EURUSD is under pressure ahead of key US inflation data

The EURUSD rate is declining, remaining near the November lows, with the current price at 1.0366. More details in our analysis for 20 December 2024.

EURUSD forecast: key trading points

- The US economy expanded by 3.1% in Q3, surpassing the preliminary estimate of 2.8%

- US initial jobless claims decreased by 22 thousand to 220 thousand, outperforming the forecast

- US existing home sales rose by 4.8% to 4.15 million homes in November, marking the highest level since March 2024

- EURUSD forecast for 20 December 2024: 1.0365 and 1.0435

Fundamental analysis

The EURUSD rate remains under pressure on Friday as investors prepare for the release of the PCE Price Index, a key inflation gauge for the Federal Reserve.

Federal Reserve Chair Jerome Powell stated that the PCE Price Index will likely show annual inflation above the 2.0% target. These comments followed a 25-basis-point rate cut, but the Fed projects only two cuts in 2025, down from the previously planned four. As part of today’s EURUSD forecast, these expectations helped strengthen the US currency.

The Federal Reserve also raised its 2025 GDP and inflation forecasts while lowering its unemployment expectations. The latest data revealed that the US economy grew by 3.1% in Q3 year-on-year, surpassing the preliminary estimate of 2.8%. In Q2, it expanded by 3.0%. The markets currently estimate a 90.3% probability that the Federal Reserve will keep the interest rate unchanged in January.

Meanwhile, initial jobless claims decreased by 22 thousand to 220 thousand, better than analysts’ forecasts of 230 thousand. US existing home sales rose by 4.8% in November to 4.15 million homes year-on-year, marking the highest reading since March 2024. The increase in sales is driven by job growth, a rise in housing supply, and buyers adapting to mortgage rates at 6.0-7.0%.

EURUSD technical analysis

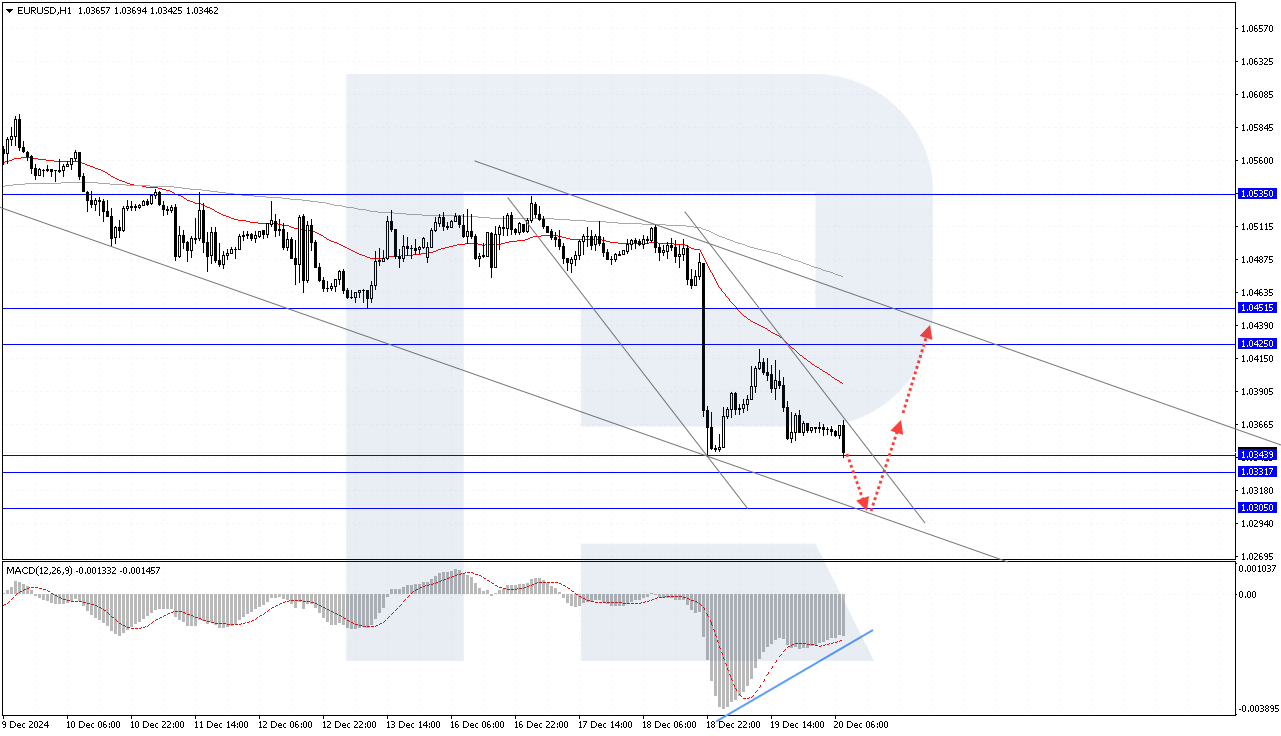

The EURUSD rate is moving within a strong downward momentum. However, the MACD indicator still shows the potential for bullish divergence, which may propel the price to 1.0425. For this signal to fully form, the price should fall to 1.0340. According to today’s EURUSD forecast, sellers are expected to attempt to secure below November’s lows with a test of the 1.0305 level, followed by growth to 1.0365 and 1.0435. A rise in the EURUSD rate will be further confirmed by a breakout above the upper boundary of the descending channel, with the price securing above 1.0345. The bullish scenario could be invalidated if the price breaks below the lower boundary of the bearish channel and gains a foothold below 1.0285, indicating further downward momentum.

Summary

The EURUSD rate remains under pressure amid the release of the PCE Price Index, which may show higher annual inflation than the 2.0% target. The Federal Reserve’s forecasts for 2025 help strengthen the US dollar, reflecting expectations of fewer rate cuts and improved economic indicators in the US. EURUSD technical analysis shows that a bullish divergence is forming on the MACD indicator, which may drive the price up to 1.0425. This scenario could be invalidated if the price breaks below the lower boundary of the descending channel and secures below the 1.0285 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.