EURUSD declined: the Fed and Trump’s plans ahead

The EURUSD pair tumbled to 1.0464. The market is awaiting the Federal Reserve meeting this week and taking into account the signals from the White House. Find out more in our analysis for 27 January 2025.

EURUSD forecast: key trading points

- The EURUSD pair started the week with a slight decline

- All eyes are on the outcome of the upcoming Federal Reserve meeting and its intentions regarding March

- EURUSD forecast for 27 January 2025: 1.0432 and 1.0385

Fundamental analysis

The EURUSD rate fell to 1.0464 on Monday.

The new week of January will be eventful. On Wednesday, the Federal Reserve will decide on the interest rate. The markets will primarily focus on signals regarding the March meeting. If inflation declines and approaches the Fed target of 2%, the interest rate will have to be lowered.

Friday’s US statistics showed a slowdown in business activity to a nine-month low in January. This happened amid rising price pressures. At the same time, data was released showing that existing home sales in the country soared to a 10-month high in December.

The market is very positive about Donald Trump’s program “America First”. However, against this backdrop, inflationary pressures have accelerated to a four-month peak. At the same time, companies are hiring at the fastest pace since 2022.

The EURUSD forecast is so far neutral.

EURUSD technical analysis

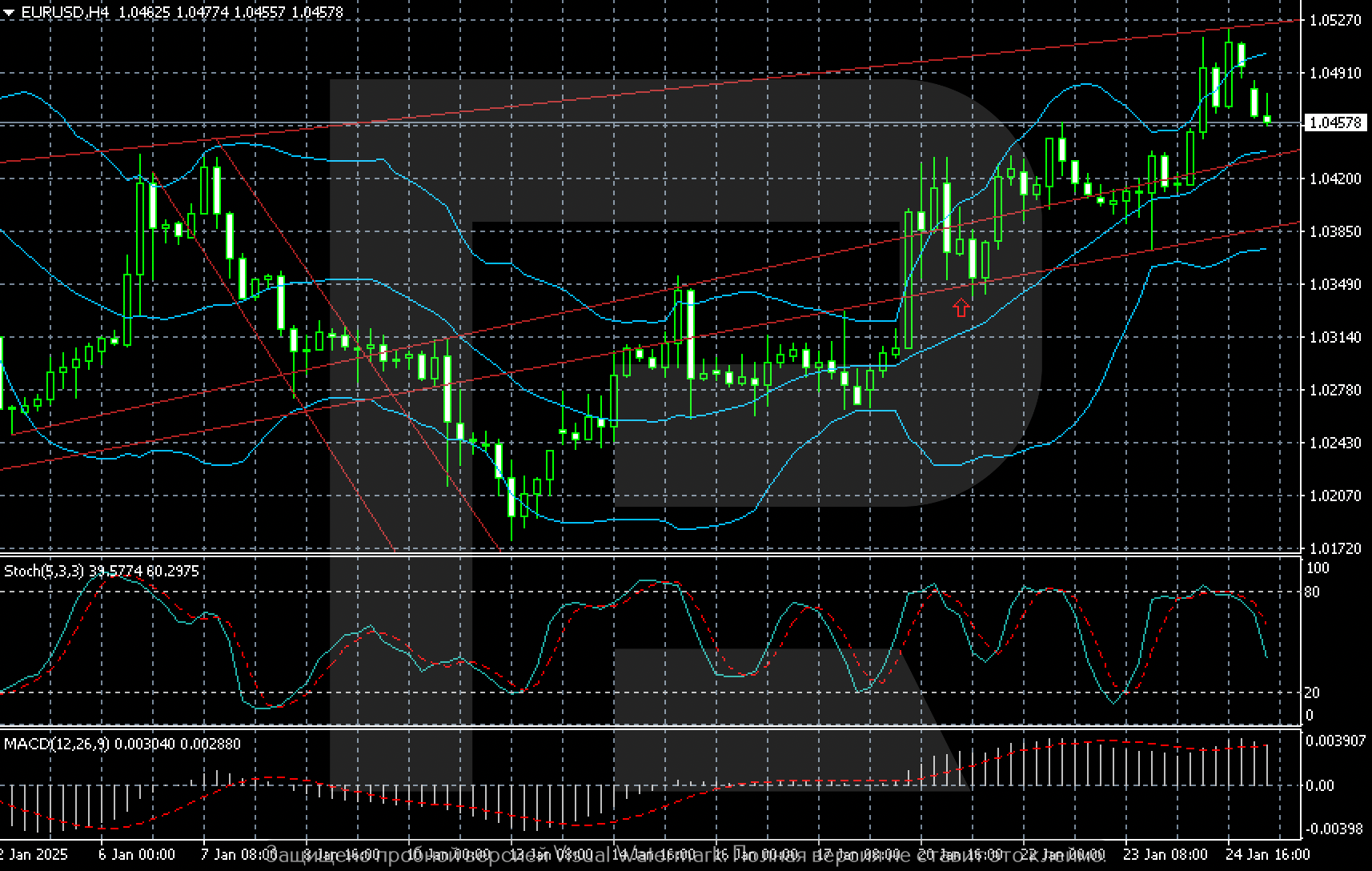

On the EURUSD H4 chart, a sideways range is forming between 1.0385 and 1.0527, with the nearest intermediate support level at 1.0432. In case of a successful attempt to test it, sellers will head towards 1.0385.

Summary

The EURUSD pair will conserve its strength until it receives signals on what the Fed will do with the interest rate in March. The EURUSD forecast for today, 27 January 2025, does not rule out a decline to the first target at 1.0432.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.