EURUSD: the euro continues to lose ground against the US dollar

The EURUSD pair may decline further to 1.0225 amid a mix of positive and neutral news from the US. Discover more in our analysis for 10 January 2025.

EURUSD forecast: key trading points

- US nonfarm payrolls: previously at 227 thousand, projected at 164 thousand

- US unemployment rate: previously at 4.2%, projected at 4.2%

- The University of Michigan Consumer Sentiment Index: previously at 74.0, projected at 74.0

- EURUSD forecast for 10 January 2025: 1.0348 and 1.0225

Fundamental analysis

US nonfarm payrolls for the previous period surprised investors by exceeding expectations at 227 thousand. The current projection is 164 thousand. If actual figures align with forecasts, the market may experience heightened volatility. Nonfarm payroll releases almost always spark excitement in financial markets, with the potential to either strengthen or weaken the US dollar.

The US unemployment rate indicates the proportion of individuals actively seeking employment and available to start immediately. The latest data reflects the percentage of unemployed relative to the total employed population. Fundamental analysis for 10 January 2025 considers that the US unemployment rate may remain unchanged at 4.2%, though any deviation from the forecast could impact the EURUSD rate.

The University of Michigan Consumer Sentiment Index gauges consumer confidence in the economy. It is a leading indicator for forecasting consumer spending, which accounts for a significant portion of economic activity. The forecast for 10 January 2025 suggests that the index may remain stable at 74.0.

EURUSD technical analysis

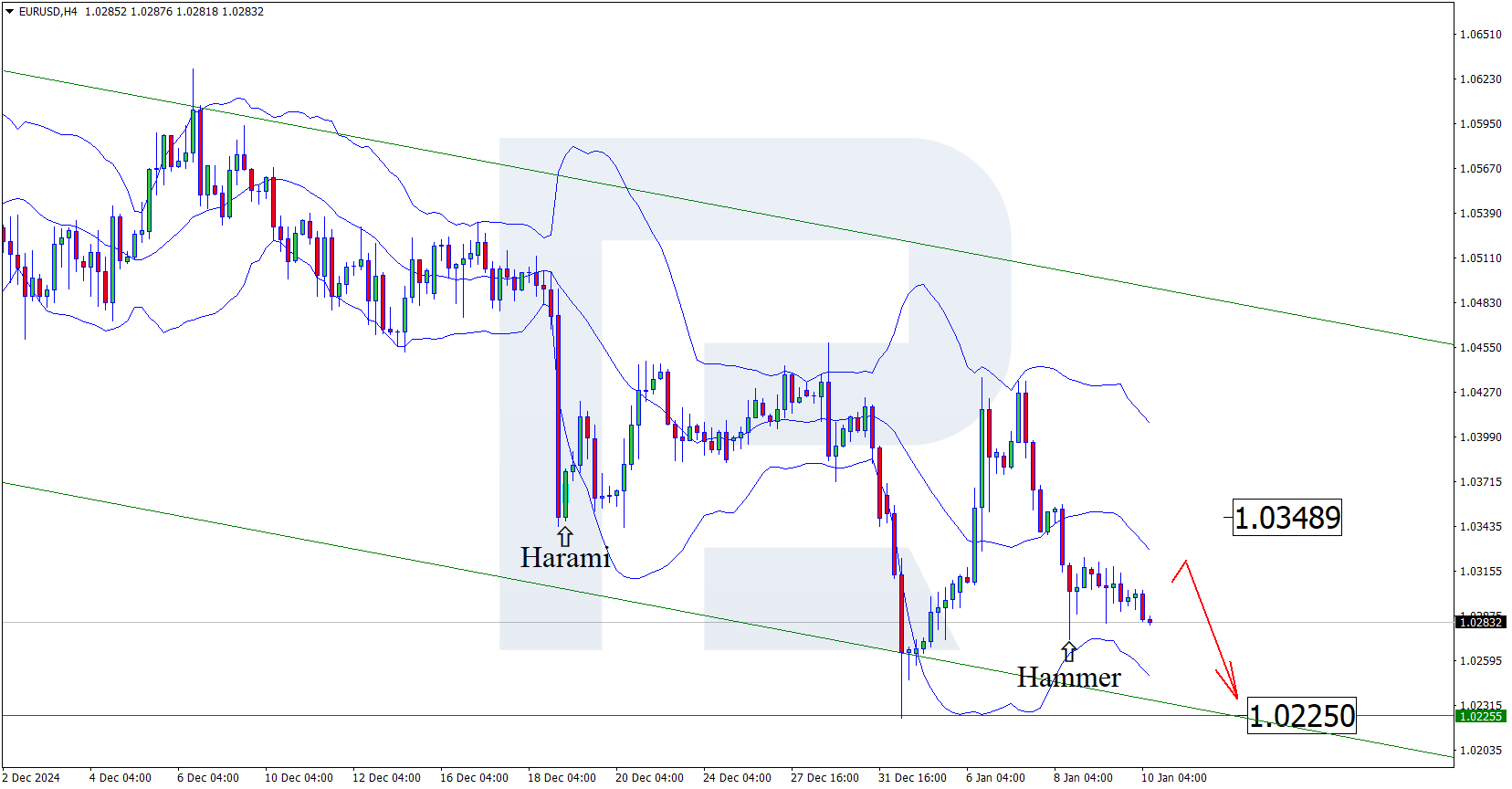

Having tested the lower Bollinger band, the EURUSD pair has formed a hammer reversal pattern on the H4 chart. At this stage, it attempts to create a corrective wave following the signal received. However, as the quotes remain within a descending channel and given the upcoming release of US fundamental data, a corrective wave is unlikely to develop, with the pair expected to maintain its downward trajectory.

The downside target is currently the 1.0225 support level. A breakout below this level could lead to a more pronounced downtrend.

However, an alternative scenario is possible, where the price retraces to 1.0348 before resuming its downward momentum.

Summary

Alongside the EURUSD technical analysis, the employment and unemployment data from the US suggest a continuation of the downtrend, with the price testing the 1.0225 support level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.