EURUSD declines to 1.0539: investors avoid risk

The EURUSD pair is under selling pressure, with the market favouring the US dollar again. Find out more in our analysis for 9 December 2024.

EURUSD forecast: key trading points

- The EURUSD pair has been declining for the second consecutive trading session

- This week’s US inflation report will be the last statistics to be released before the Federal Reserve meeting

- EURUSD forecast for 9 December 2024: 1.0535, 1.0480, and 1.0460

Fundamental analysis

The EURUSD rate fell to 1.0539 on Monday.

The US dollar earlier came under pressure as investors were selling the USD following the release of US labour market statistics for November. The unemployment rate rose to 4.2% from the previous 4.1%. It remained unchanged for two consecutive months and has only now shifted in a negative direction. Nonfarm payrolls expanded by 227 thousand, while a month ago, the indicator increased by a symbolic 36 thousand.

Monthly job gains in the past four reports averaged 150 thousand. The figure is less than required to provide jobs for the constantly growing population.

This week, the focus will be on the inflation release, the last significant report before the December Federal Reserve meeting.

The EURUSD forecast appears negative.

EURUSD technical analysis

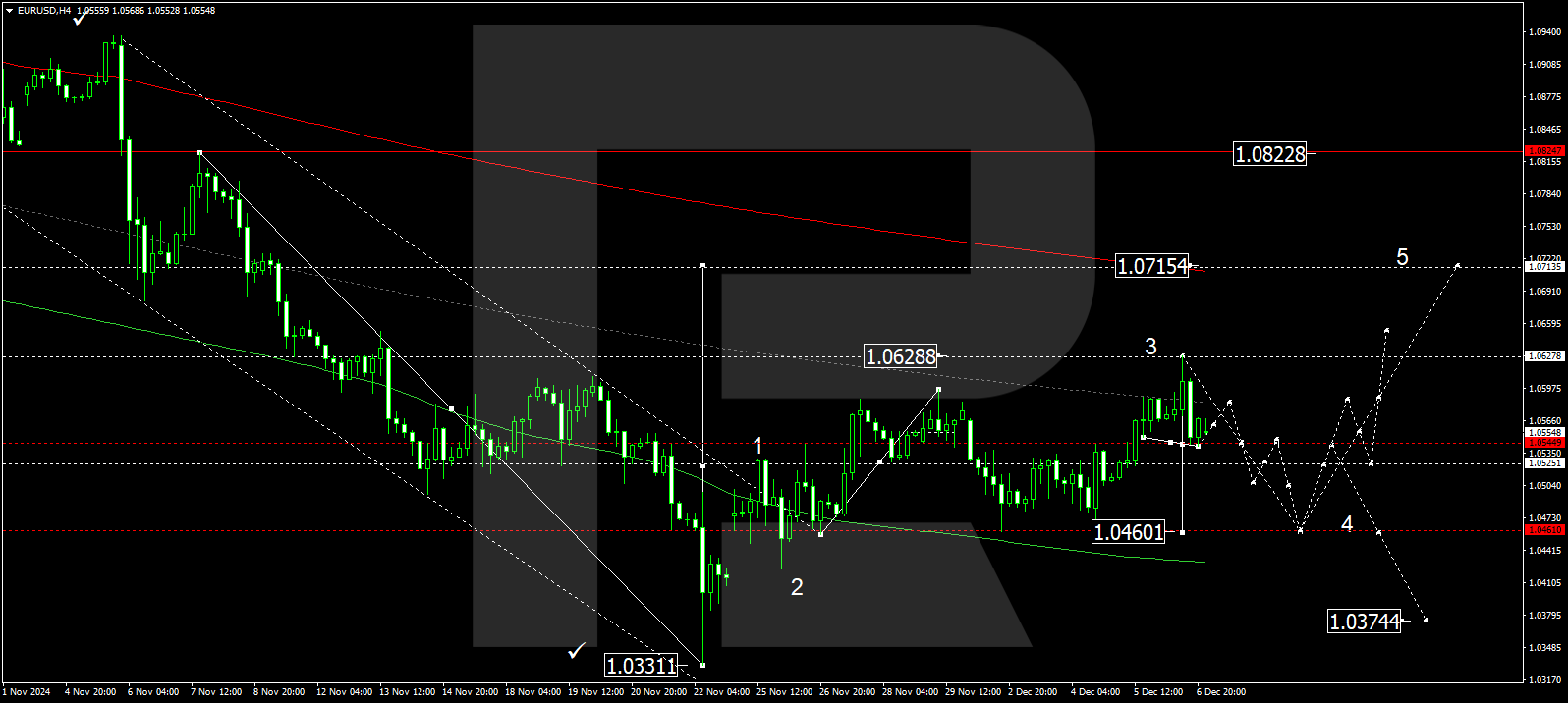

The EURUSD H4 chart shows that the market has risen to 1.0629. A downward impulse could follow today, 9 December 2024, aiming for 1.0535, with a consolidation range forming above this level later. An upward breakout could push the price up to 1.0580. A breakout below the range might extend the downward wave to 1.0480, potentially continuing the trend towards 1.0460.

The Elliott Wave structure and downward wave matrix, with a pivot point at 1.0550, technically support this scenario. This level is considered crucial for the EURUSD rate. The market has reached the central line of a price envelope and rebounded downwards. The downward wave could develop further, aiming for the envelope’s lower boundary at 1.0460 and potentially further for 1.0050.

Summary

The EURUSD pair edges down as the US dollar appears more appealing. Technical indicators for today’s EURUSD forecast suggest a potential downward wave towards the 1.0535, 1.0480, and 1.0460 levels.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.