EURUSD hits a three-year high: the US dollar is not in demand

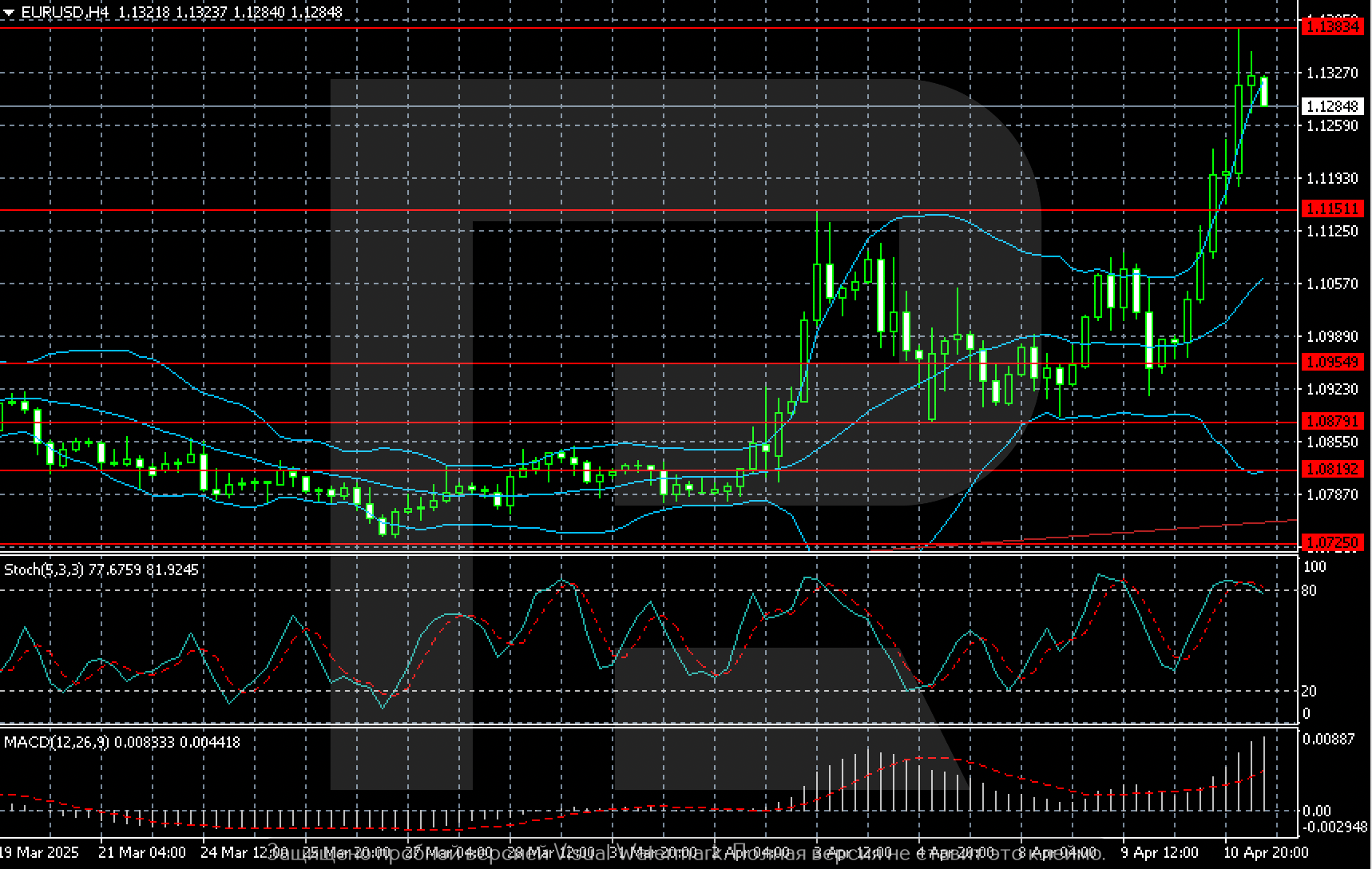

The EURUSD rate is testing the 1.1285 level and setting a new peak at 1.1383, with the market concerned about the impact of the US trade war. Find out more in our analysis for 11 April 2025.

EURUSD forecast: key trading points

- The EURUSD pair hits a three-year high and shows no signs of slowing

- The market remains focused on tariff-related risks and sees reasons for a decline in US GDP

- US core inflation for March gives reason for the Fed to cut interest rates

- EURUSD forecast for 11 April 2025: 1.1384

Fundamental analysis

The EURUSD rate touched the 1.1384 level but is now hovering around 1.1285.

The dominant market driver working against the US dollar is concern over the state of the US economy. Investors fear that aggressive tariffs will slow down US growth despite the current 90-day tariff pause.

US inflation data for March came in mixed. The core CPI rose just 2.8% year-on-year, marking the slowest increase since March 2021. This gives markets further reason to anticipate a rate cut from the Federal Reserve.

Overall, the EURUSD forecast is favourable.

EURUSD technical analysis

On the EURUSD H4 chart, conditions still support upward movement, with the price potentially retesting the local high of 1.1384.

Summary

The EURUSD pair has climbed confidently in recent sessions, reaching a new three-year high. Markets increasingly expect the US economy to suffer from the White House’s tariff strategy. The EURUSD forecast for today, 11 April 2025, suggests a continued wave of buying with the next target at 1.1384.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.