EURUSD holds firm — ECB President Lagarde’s speech in focus today

EURUSD remains steady above 1.1300, as markets await ECB President Christine Lagarde’s speech, which could be a catalyst for further upside. Full details in our analysis for 15 April 2025.

EURUSD forecast: key trading points

- Market focus: ECB President Christine Lagarde to deliver remarks today

- Current trend: upward

- EURUSD forecast for 15 April 2025: 1.1500 and 1.1300

Fundamental analysis

EURUSD is trading confidently near 1.1400 after posting a 3.6% weekly gain. The euro's strength stems from ongoing US dollar weakness and heightened uncertainty surrounding President Trump’s tariff agenda. Concerns that aggressive trade policy may trigger a US recession are eroding investor confidence in dollar-denominated assets.

The European Central Bank will hold its next policy meeting on Thursday, with analysts expecting a 25-basis-point rate cut. Today, markets are focused on ECB President Christine Lagarde’s speech, as traders look for forward guidance on how the ECB views trade tensions, inflation, and rate policy moving forward.

EURUSD technical analysis

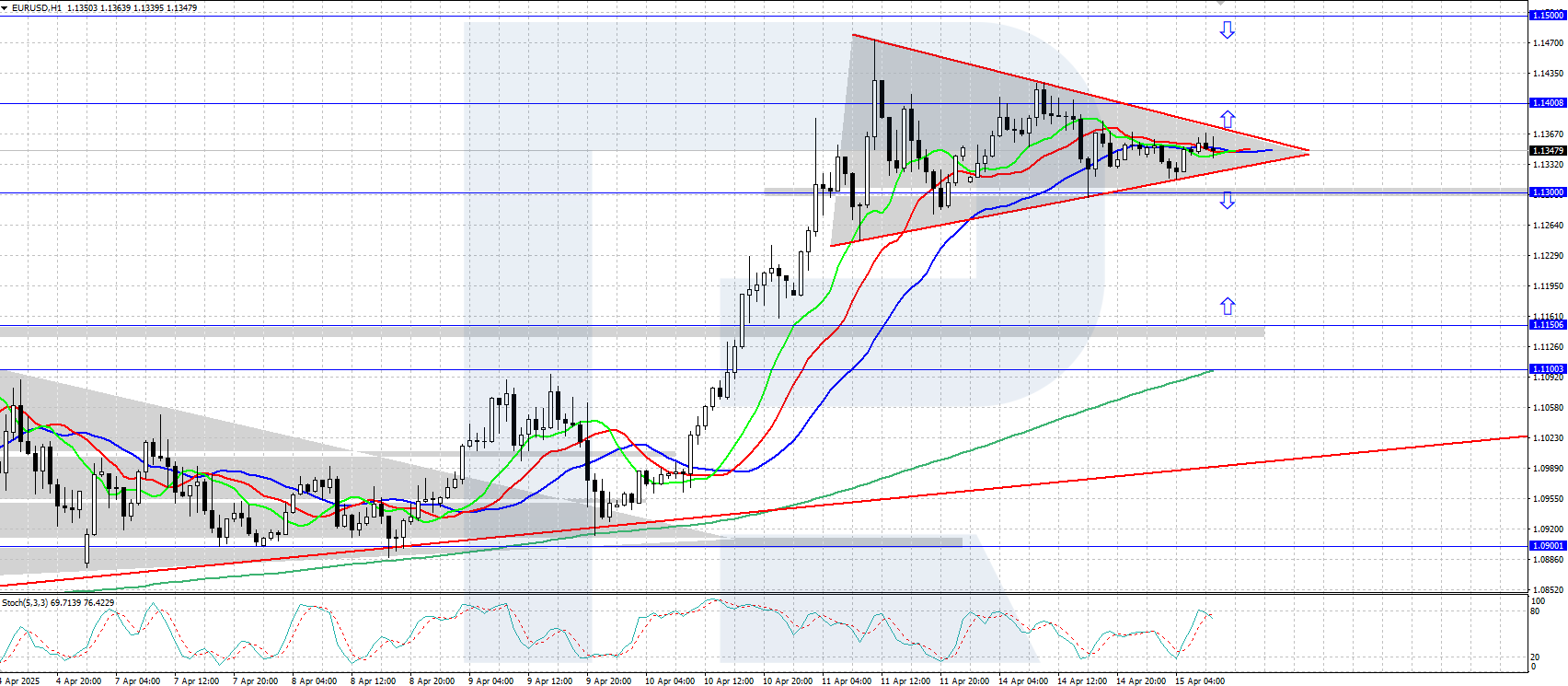

On the H4 chart, EURUSD maintains a solid bullish trend, moving within an ascending price channel. A Triangle pattern has formed, suggesting potential continuation toward the 1.1500 level.

In the short-term forecast, if bulls manage to keep the price above 1.1300, the 1.1500 target appears well within reach. However, a break below 1.1300 could lead to a correction down to the 1.1150 support level.

Summary

EURUSD holds firmly above 1.1300 as markets brace for ECB President Christine Lagarde’s speech. Her comments may act as a key catalyst for further upside. Today’s forecast sees the potential for continued growth toward 1.1500, barring a break below key support.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.