EURUSD maintains a bullish bias ahead of U.S. macro data releases

EURUSD is strengthening, reflecting U.S. dollar weakness amid rising expectations of monetary policy easing by the Federal Reserve. The current quote is 1.1775. Details — in our analysis for 23 December 2025.

EURUSD forecast: key takeaways

- The market is pricing in two Federal Reserve rate cuts of 25 basis points each in 2026

- This week, key U.S. macroeconomic data are expected, including the preliminary estimate of Q3 GDP

- EURUSD forecast for 23 December 2025: 1.1830

Fundamental analysis

EURUSD is rising for the second consecutive trading session. Buyers are maintaining control and are attempting to consolidate above the nearest resistance level at 1.1765. The U.S. dollar remains under pressure as the market strengthens expectations of further monetary policy easing by the Federal Reserve. Currently, market participants are pricing in two Fed rate cuts of 25 basis points each in 2026.

This week, several important U.S. macroeconomic indicators are scheduled for release, including the preliminary estimate of GDP growth for the third quarter. Weak data could further increase pressure on the dollar within today’s EURUSD outlook and trigger a move toward annual highs.

EURUSD technical analysis

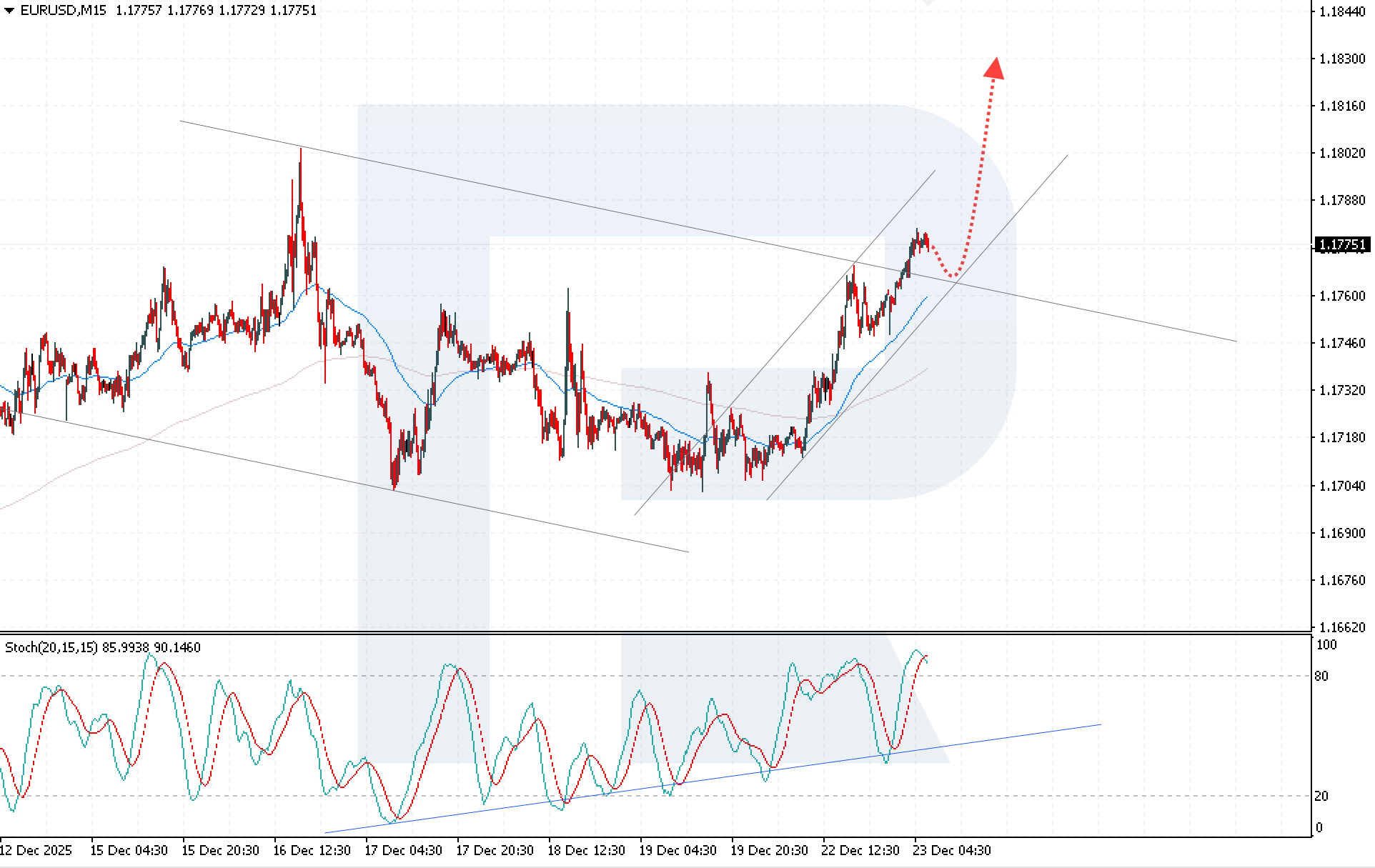

EURUSD has broken out of its descending channel. Buyers are holding prices above the EMA-65, indicating the persistence of a strong bullish impulse.

Today’s EURUSD forecast suggests continued growth toward the 1.1830 level. Additional confirmation of the bullish scenario would come from a rebound off the upper boundary of the previously formed descending channel, which is now acting as support. The Stochastic Oscillator also supports the upside scenario, with its signal lines turning down from the overbought area.

A sustained move above the 1.1805 level would further strengthen buyers’ positions and confirm the potential for continuation of the upward move within the current trend.

Summary

Rising expectations of Federal Reserve rate cuts and the potential deterioration of U.S. macroeconomic indicators are creating conditions for further strengthening of the currency pair. Technical analysis of EURUSD points to the preservation of a bullish scenario and suggests continued growth toward the 1.1830 level, provided prices hold above 1.1805.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.