EURUSD declines: everyone awaits US data

The EURUSD pair fell to 1.1594 as the market awaits a flood of key US statistics. Discover more in our analysis for 17 November 2025.

EURUSD forecast: key trading points

- Market focus: the EURUSD pair is correcting after last week’s active movements

- Current trend: the market awaits macroeconomic data delayed due to the US government shutdown

- EURUSD forecast for 17 November 2025: 1.1561

Fundamental analysis

On Monday, the EURUSD rate is hovering around 1.1594 as the US dollar gradually recovers from last week’s losses. Investors are preparing for a large block of US data, the publication of which was postponed due to the government shutdown and will now be key to understanding the Federal Reserve’s next steps.

The main event is the September labour market report, due on Thursday. In addition, the week will feature the S&P Global PMI figures, existing home sales data, the NAHB confidence index, and the ADP employment estimate.

Several Federal Reserve officials have recently voiced doubts about the need for a December rate cut, with some dismissing the idea altogether. Currently, markets price in around a 46% likelihood of a 25-basis-point reduction in December, down from 88% a month ago.

The EURUSD forecast is neutral.

EURUSD technical analysis

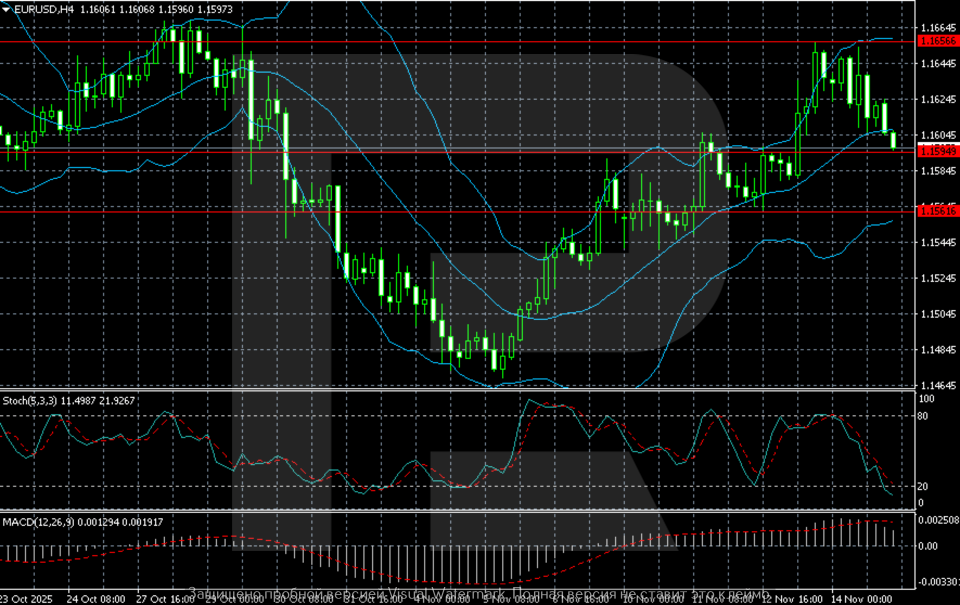

On the H4 chart, the EURUSD pair is moving within a correction after failing to consolidate above the 1.1656 resistance level. The price pulled back and is testing the 1.1595 level, which now acts as the nearest support. The pair remains in the upper half of Bollinger Bands, but the upper band is turning downwards, signalling weakening bullish momentum.

Oscillators also confirm the corrective phase. The Stochastic Oscillator is declining steadily and entering oversold territory, suggesting a potential pause in the decline but no reversal signals yet. MACD remains in positive territory, although its histogram is shrinking, indicating reduced buyer momentum. The key support level sits at 1.1561. Holding above it would allow the pair to attempt a rebound towards 1.1650, while a breakout below would increase downward pressure and open the way to deeper losses.

Summary

The EURUSD pair is undergoing a correction amid stabilising conditions in the US and technical factors. The EURUSD forecast for today, 17 November 2025, suggests a move towards 1.1561.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.