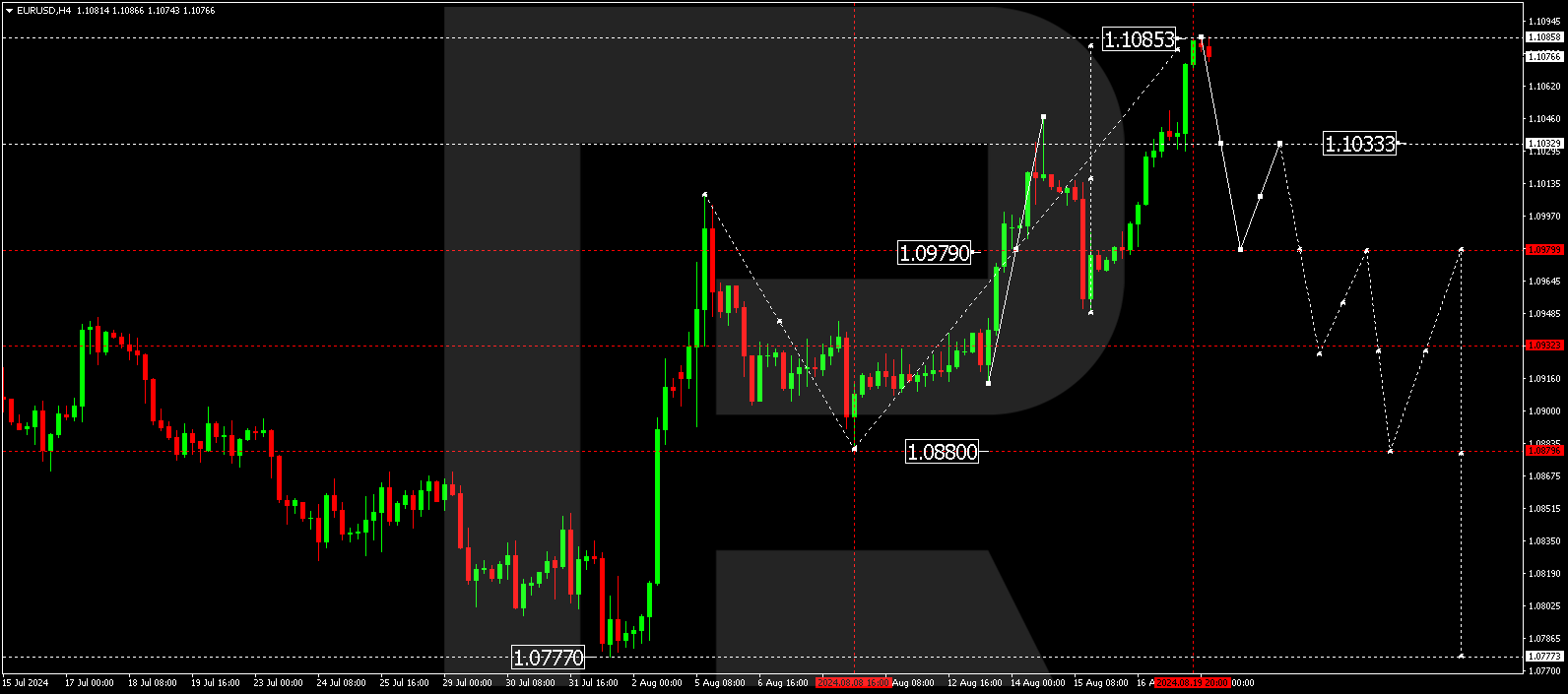

The EURUSD H4 chart shows that the market has formed a consolidation range around 1.1033 and, breaking above it, extended a growth wave towards 1.1085. A downward wave towards 1.1033 (testing from above) is expected today, 20 August 2024. A breakout below this level will open the potential for a downward wave to 1.0980, the first target. Subsequently, a correction towards 1.1033 is possible, followed by a decline to 1.0933, potentially continuing to 1.0880.

Summary

Risks in the employment market and expectations of an interest rate cut make investors cautious about the EURUSD pair. More aggressive Fed actions may weaken the US dollar, although a minimum interest rate cut in September has probably already been priced in by the market and may cause a bearish correction in the pair. Technical indicators in today’s EURUSD forecast suggest that a growth wave is over and a downward wave could start, aiming for the 1.0980, 1.0933, and 1.0880 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.