EURUSD reverses lower from 1.1670

The EURUSD pair is moderately declining after failing to break above the 1.1670 resistance level. Today, markets are focused on the Federal Reserve’s rate decision. Find more details in our analysis for 29 October 2025.

EURUSD forecast: key trading points

- Market focus: today’s key event is the Federal Reserve’s interest rate decision

- Current trend: moving downwards

- EURUSD forecast for 29 October 2025: 1.1580 or 1.1730

Fundamental analysis

Today, investors are preparing for the Federal Reserve’s interest rate decision, where a 25-basis-point cut is widely expected. Traders will closely monitor comments from Chairman Jerome Powell for hints regarding the pace of future easing, with markets already pricing in another potential cut in December.

Meanwhile, the European Central Bank is expected to keep rates unchanged at its Thursday meeting. In addition, preliminary Q3 GDP and October inflation data will be released, offering more insight into the eurozone’s economic outlook.

EURUSD technical analysis

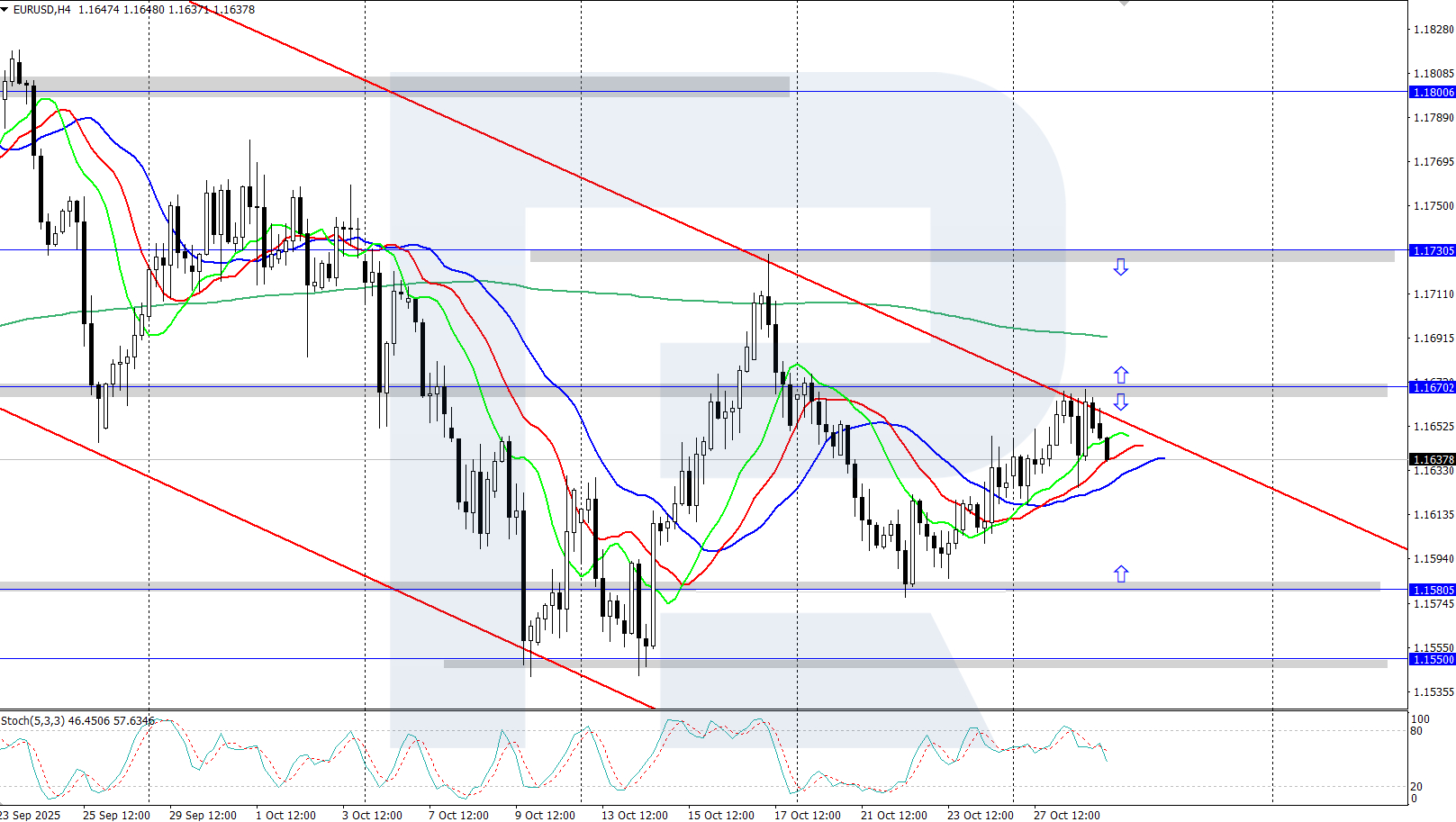

On the H4 chart, the EURUSD pair is edging lower after reversing downwards from the 1.1670 level. The quotes remain near the resistance line of a long-term descending channel. If buyers fail to push the price above 1.1670, the decline may extend further.

The short-term EURUSD forecast suggests a rise towards 1.1730 if bulls regain control and lift the price above 1.1670. Conversely, if bears maintain momentum, the pair could fall towards the 1.1580 support level.

Summary

The EURUSD pair is edging lower, reversing from the 1.1670 resistance level. Market participants are focused on today’s Federal Reserve rate decision.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.