EURUSD continues to lose ground after attempting to recover

The ECB President’s speech could push EURUSD quotes down to 1.0350. Find out more in our analysis for 22 January 2025.

EURUSD forecast: key trading points

- The US Leading Economic Index, m/m: previously at 0.3%, projected at -0.1%

- ECB President Christine Lagarde will deliver a speech

- EURUSD forecast for 22 January 2025: 1.0470 and 1.0350

Fundamental analysis

The US Leading Economic Index (LEI) is a composite indicator reflecting the likely directions of economic development. It includes data on manufacturing activity, the labour market, new orders, consumer sentiment, and other key factors. The index is used to forecast economic trends, such as growth or a downturn, and helps assess the state of the economy for several months ahead.

The forecast for 22 January 2025 takes into account that the index may fall to -0.1%, which could signal an economic downturn in the US in the near term. Typically, a negative reading could impact the EURUSD rate.

Fundamental analysis for 22 January 2025 considers that ECB President Christine Lagarde will deliver a speech today.

Investors and analysts will closely follow her speech to gain insight into the ECB’s future monetary policy, especially given the eurozone’s current economic conditions.

The markets may react to any hints from Lagarde about interest rate changes, quantitative easing programs, or economic outlook assessment. Research shows that even non-verbal signals, such as the president’s facial expressions, can influence investors’ perceptions.

Lagarde’s speech also draws attention because her comments could affect the euro rate, potentially influencing the global financial markets.

EURUSD technical analysis

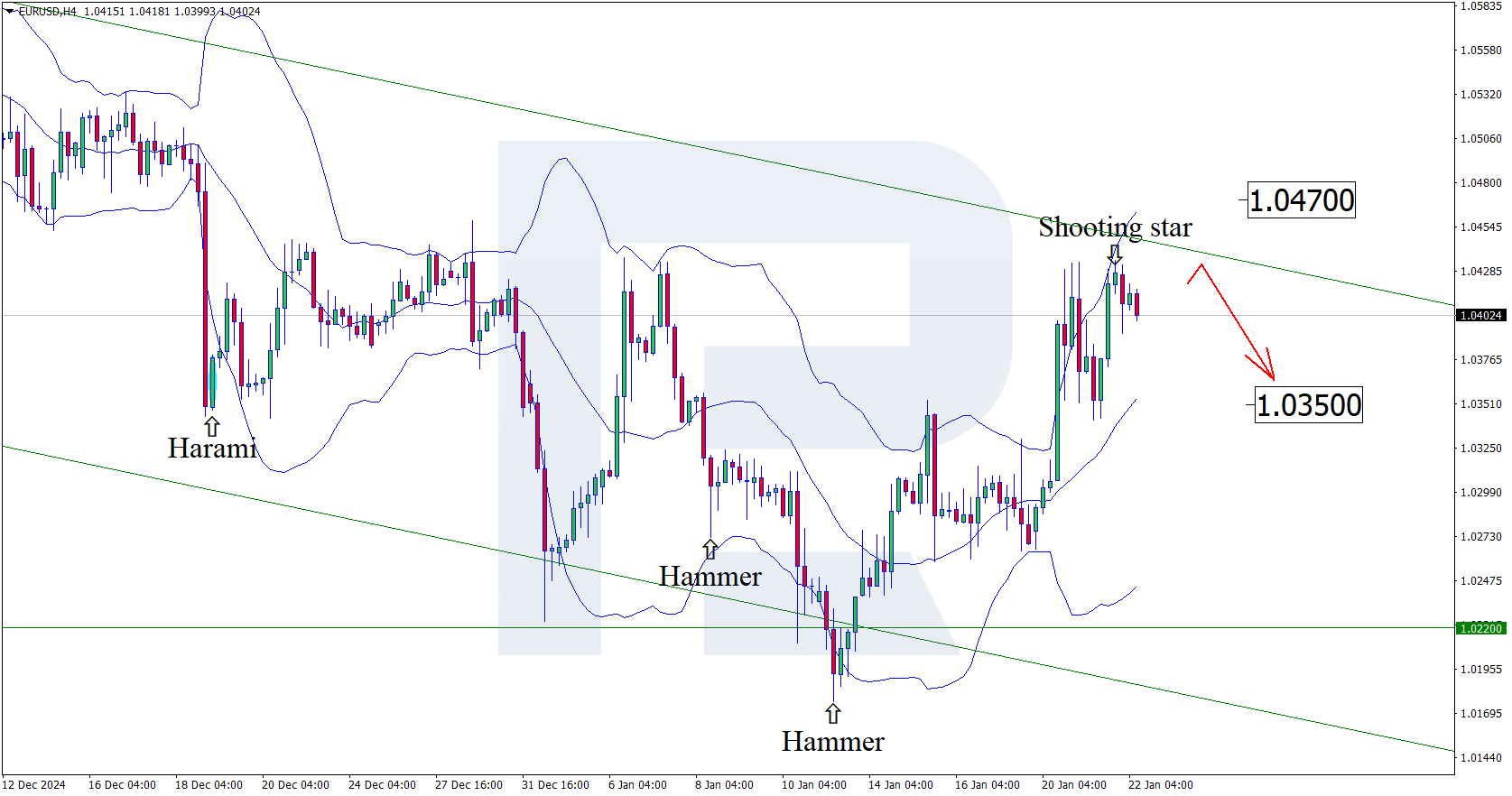

On the H4 chat, EURUSD tested the upper Bollinger Band and formed a Shooting Star reversal pattern. At this stage, it continues developing a downward wave following the signal received. Since the quotes remain within a descending channel, the downward wave is expected to continue to the nearest support level at 1.0350. A breakout below this level would open the potential for a more substantial downtrend.

However, an alternative scenario is possible: the price could rise to the 1.0470 resistance level before the downtrend gains momentum.

Summary

Alongside the EURUSD technical analysis for 22 January 2025, the ECB President’s speech suggests a decline in the price to the support level near 1.0350.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.