EURUSD stuck in sideways range: US shutdown decision expected soon

The EURUSD pair stalled around 1.1555 as the market awaits updates on the US government shutdown. Discover more in our analysis for 11 November 2025.

EURUSD forecast: key trading points

- Market focus: the EURUSD pair remains on hold as traders await a decision on the US government shutdown

- Current trend: the main currency pair is under moderate bearish pressure

- EURUSD forecast for 11 November 2025: 1.1540

Fundamental analysis

The EURUSD rate is hovering around 1.1555 on Tuesday, showing sideways dynamics as the market awaits news about the end of the longest US government shutdown in history.

The Senate approved a bill to restore federal government operations, achieving the minimum required 60 votes. House of Representatives Speaker Mike Johnson stated that the document could be approved on Wednesday and has already been sent to President Donald Trump for signing.

Last week’s statistics showed that US employment declined in October. The Consumer Confidence Index fell to a three-and-a-half-year low, reinforcing expectations of a Federal Reserve rate cut in December.

Currently, markets estimate the likelihood of a 25-basis-point rate cut at approximately 64%. Earlier, Federal Reserve Governor Stephen Miran supported a more decisive half-point reduction amid falling inflation and rising unemployment.

The EURUSD forecast is neutral.

EURUSD technical analysis

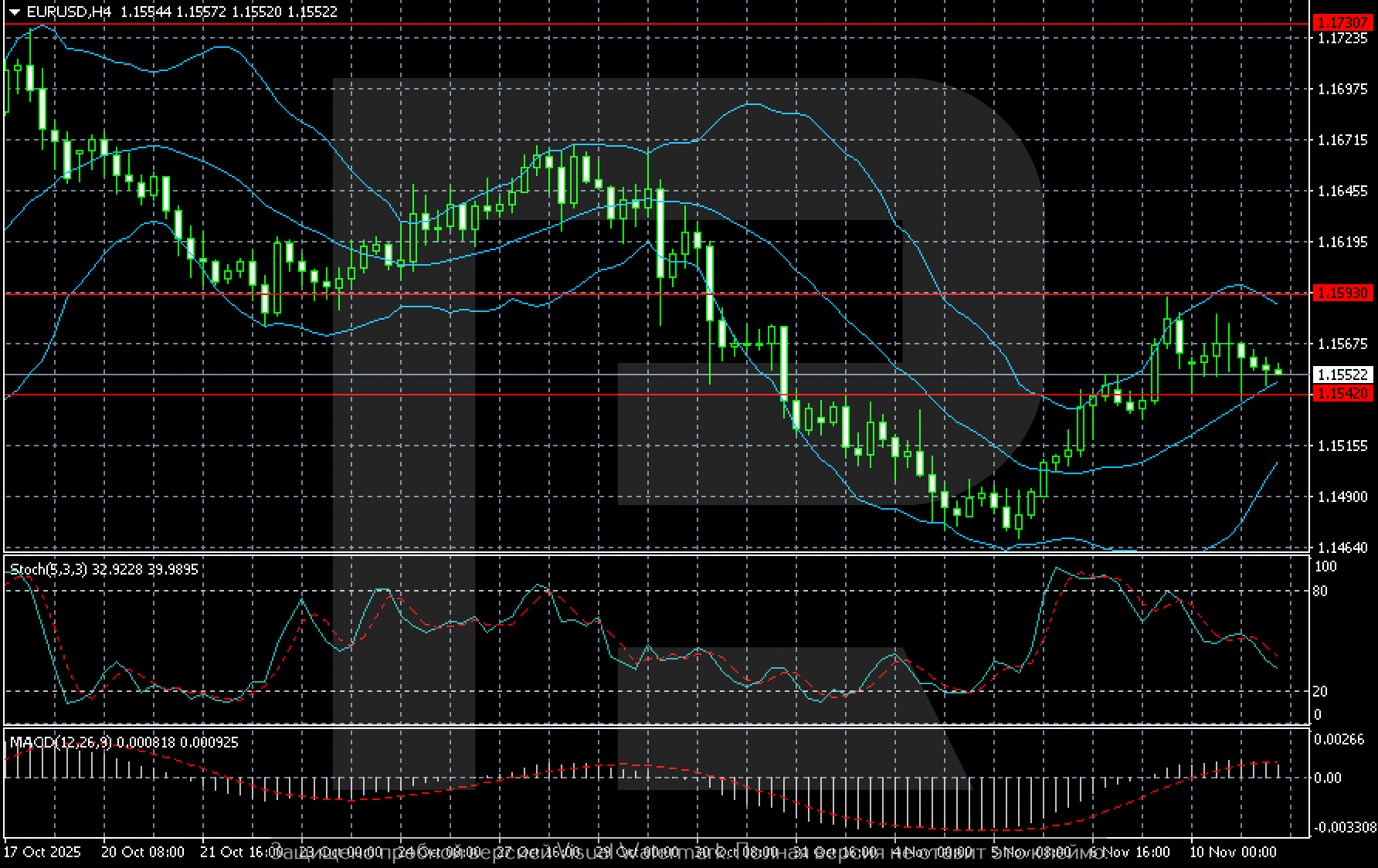

On the H4 chart, the EURUSD pair is consolidating after a short-term recovery from the 1.1465 low seen in late October. The rally slowed around 1.1593, which acts as local resistance. In recent sessions, the market entered a sideways phase, moving within the 1.1540–1.1590 range.

Bollinger Bands are narrowing, reflecting lower volatility and anticipation of a new impulse. The Stochastic Oscillator is rising from oversold territory, signalling the potential for a short-term rebound, while MACD remains near the zero line, confirming consolidation and the absence of a clear trend.

The nearest support level lies at 1.1540, followed by 1.1465, where the previous rebound started. A sustained consolidation above 1.1593 would open the path towards 1.1670–1.1730. A breakout below 1.1540 would increase pressure on the euro and could lead to a decline towards 1.1480–1.1460.

Summary

The EURUSD pair maintains a sideways trend with a moderate bearish bias, reflecting market caution ahead of new signals from the Fed and upcoming US economic data. The EURUSD forecast for today, 11 November 2025, suggests a slide towards 1.1540.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.