EURUSD may come under renewed selling: risk level is rising

The EURUSD pair stabilised yesterday and starts Friday near 1.0791, with investors awaiting the US core PCE data. Find more details in our analysis for 28 March 2025.

EURUSD forecast: key trading points

- The EURUSD pair has halted its decline, but this may be temporary

- Investors are awaiting the evening core PCE report from the US and tariff decisions next week

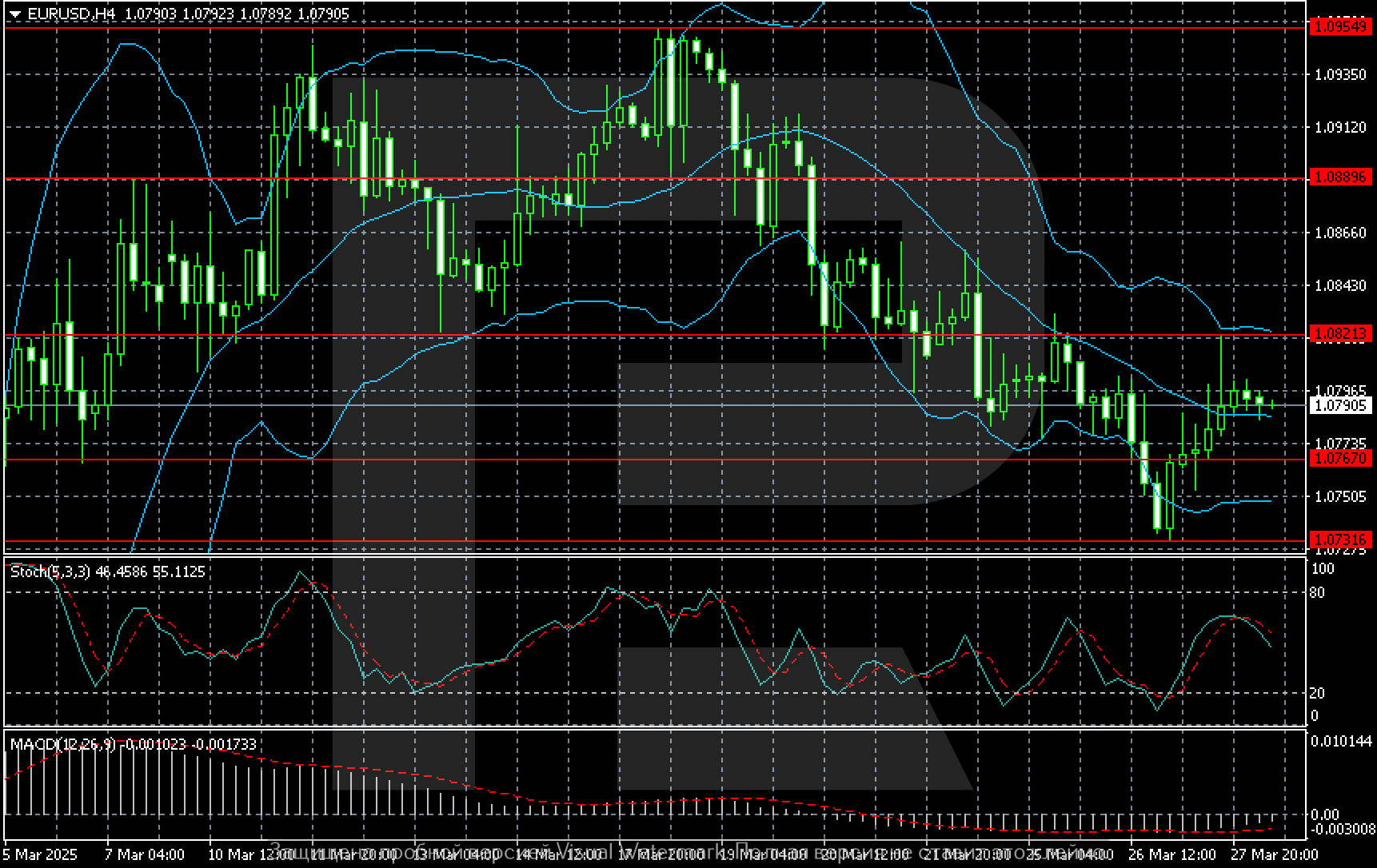

- EURUSD forecast for 28 March 2025: 1.0767 and 1.0731

Fundamental analysis

The EURUSD rate stopped near 1.0791 on Friday.

The market is conserving its strength ahead of the release of the latest PCE price index report, the Federal Reserve's main inflation gauge. Earlier, the Fed raised its inflation outlook due to concerns that tariffs could worsen the prospects for further rate cuts.

The upcoming mutual tariffs, set to take effect next week, are fuelling fears of retaliatory actions from key US trading partners. The most significant date in this context is 2 April.

Trade tensions could escalate to a new level next week, and under such conditions, the market is unlikely to take major risks.

The EURUSD outlook is moderately negative.

EURUSD technical analysis

On the EURUSD H4 chart, there are chances for a downward wave to develop towards 1.0731 through 1.0767.

A consolidation above 1.0821 would invalidate this scenario.

Summary

The EURUSD pair underwent a correction yesterday, but that appears to have run its course. Key inflation data lies ahead. The EURUSD forecast for today, 28 March 2025, expects continued selling pressure towards 1.0731.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.