EURUSD retreats into correction; will the decline continue?

The EURUSD pair sharply entered a corrective phase after hitting 1.1573. A reversal pattern may form on the chart. Find more details in our analysis for 25 April 2025.

EURUSD forecast: key trading points

- Market focus: US durable goods orders jumped by 9.2% in March, exceeding the forecast of +2.0%

- Current trend: bearish correction in progress

- EURUSD forecast for 25 April 2025: 1.1400 and 1.1150

Fundamental analysis

Yesterday’s data showed US durable goods orders rose by 9.2% month-on-month in March 2025, far exceeding market expectations of 2.0%. The sharp increase was primarily driven by a surge in new orders for commercial aircraft.

The dollar received additional support after US President Donald Trump stated that trade talks with China are ongoing, despite denials from Beijing. Continued negotiations with Japan and South Korea further reassured markets and eased fears of renewed trade tensions.

EURUSD technical analysis

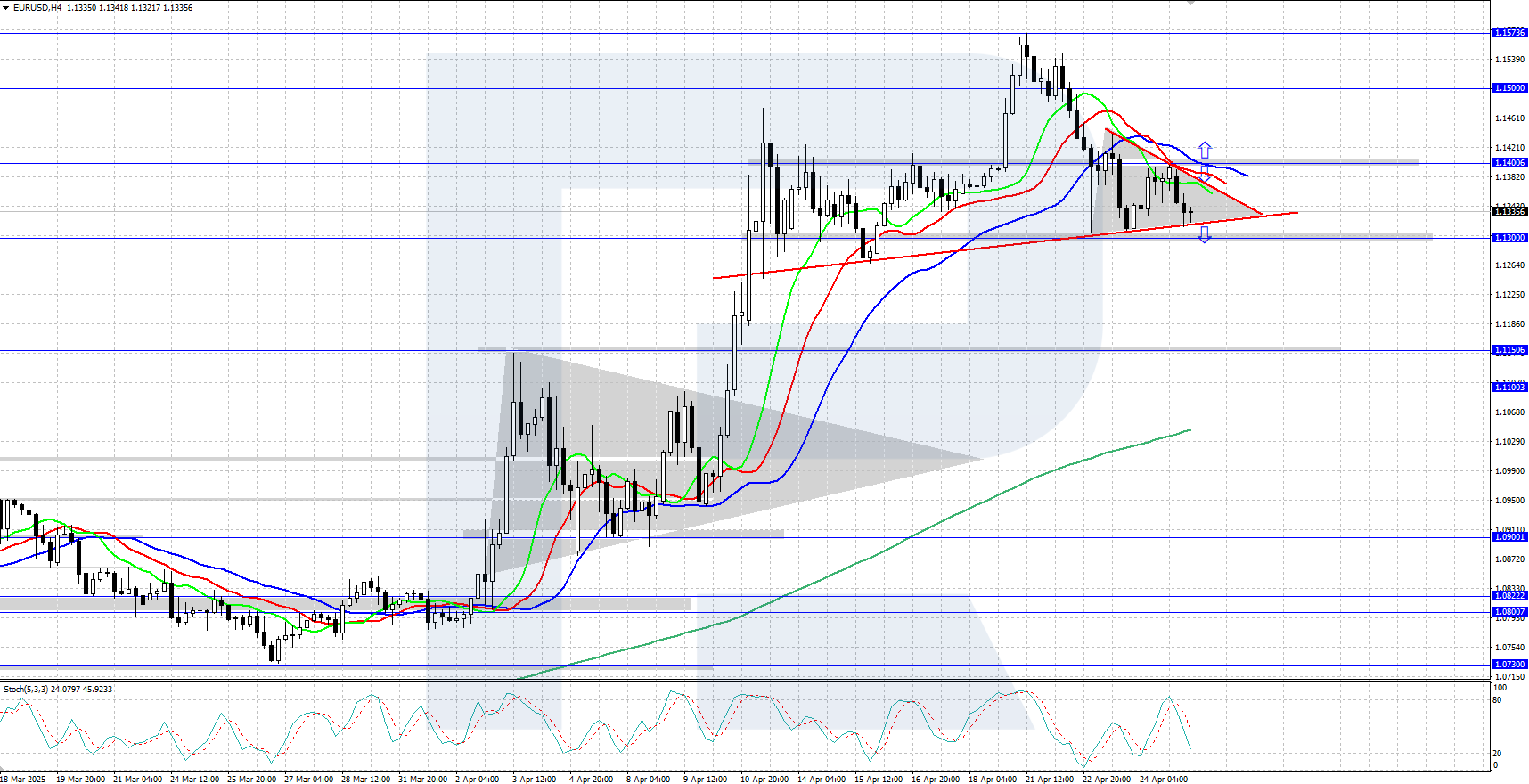

On the H4 chart, the EURUSD rate is undergoing a bearish correction after reaching a yearly high of 1.1573. A Head and Shoulders reversal pattern could form if the price consolidates below 1.1300. In this scenario, the next downside target will be the 1.1150 support level.

The short-term EURUSD price forecast suggests that the price could revisit the 1.1400 level if bulls keep the pair above 1.1300. However, if bears push the price below 1.1300, a downward correction would likely continue towards the 1.1150 support level.

Summary

The EURUSD pair has entered a downward correction after reaching its yearly high of 1.1573. The strong US durable goods orders report and signs of easing trade tensions have supported the dollar.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.