EURUSD remains weak as Fed strategy steers market direction

The EURUSD pair remains under pressure as shifting expectations regarding the Federal Reserve’s policy weigh on sentiment. The market is uncertain and consolidating after a volatile week. Discover more in our analysis for 31 October 2025.

EURUSD forecast: key trading points

- EURUSD consolidates after a turbulent week

- Market focus is on the upcoming US Producer Price Index (PPI) data

- EURUSD forecast for 31 October 2025: 1.1540–1.1670

Fundamental analysis

The EURUSD pair is consolidating near 1.1568 towards the end of the week. The euro remains under pressure after investors scaled back expectations for further Fed policy easing.

At the recent meeting, the Federal Reserve lowered interest rates by 25 basis points, bringing the benchmark to 4%. However, Fed Chair Jerome Powell emphasised that another cut in December is not guaranteed. As a result, the probability of an additional rate cut in December fell to around 75%, down from over 90% before the meeting.

The US dollar also found support following the Trump–Xi summit, where both leaders agreed to reduce tariffs on Chinese goods, suspend export restrictions on rare earth metals, and resume US soybean purchases.

Today, traders are closely watching the release of the US PPI report.

The EURUSD forecast is mixed.

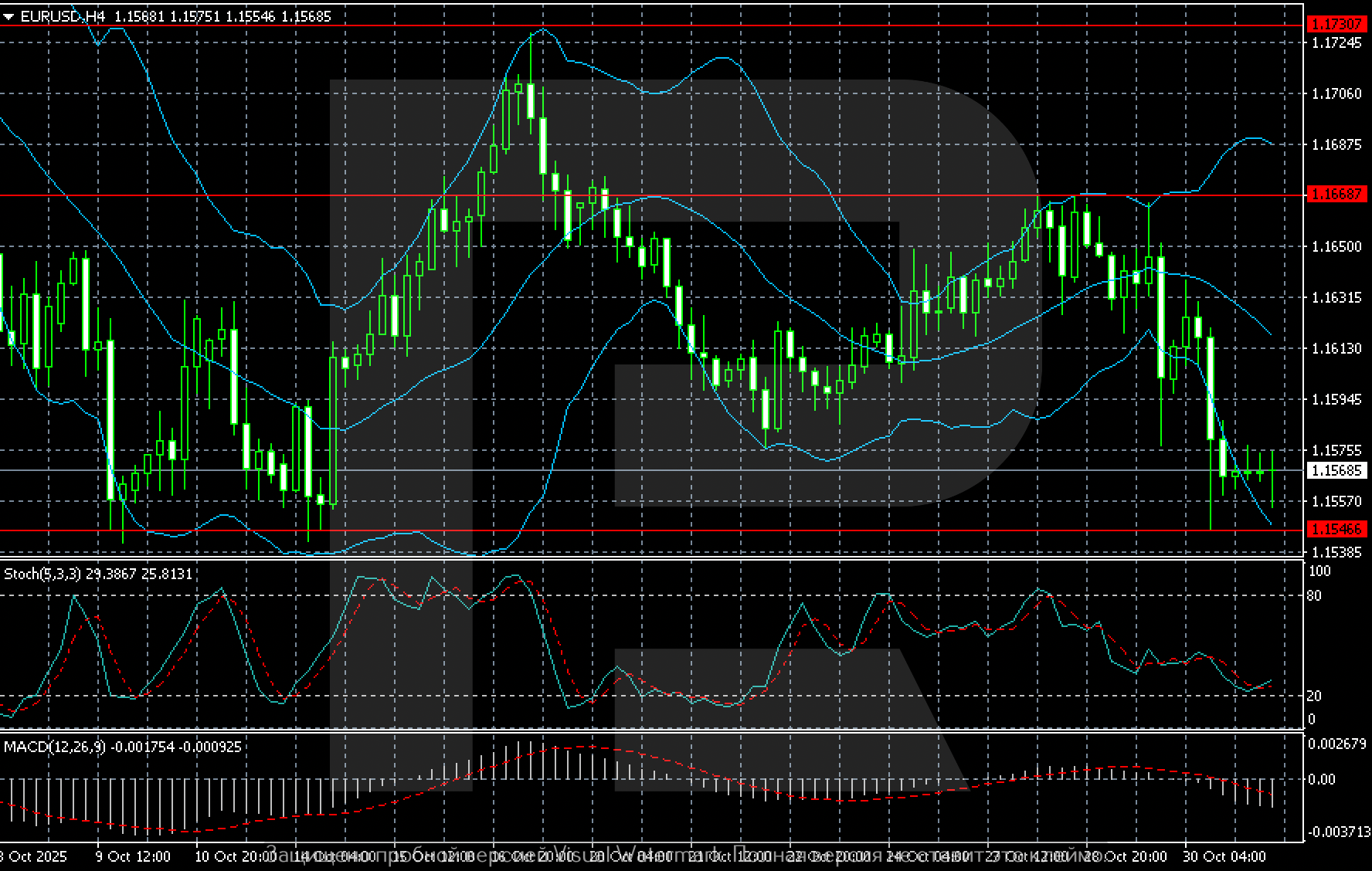

EURUSD technical analysis

The price is moving along the lower Bollinger Band, indicating sustained selling pressure. MACD remains in negative territory, confirming prevailing bearish momentum, while the Stochastic Oscillator hovers near oversold levels, suggesting a possible short-term rebound.

Key resistance levels are located at 1.1668 and 1.1730, while support is seen near 1.1545. A breakout below this level could add to pressure on the euro, pushing the pair lower to 1.1500.

Overall, the pair remains within a downward channel between 1.1540 and 1.1670, dominated by a strong US dollar.

Summary

The EURUSD pair continues to trade under bearish control.

The EURUSD forecast for today, 31 October 2025, suggests consolidation within the 1.1540–1.1670 range.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.