EURUSD: US retail sales exceed forecasts

The EURUSD rate is slightly rising, with buyers aiming to test the 1.0525 resistance level. More details in our analysis for 18 December 2024.

EURUSD forecast: key trading points

- The markets expect the Federal Reserve to lower the interest rate by 25 basis points with a 95.4% likelihood

- US retail sales rose by 0.7% in November, exceeding forecasts due to solid consumer spending

- US industrial production declined for the third consecutive month, highlighting ongoing challenges in the sector

- EURUSD forecast for 18 December 2024: 1.0475 and 1.0435

Fundamental analysis

The EURUSD rate moderately increased on Wednesday. However, the currency pair continues to trade within a sideways range. Investors remain cautious ahead of the Federal Reserve’s decision, which is expected to lower the interest rate by a quarter percentage point.

According to market estimates, the likelihood of such a cut is 95.4%. Market participants are focused on updated economic forecasts and comments from Federal Reserve Chair Jerome Powell following the meeting. Speculation is growing that the Federal Reserve may announce fewer rate cuts in 2025 than originally expected due to rising inflation. Some traders also anticipate a pause in monetary policy easing as early as January, which, according to today’s EURUSD forecast, may support the US dollar.

Meanwhile, US retail sales in November exceeded expectations, rising by 0.7% from the previous month due to steady consumer spending. Analysts had forecasted a more modest increase of 0.5%. At the same time, industrial production contracted for the third consecutive month, highlighting persistent challenges in this economic sector.

EURUSD technical analysis

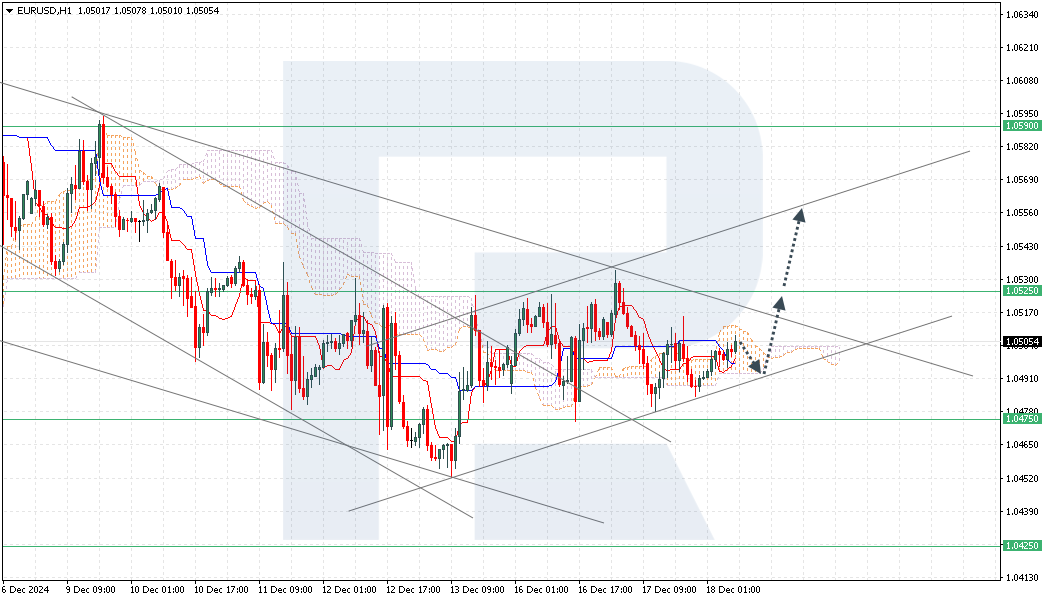

On the H1 chart, the EURUSD pair rises after bouncing from the lower boundary of an ascending channel. The crucial resistance level on the buyers’ path is located at 1.0525. The currency pair is moving within the Ichimoku Cloud, suggesting a sideways trend. The short-term EURUSD forecast indicates that the price will test the Cloud’s lower boundary at 1.0495 before rising to the 1.0525 resistance level.

Breaking above this resistance level will open the way for further growth to 1.0555. Growth will be confirmed by a breakout above the upper boundary of a descending channel, with the price securing above 1.0515. The bullish scenario could be invalidated if the price breaks below the Cloud’s lower boundary and settles below 1.0475, indicating a further decline towards 1.0425.

Summary

The EURUSD rate remains under pressure due to uncertainty surrounding expectations of the Federal Reserve’s decision. The US dollar could gain more support amid expectations of a pause in rate cuts, which Jerome Powell will likely confirm after the regulator’s meeting. The EURUSD pair continues its ascent after bouncing from the lower boundary of the ascending channel. Breaking above the crucial resistance level at 1.0525 and securing above the upper boundary of the descending channel could increase the potential for further growth to 1.0555. Otherwise, the price falling below the 1.0475 level will indicate further downward movement towards 1.0425.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.