EURUSD consolidates above 1.1600

The EURUSD rate is trading above the 1.1600 level. The market is awaiting the eurozone labour market and CPI inflation data today. Find out more in our analysis for 2 December 2025.

EURUSD forecast: key trading points

- Market focus: the eurozone inflation statistics (Consumer Price Index) are scheduled for release today

- Current trend: moderate growth

- EURUSD forecast for 2 December 2025: 1.1500 or 1.1650

Fundamental analysis

The EURUSD pair climbed above 1.1600, reaching its highest level since mid-November, as investors took a cautious stance ahead of key economic data from the eurozone and the US. These indicators may influence central bank decisions on interest rates.

Today, the market focus is on eurozone consumer inflation and unemployment for November. Inflation is expected to rise by 0.2% month-on-month and 2.1% year-on-year. The unemployment rate is projected at 6.3%. While the market does not expect any changes from the ECB, traders anticipate a rate cut from the Federal Reserve at next week’s meeting.

EURUSD technical analysis

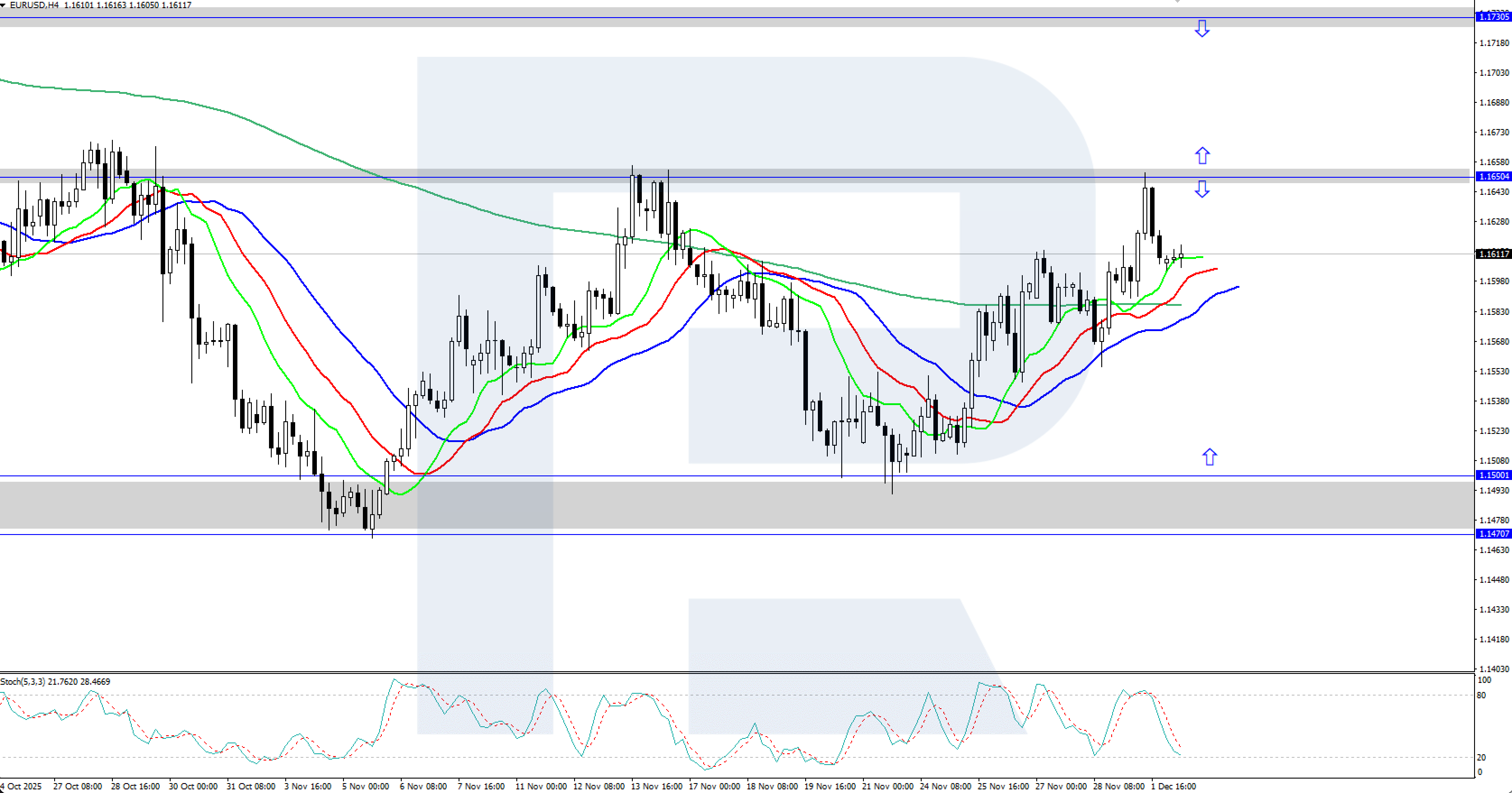

On the H4 chart, the EURUSD pair continues to strengthen, rising above 1.1600. The Alligator indicator has also turned upwards following the price, suggesting a potential continuation of the euro’s advance. The key support zone is 1.1470–1.1500.

The short-term EURUSD forecast suggests growth to 1.1650 and higher in the near term if bulls maintain control. Conversely, if bears regain momentum, the pair could dip towards the 1.1500 support level.

Summary

The EURUSD pair has risen above 1.1600. The market is awaiting the eurozone inflation and labour market data today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.