EURUSD rose and paused: trade tariffs are still a key concern

The EURUSD quotes are hovering near 1.0391 on Tuesday. Trump’s first day in office has been eventful. Find out more in our analysis for 21 January 2025.

EURUSD forecast: key trading points

- The EURUSD pair rose and paused

- Trump postponed trade tariffs on China, delighting risk-sensitive assets

- EURUSD forecast for 21 January 2025: 1.0433

Fundamental analysis

The EURUSD rate rose to 1.0391, preparing for a local correction. Yesterday, the US dollar experienced its sharpest decline in 14 months.

Following his inauguration, US President Donald Trump refrained from making immediate statements about China. Instead, he announced plans to impose 25% trade tariffs on Canada and Mexico in February. So far, Trump appears amicable towards China, having cancelled the TikTok ban and extended the deadline for trade tariff negotiations. This is a positive signal for capital markets, supporting risk appetite.

From a fundamental perspective, volatility in the EURUSD pair remains high. Trade tariffs will be the central issue until the White House provides definitive clarity. The market recognises Trump’s tendency to speculate, and his words do not always translate into concrete decisions and actions. At times, currencies may ignore his comments, while at others, they react.

The EURUSD forecast appears cautious.

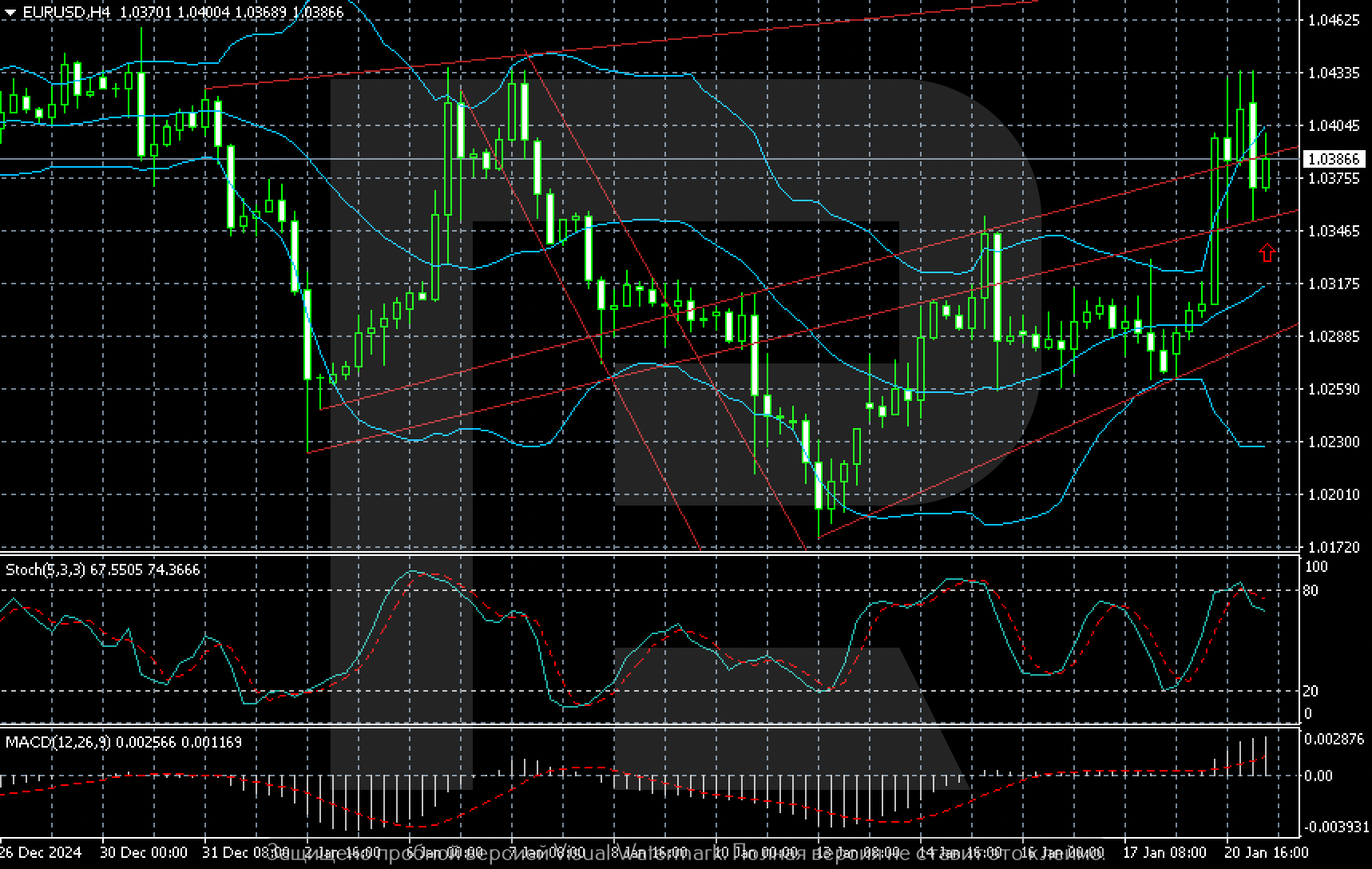

EURUSD technical analysis

The main near-term scenario on the EURUSD H4 chart suggests growth to 1.0433. It is worth monitoring the 1.0349-1.0377 channel. If the pair remains above its upper boundary, the likelihood of further price rises will increase.

Crucial support lies at the 1.0265 level. A breach of this level could intensify sellers’ pressure towards 1.0230.

Summary

The EURUSD pair has rebounded following a local improvement in risk sentiment in capital markets. However, the environment remains favourable for the US dollar. According to the EURUSD forecast for today, 21 January 2025, the pair could rise to 1.0433.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.