EURUSD: pressure builds, US CPI in focus

The EURUSD rate is consolidating within a narrow range near 1.1600 as the market awaits today’s US inflation report – the Consumer Price Index (CPI). Discover more in our analysis for 13 November 2025.

EURUSD forecast: key trading points

- Market focus: US CPI data is due today

- Current trend: moderate upward movement

- EURUSD forecast for 13 November 2025: 1.1470 or 1.1670

Fundamental analysis

ECB Vice President Luis de Guindos stated in an interview that current interest rates are appropriate and emphasised the need for the ECB to remain very cautious despite a decline in uncertainty over the past six months following the trade agreement between the US and the EU.

US President Donald Trump has signed a government funding bill, officially ending the record-breaking 43-day shutdown, according to Bloomberg News. The signing took place just hours after the House of Representatives approved the bill by 222 votes to 209, following the Senate’s approval on Monday.

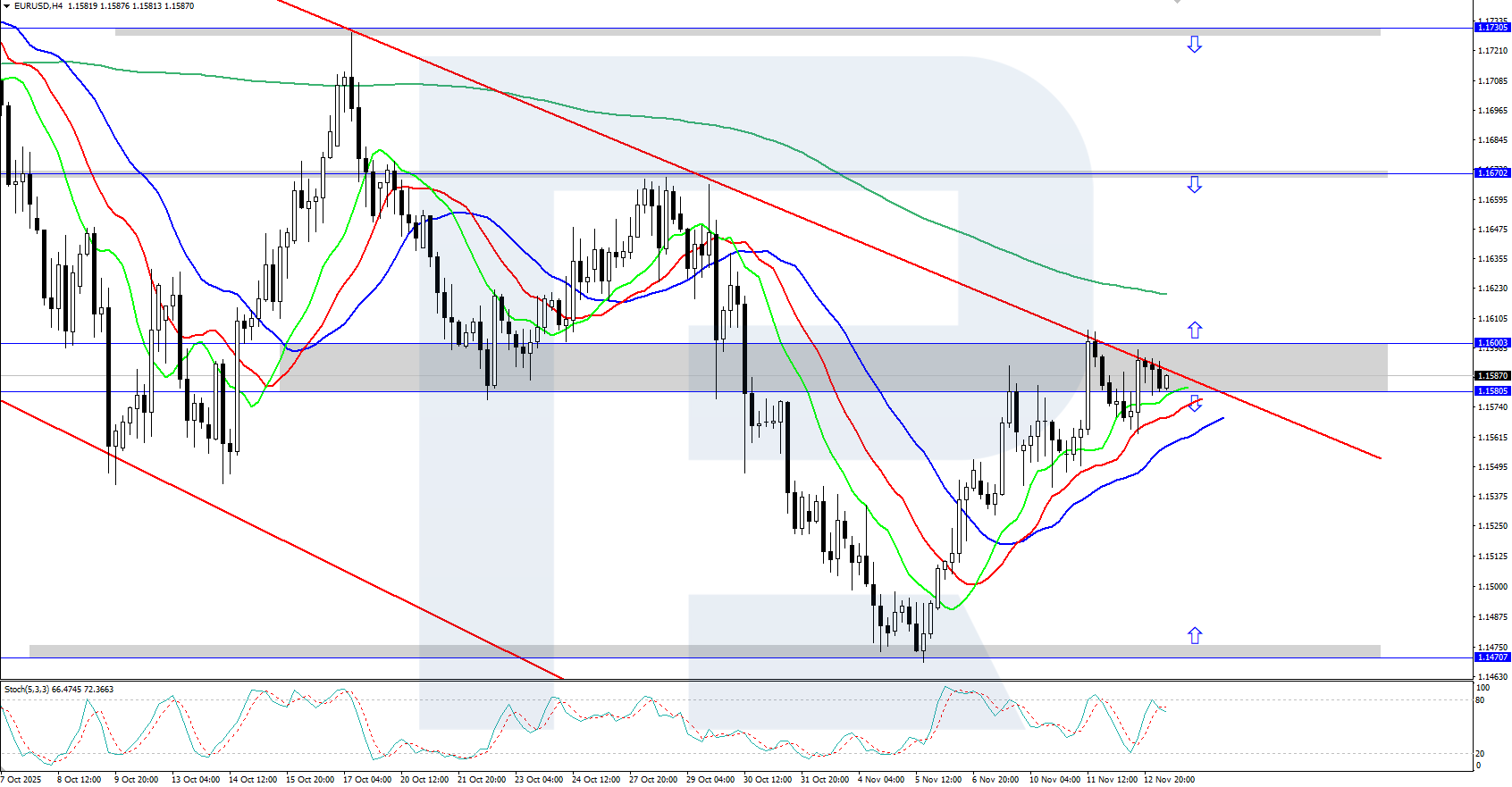

EURUSD technical analysis

On the H4 chart, EURUSD quotes are consolidating within a narrow range. For further growth, the pair needs to break above the 1.1600 resistance level, which coincides with the upper boundary of the descending price channel.

The short-term EURUSD forecast suggests a rise towards 1.1670 if the bulls gain a foothold above 1.1600. However, if the bears reverse quotes downwards, the pair could dip towards the 1.1470 support level.

Summary

The EURUSD rate is consolidating in a narrow range near 1.1600 as the market awaits today’s US inflation data.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.