EURUSD rises above 1.1600

The EURUSD pair is trading above 1.1600 on Friday as the market awaits the eurozone’s Q3 GDP data. Discover more in our analysis for 14 November 2025.

EURUSD forecast: key trading points

- Market focus: the eurozone Q3 GDP growth data will be released today, with expectations of a 0.2% increase

- Current trend: moderate upward movement

- EURUSD forecast for 14 November 2025: 1.1600 or 1.1670

Fundamental analysis

The EURUSD rate rose above 1.1600, reaching the highest level since late October, as risk appetite improved following the reopening of the US federal government. Investors are awaiting further signals regarding the policies of the ECB and the Fed.

The ECB is expected to keep rates unchanged, with markets estimating the likelihood of a rate cut by September 2026 at only 40%. ECB Vice President Luis de Guindos stated that the current rates remain appropriate and urged the central bank to stay very prudent and cautious.

EURUSD technical analysis

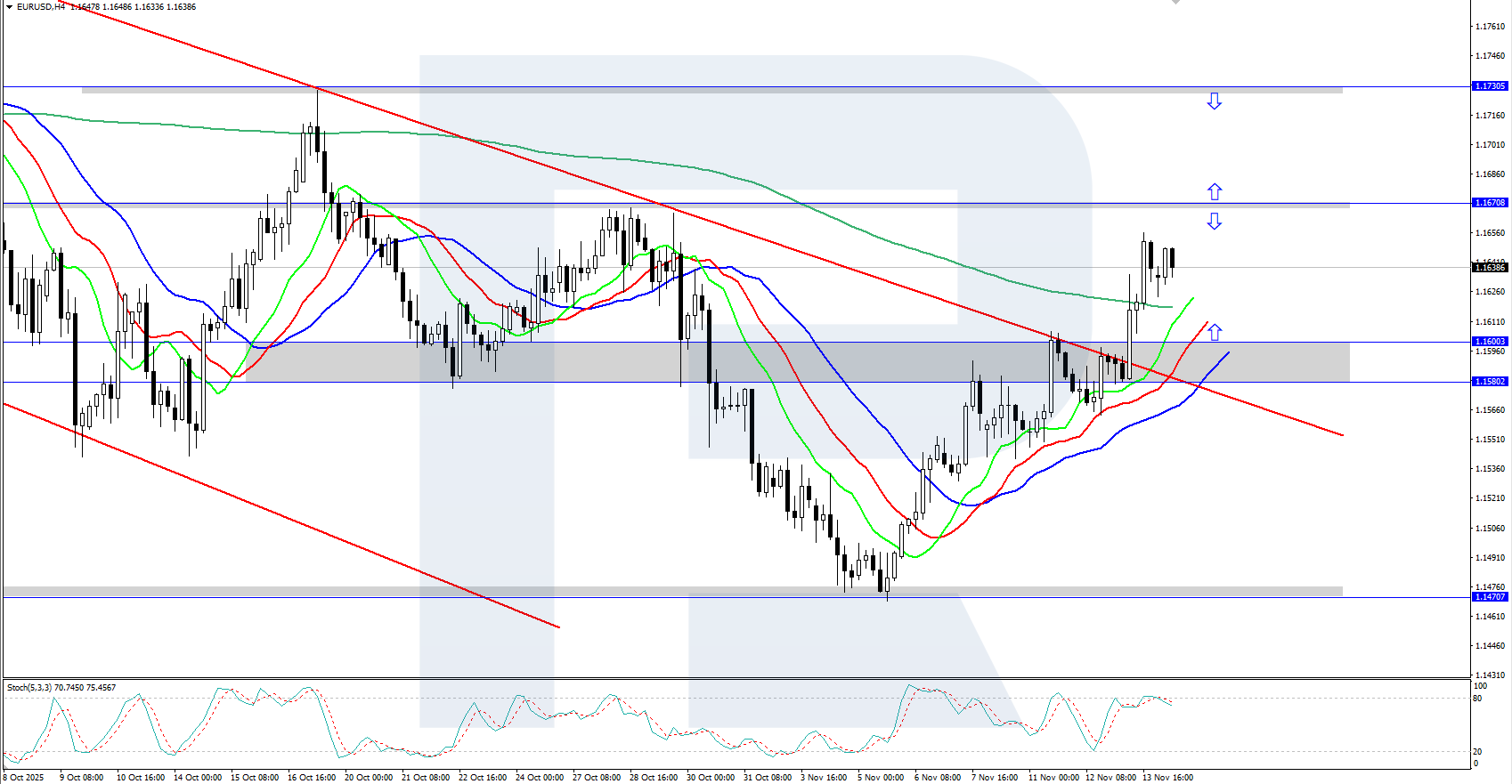

On the H4 chart, the EURUSD pair is strengthening, having broken above the upper boundary of the descending price channel. The Alligator indicator has also turned upwards, following the price, suggesting that the euro’s growth may continue. The key support area lies between 1.1580 and 1.1600.

The short-term EURUSD forecast suggests growth towards 1.1670 and potentially higher if the bulls maintain control. However, if the bears regain initiative, a pullback towards the 1.1580–1.1600 support zone may follow.

Summary

The EURUSD price has climbed above 1.1600 as the market awaits the eurozone’s Q3 GDP data release later today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.