EURUSD on the edge of explosive moves — all eyes on Daly's speech

FOMC member Mary Daly's upcoming speech could trigger a breakout in EURUSD toward the 1.1500 resistance level. Full analysis for 18 April 2025 below.

EURUSD forecast: key trading points

- US markets are closed for a public holiday

- Spain’s Consumer Confidence Index: previous – 81.4

- FOMC member Mary Daly to speak today

- EURUSD forecast for 18 April 2025: 1.1500 and 1.1280

Fundamental analysis

Spain’s Consumer Confidence Index, which measures consumer optimism regarding current economic conditions, is expected to remain steady at 81.4 — signalling continued resilience in consumer sentiment.

Meanwhile, the main market focus today is the speech by Mary Daly, President of the San Francisco Federal Reserve and a key FOMC voice. Daly’s comments often provide insight into the broader mood of the Fed, especially in periods of heightened inflation uncertainty.

Given the current backdrop, traders will parse her words closely for clues on whether the Fed may pause or even pivot toward rate cuts. Any mention of economic fragility, inflation trends, or labour market shifts could move expectations and, in turn, the US dollar. Even subtle hints at policy easing may trigger renewed volatility across USD pairs and support euro gains.

The fundamental outlook for EURUSD remains bullish.

EURUSD technical analysis

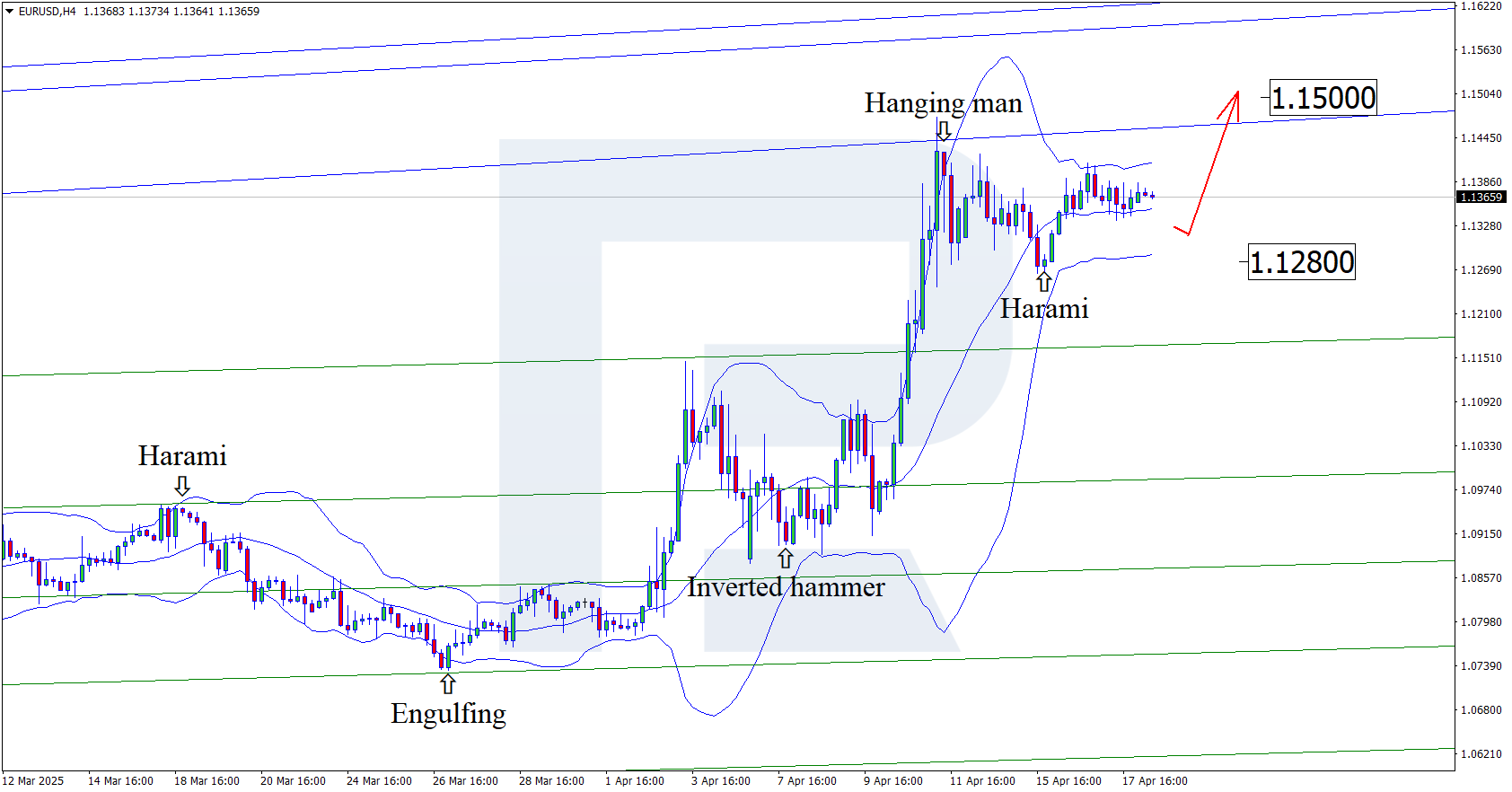

On the H4 chart, EURUSD has formed a Harami reversal pattern near the lower Bollinger Band. The price is currently in the early stages of a bullish wave, working through the reversal signal.

As the pair trades within an ascending channel, a continued rally is likely. A breakout above the immediate resistance at 1.1500 would confirm further upside potential. However, a temporary correction toward 1.1280 remains a possibility before the next leg higher.

Summary

Spain’s consumer sentiment remains strong, while today’s focus will be on Mary Daly’s speech. Any dovish tilt in her remarks could weigh on the dollar and boost EURUSD. Technically, the pair is well-positioned to continue higher, with a short-term target of 1.1500, following a potential correction toward 1.1280.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.