EURUSD: the euro may lose ground again

Amid a speech by the ECB President, the EURUSD rate may decline to 1.0414 following a correction. Discover more in our analysis for 16 December 2024.

EURUSD forecast: key trading points

- ECB President Christine Lagarde will deliver a speech

- US manufacturing PMI: previously 49.7, projected at 49.4

- US services PMI: previously 56.1, projected at 55.7

- EURUSD forecast for 16 December 2024: 1.0530 and 1.0414

Fundamental analysis

Fundamental analysis for 16 December 2024 suggests that ECB President Christine Lagarde may provide signals regarding the eurozone’s future monetary policy in her speech. Investors will focus on her assessment of current inflation, the state of the economy, and potential changes to interest rates. The key areas of interest could be the fight against high inflation, the pace of economic recovery, and reactions to geopolitical risks. Any hints of tightening or easing monetary policy may significantly impact the EURUSD rate and financial markets.

The manufacturing PMI gauges the activity of purchasing managers in the industrial sector. It reflects the condition of the industrial sector and the dynamics of manufacturing processes in the country. Traders closely monitor changes in this index, as purchasing managers are the first to receive information about their companies’ performance. Thus, the PMI is a critical indicator for assessing the overall economic situation. Readings above 50.0 indicate increased production, while values below signal a decline.

The forecast for 16 December 2024 suggests that the US manufacturing PMI could fall to 49.4. While not critical, it should be noted that the figure is below the 50.0 level.

The US services PMI is projected to rise to 55.7. The index has remained relatively unchanged over the past six months, so investors are not expecting significant deviations from the forecast. If the data exceeds expectations, it will likely strengthen the US dollar against the euro.

EURUSD technical analysis

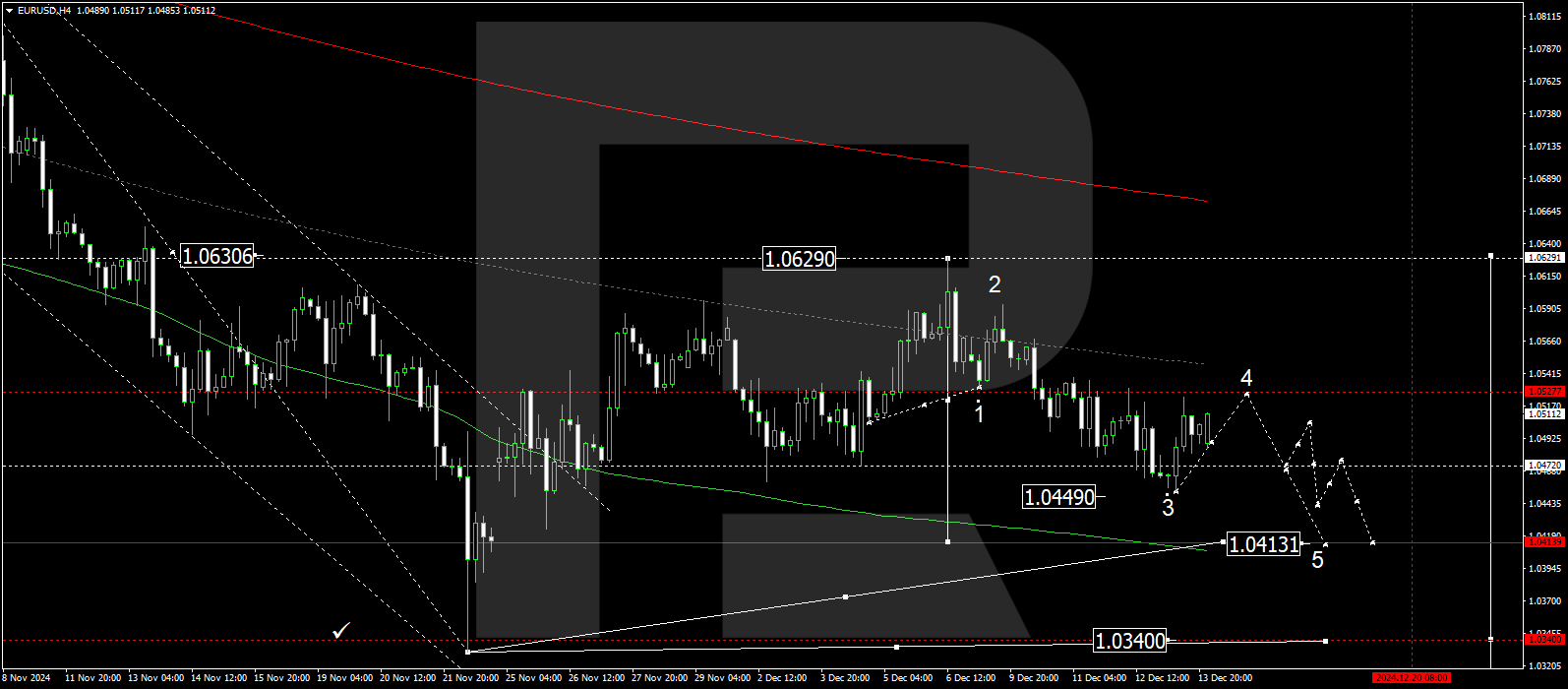

The EURUSD H4 chart shows the market has completed a downward wave, reaching 1.0452. Today, 16 December 2024, a consolidation range may form around 1.0530 (testing from below). Once the price reaches this level, it is expected to decline to 1.0470, potentially continuing the trend towards 1.0414.

The Elliott Wave structure and downward wave matrix, with a pivot point at 1.0530, technically confirm this scenario. This level is considered crucial for the EURUSD rate, with the market forming a consolidation range around it. The price is expected to break below the range and maintain its trajectory towards the lower boundary of the envelope at 1.0414.

Summary

According to the forecast for 16 December 2024, US indices may decline. Technical analysis for today’s EURUSD forecast suggests a potential correction towards 1.0530, followed by a decline to 1.0414.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.