EURUSD: the euro gains strength, but what may halt the rise?

The euro continues its attempts to strengthen against the USD, with the EURUSD rate currently testing the 1.1660 level. Find out more in our analysis for 20 January 2026.

EURUSD forecast: key takeaways

- Germany’s Producer Price Index (PPI): previously at 0.0%, projected at -0.2%

- Eurozone ZEW Economic Sentiment Index: previously at 33.7, projected at 36.7

- EURUSD forecast for 20 January 2026: 1.1805

Fundamental analysis

The EURUSD forecast takes into account that today the euro is forming an upward wave and trading around 1.1660.

The ECB remains interested in strengthening the European currency and may continue to tighten monetary policy this month in order to support the euro.

The impact of political decisions on the economic situation in the EU remains in focus. For example, uncertainty surrounding trade relations with the UK or decisions to introduce new sanctions against certain countries may affect the EURUSD pair.

According to the forecast for 20 January 2026, Germany’s Producer Price Index may decline to -0.2%. While the decrease is not critical, the indicator may move into negative territory, which in turn will weigh on the EURUSD rate.

The Eurozone ZEW Economic Sentiment Index for the previous reporting period may rise to 36.7 from 33.7. In this case, the euro will receive support, and the EURUSD rate may continue to rise.

Technical outlook

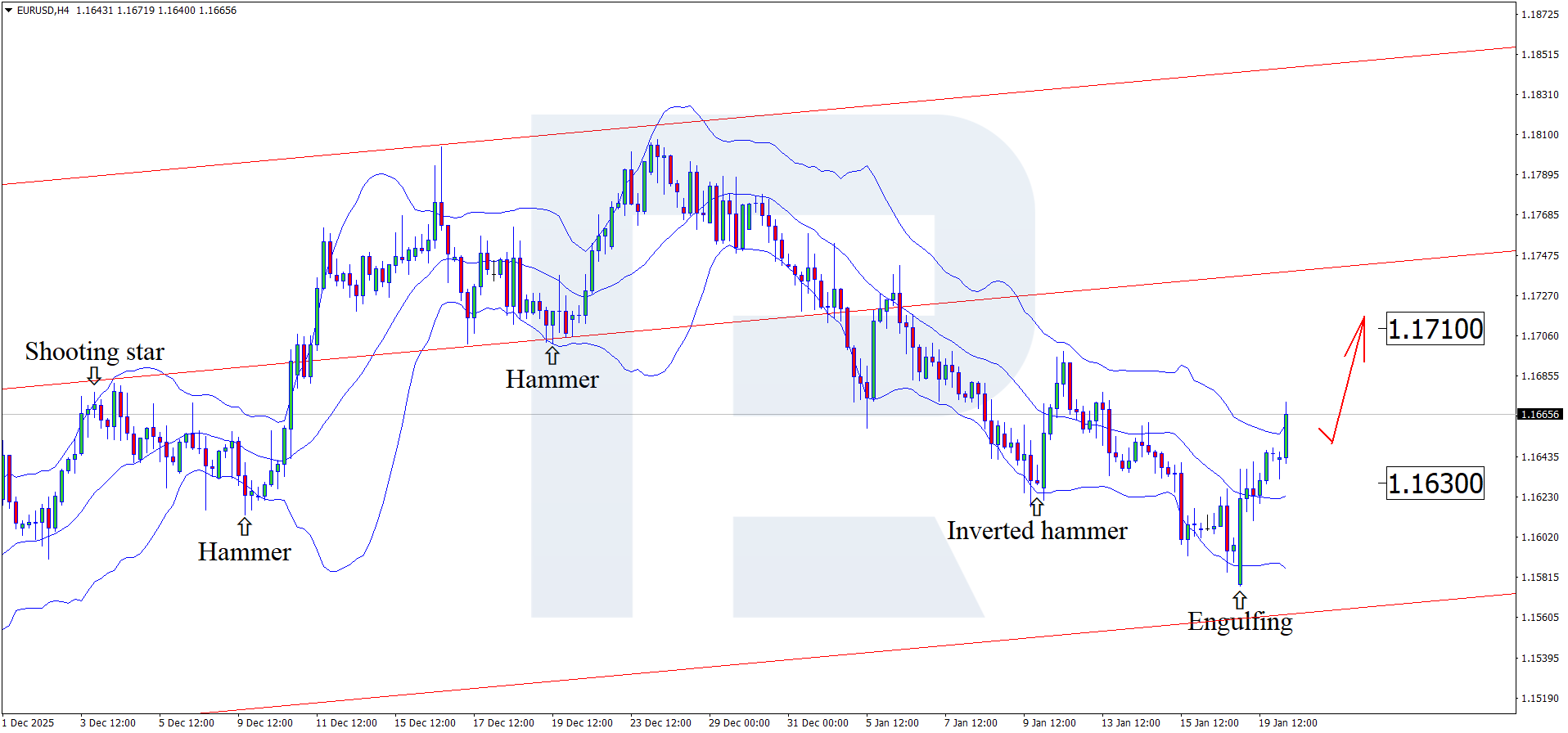

On the H4 chart, the EURUSD pair formed a Bullish Engulfing reversal pattern near the lower Bollinger Band. At this stage, the price continues its upward momentum, following the pattern signal. Since quotes remain within the ascending channel, they may move towards 1.1710. A breakout above this level would open the door for an uptrend.

At the same time, today’s EURUSD forecast also considers an alternative scenario, where the price declines towards the 1.1630 level without testing the resistance level.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: Bullish

- Key resistance levels: 1.1670 and 1.1805

- Key support levels: 1.1580 and 1.1490

EURUSD trading scenarios for today

Main scenario (Buy Stop)

A breakout and consolidation above the 1.1670 level would confirm the completion of the corrective phase and the implementation of the Wedge reversal pattern. This will indicate the market is ready to resume its upward movement. Growth is driven by US dollar weakness amid trade and geopolitical risks.

The risk-to-reward ratio exceeds 1:2. Potential profit upon reaching the target amounts to around 180 pips, while possible losses are limited to 70 pips.

- Buy Stop: 1.1670

- Take Profit: 1.1850

- Stop Loss: 1.1600

Alternative scenario (Sell Stop)

A decline in EURUSD quotes with a move and consolidation below the 1.1580 level would signal weakening bullish momentum and indicate a continued correction. In this case, pressure on the pair may intensify amid profit-taking after the rise.

- Take Profit: 1.1480

- Stop Loss: 1.1675

Risk factors

Despite pressure on the USD, strong published data on US industrial production and rising business activity in the US service sector may eventually restore investor interest in the US currency. In this case, fundamental support for the US dollar may limit EURUSD growth even amid lingering trade risks.

Summary

Amid potential growth in some eurozone economic indicators, the euro continues to strengthen. EURUSD technical analysis suggests growth towards the 1.1710 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.