EURUSD attempts to reverse upwards

The EURUSD rate corrected downwards to the 1.1470 support level, where it met strong buying interest and is now attempting to reverse upwards. Discover more in our analysis for 10 November 2025.

EURUSD forecast: key trading points

- Market focus: the Sentix Investor Confidence Index for the eurozone will be published today

- Current trend: moderately rising

- EURUSD forecast for 10 November 2025: 1.1580 or 1.1470

Fundamental analysis

The EURUSD pair is showing moderate growth amid current US dollar weakness. The European Central Bank is expected to keep rates unchanged for some time, as analysts now estimate the probability of a rate cut by September 2026 at only 45%.

Across the Atlantic, the US dollar came under pressure after Challenger data showed that job cuts in the US rose sharply in October to a 20-year high, fuelling expectations of a Federal Reserve rate cut in December.

EURUSD technical analysis

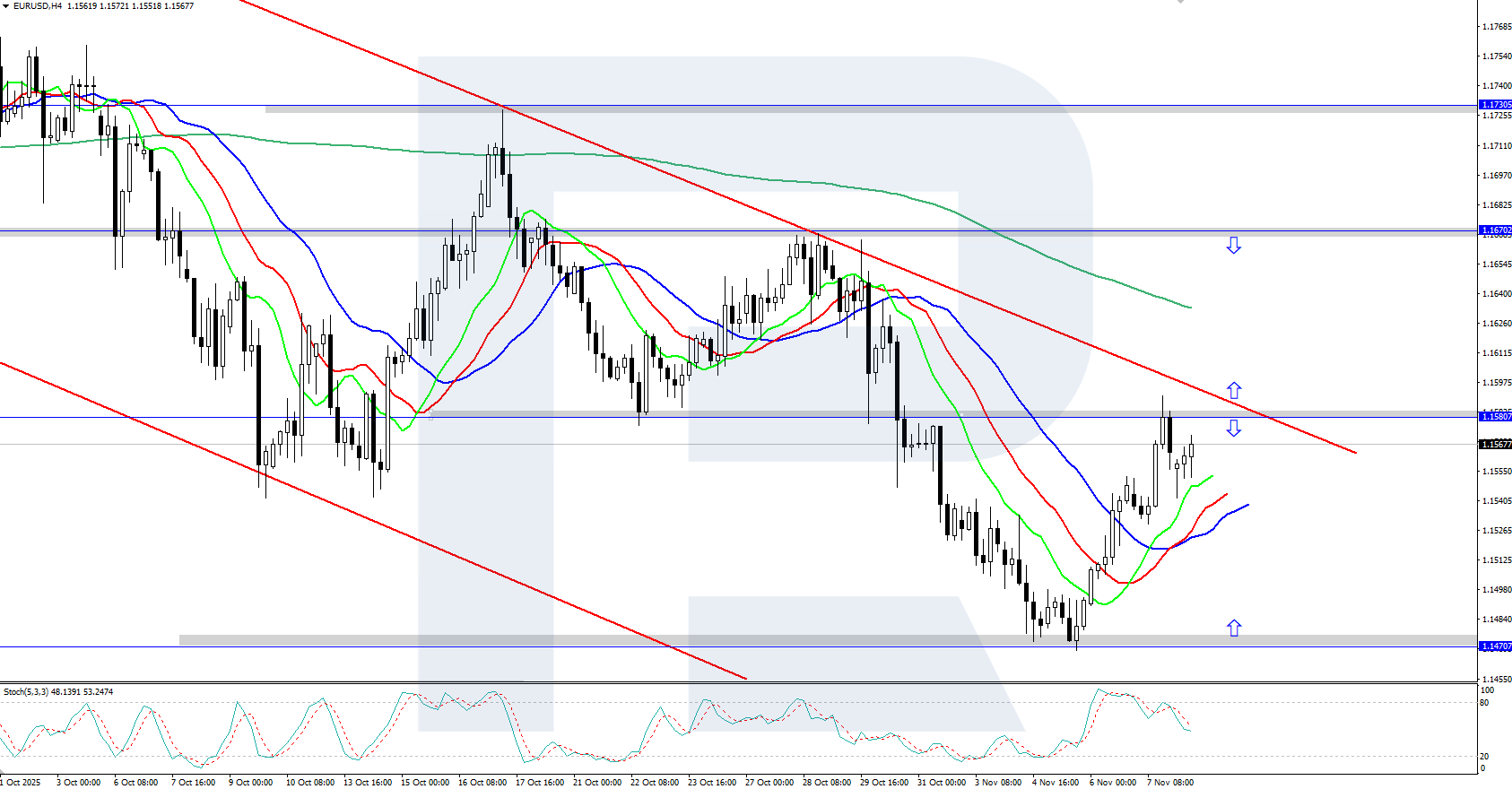

On the H4 chart, the EURUSD pair is attempting to reverse upwards, supported by buyers around the 1.1470 level. For further growth, the pair needs to break above the 1.1580 resistance level, which coincides with the upper boundary of the descending price channel.

The short-term EURUSD price forecast suggests an advance towards 1.1670 in the near term if the bulls gain a foothold above 1.1580. However, if the bears push the price lower, the pair could decline back to the 1.1470 support level.

Summary

The EURUSD rate is moderately rising, rebounding upwards from the 1.1470 support level. The key resistance to overcome for continued growth is located at 1.1580.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.