EURUSD: the US dollar loses ground amid hawkish ECB comments

The EURUSD rate is testing the crucial 1.0580 resistance level. Discover more in our analysis for 29 November 2024.

EURUSD forecast: key trading points

- Hawkish comments from an ECB official support the euro’s rally

- Germany’s annual inflation rose to 2.2% in November 2024, with core inflation up to 3.0%

- The likelihood of a 50-basis-point ECB rate cut in December is estimated at 13%

- EURUSD forecast for 28 November 2024: 1.0460

Fundamental analysis

The EURUSD rate rose on Friday following a minor correction, bolstered by ECB Executive Board member Isabel Schnabel’s hawkish statements. She underscored that the neutral interest rate ranges between 2% and 3%, calling a return to stimulative values unjustified. These comments heightened expectations that the ECB may maintain a restrictive monetary policy stance.

Traders anticipate a quiet end to the week but expect the US dollar to strengthen at the beginning of December. Analysts point out that the current pressure on the US dollar appears unsupported by fundamental factors, with the stable US economy continuing to contrast with the eurozone’s problems.

Germany’s inflation grew to 2.2% in November 2024 from 2.0% in October, below the market forecasts of 2.3%. Core inflation (excluding food and energy) increased to 3.0% from 2.9% a month earlier. The data signals persistent price pressures.

Meanwhile, the likelihood of a 50-basis-point ECB rate cut at a meeting on 12 December 2024 is estimated at 13%, while the markets have already priced in a 25-basis-point cut. The upcoming macroeconomic data from the eurozone may strengthen the position of opponents of a significant policy easing, which may support the current uptick in the currency pair as part of today’s EURUSD forecast.

EURUSD technical analysis

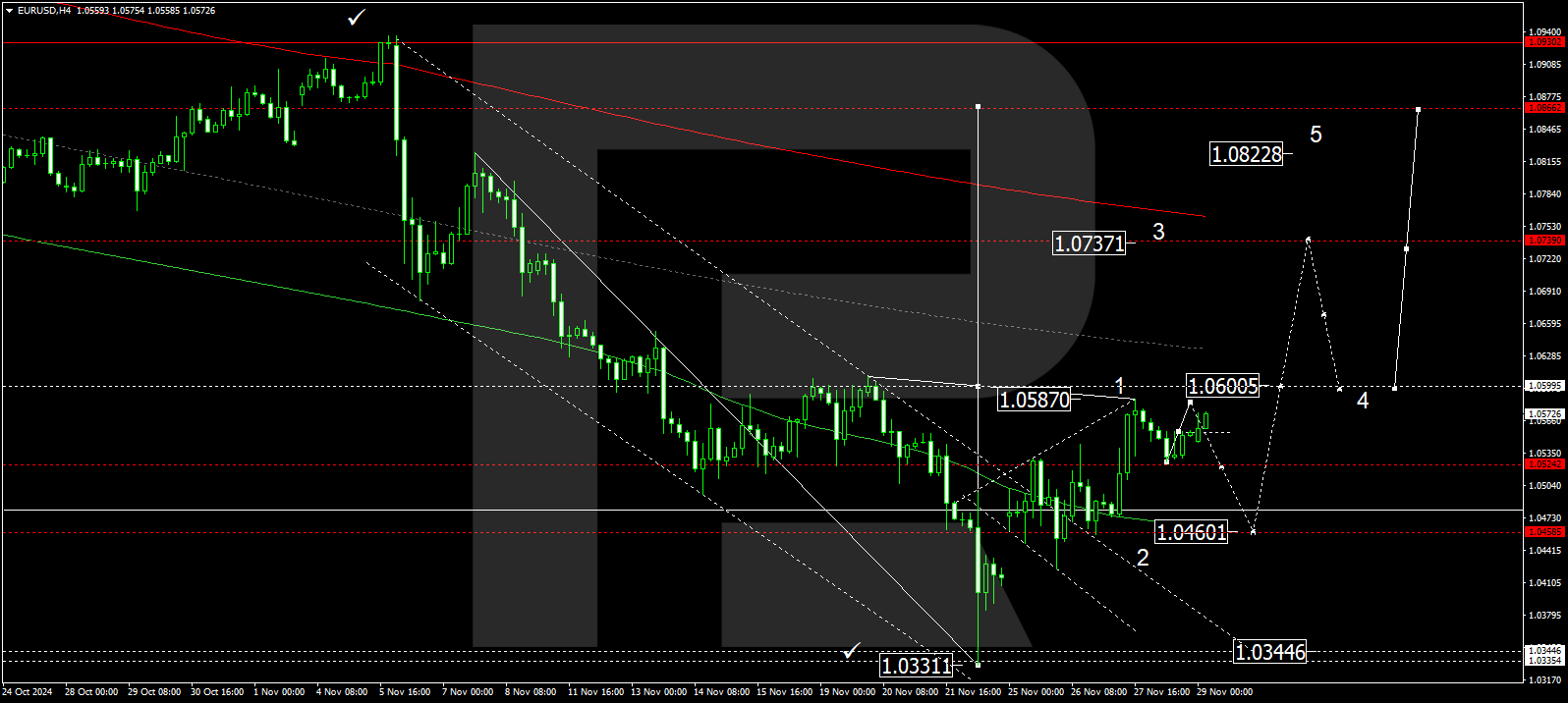

The EURUSD H4 chart shows that the market has completed a downward structure, reaching 1.0571. The growth structure towards 1.0580 could develop today, 29 November 2024. The market is forming a consolidation range here, and the downward wave might continue towards 1.0460 with a breakout below the range. Once the price reaches it, a new growth wave could aim for 1.0600 and potentially 1.0737, the local target.

The Elliott Wave structure and growth wave matrix, with a pivot point at 1.0600, technically support this scenario. This level is considered crucial for the EURUSD rate. Another downward wave could target the lower boundary of the price envelope at 1.0460. Once this level is reached, a growth wave is expected to develop, aiming for the envelope’s central line at 1.0600 and potentially continuing the trend to its upper boundary at 1.0737.

Summary

The EURUSD rate is supported by hawkish comments from the ECB official, which diminishes the likelihood of a substantial monetary policy easing. However, US economic resilience and persistent problems in the eurozone may curb further currency pair growth. Technical indicators for today’s EURUSD forecast suggest a potential downward wave towards the 1.0460 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.