EURUSD awaits news: the Fed to provide direction

The EURUSD pair has declined and is now holding near 1.1500. All eyes are on the upcoming Federal Reserve decision. Find more details in our analysis for 18 June 2025.

EURUSD forecast: key trading points

- The EURUSD pair has halted its decline ahead of key events

- The Fed is expected to keep rates unchanged and share its outlook on the US economy

- EURUSD forecast for 18 June 2025: 1.1581

Fundamental analysis

The EURUSD rate is hovering around 1.1500 as the market focuses on the upcoming Federal Reserve interest rate decision. While no change in rates is expected, investors will be watching for forward guidance amid ongoing trade tensions and geopolitical risks.

Today’s focus also includes fresh data on the US housing market and jobless claims, set to be released today before the US holiday.

Earlier, the US dollar gained support from safe-haven demand following renewed conflict between Israel and Iran. Geopolitical tensions escalated after President Donald Trump demanded Iran’s unconditional surrender and threatened to target the supreme leader in his statements published via the Truth Social platform.

According to the latest report, US retail sales for May came in weaker than expected. However, consumer activity remains relatively stable due to wage growth.

The EURUSD forecast is cautious.

EURUSD technical analysis

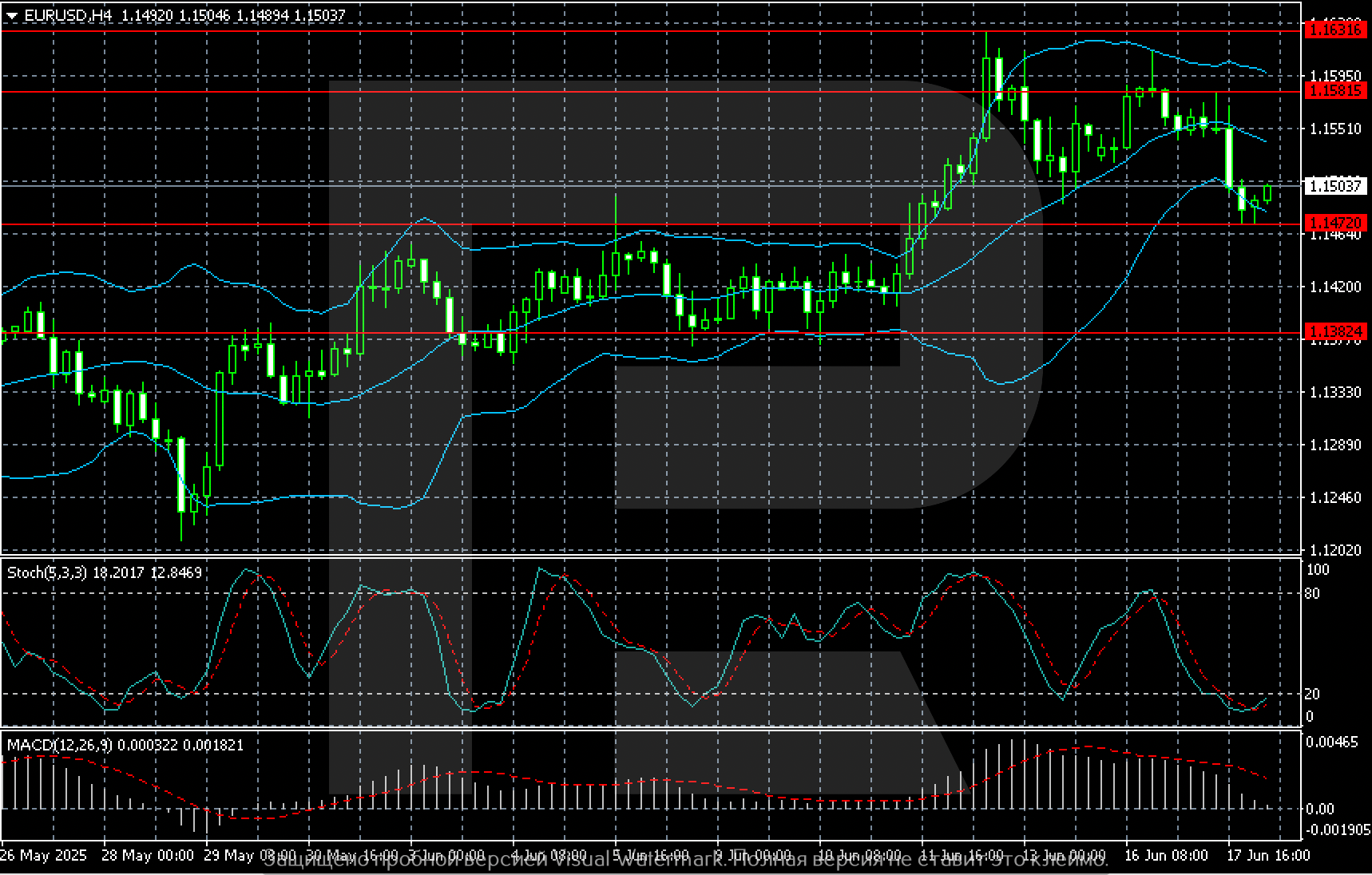

On the H4 chart, the EURUSD pair shows potential for resuming its upward movement, with the first target at 1.1581 and a secondary target at 1.1631.

Summary

Despite yesterday’s pullback, the EURUSD pair retains its bullish momentum. The EURUSD forecast for today, 18 June 2025, anticipates a renewed upward move towards 1.1581 and then 1.1631.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.