EURUSD attempts to reverse upwards

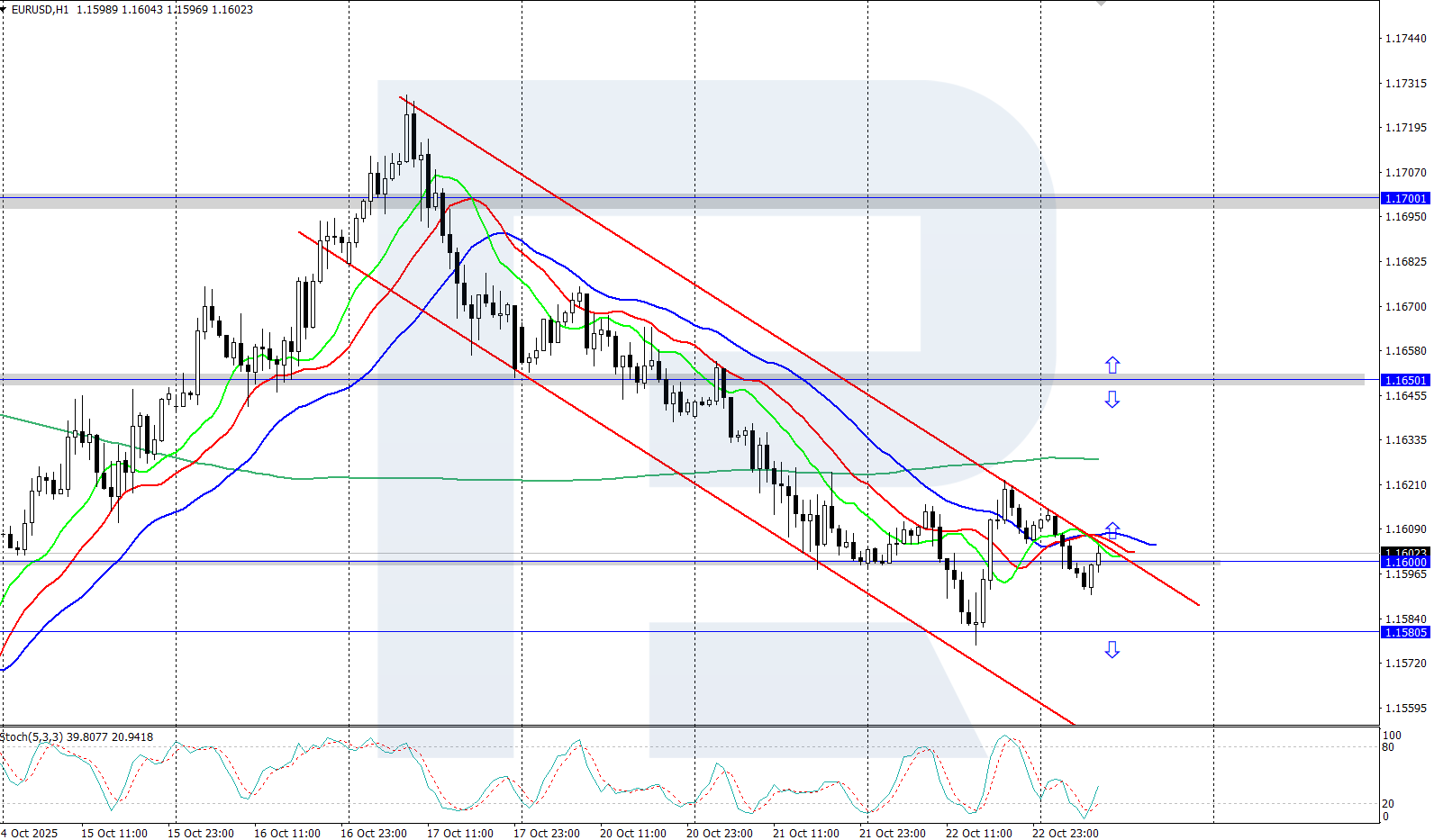

The EURUSD pair corrected down to the 1.1580 support level, where it met strong buying interest and is now attempting to turn upwards. Find more details in our analysis for 23 October 2025.

EURUSD forecast: key trading points

- Market focus: investors await the outcome of US-China trade talks

- Current trend: moderate correction

- EURUSD forecast for 23 October 2025: 1.1500 or 1.1650

Fundamental analysis

The EURUSD rate declined slightly as the US dollar gained modest support from renewed optimism surrounding US-China trade negotiations. President Donald Trump expressed confidence that his upcoming meeting with Xi Jinping would lead to a mutually beneficial trade deal.

Market participants now see a 25-basis-point rate cut by the Federal Reserve in October as nearly certain, while the European Central Bank is not expected to ease monetary policy again until July 2026.

EURUSD technical analysis

On the H4 chart, the EURUSD pair is undergoing a downward correction, dipping to the 1.1580 support level. The broader daily momentum is bullish, suggesting that the European currency may continue to rise once the correction ends.

The short-term EURUSD forecast expects growth towards 1.1650 if buyers gain a foothold above 1.1600. Conversely, if sellers push the pair below 1.1580, a further decline towards the 1.1500 support level may follow.

Summary

The EURUSD pair has fallen to the 1.1580 support level, where it found active buying interest. The market focus in the coming week will shift to the upcoming Fed and ECB rate decisions.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.