EURUSD has digested US data, but the market has many other drivers

The EURUSD pair has stopped falling and stabilised near 1.1877. Expectations for a Federal Reserve rate cut have shifted towards mid-summer. Find out more in our analysis for 12 February 2026.

EURUSD forecast: key takeaways

- The EURUSD pair has priced in US employment data and the shift in Fed rate expectations

- The strengthening Japanese yen is adding to pressure on the US dollar

- EURUSD forecast for 12 February 2026: 1.1875 or 1.1900

Fundamental analysis

The EURUSD pair settled at 1.1877 after heightened volatility the day before. Despite strong employment data, the US dollar failed to maintain its gains, although the likelihood of an imminent Fed rate cut has decreased.

Additional pressure on the dollar came from the strengthening yen. The Japanese currency was supported by renewed verbal intervention from authorities and expectations that Japanese Prime Minister Sanae Takaichi’s expansionary fiscal policy would support domestic economic growth.

Statistics showed that US employment increased by 130 thousand in January, marking the strongest gain in more than a year. The unemployment rate unexpectedly declined to 4.3%. These figures indicate stabilisation in the labour market at the start of 2026.

The strong report pushed Treasury yields higher and reinforced the Fed’s stance of maintaining a policy pause. The market now expects the next rate cut to occur in July rather than June.

The EURUSD forecast is moderate.

Technical outlook

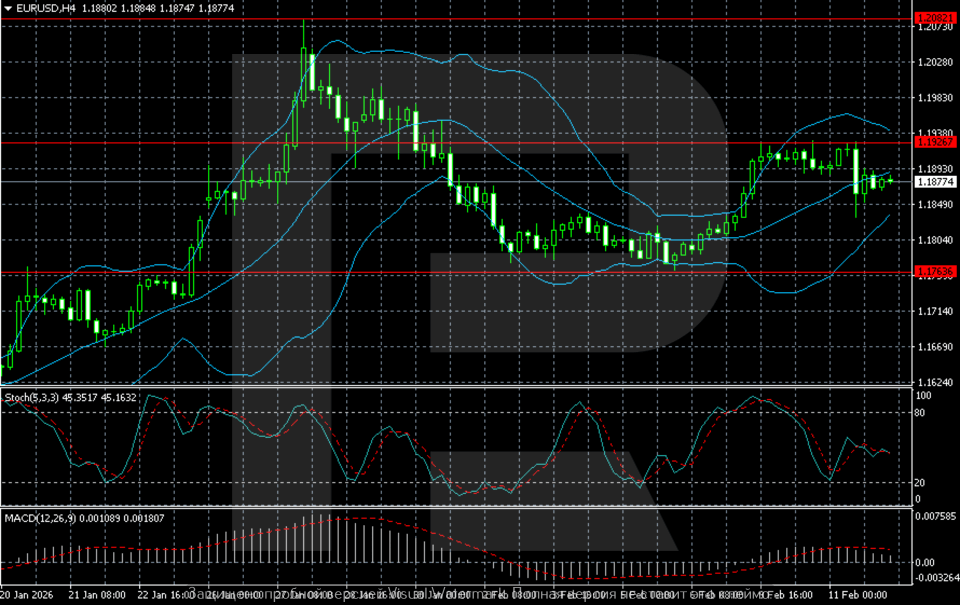

On the H4 chart, after a momentum rally towards 1.2080, the EURUSD pair entered a correction phase and formed a local bottom around 1.1760–1.1780 in early February. A recovery followed from that zone, with the price now consolidating around 1.1875–1.1900.

Bollinger Bands have narrowed, indicating a stabilisation phase after volatile movements. Quotes are hovering near the middle line, with the structure neutral and a moderate bullish bias.

The Stochastic Oscillator is in the mid-range without extreme signals, while MACD remains in positive territory, although momentum has weakened.

The nearest resistance lies in the 1.1925–1.1950 area, with support located within 1.1760–1.1780. A consolidation above 1.1930 will increase upside potential, while a move below 1.1760 would restore the risk of a deeper correction.

EURUSD overview

- Asset: EURUSD

- Timeframe: H4 (Intraday)

- Trend: neutral with a moderate bullish bias

- Key resistance levels: 1.1930 and 1.1950

- Key support levels: 1.1760 and 1.1780

EURUSD trading scenarios for today

Main scenario (Buy Stop)

A consolidation above 1.1930 will create conditions for a continued recovery after the correction. The nearest upside target will be 1.1950, with potential extension towards 1.2000 if momentum strengthens. The risk-to-reward ratio exceeds 1:2 with moderate volatility.

- Buy Stop: 1.1930

- Take Profit: 1.1950

- Stop Loss: 1.1885

Alternative scenario (Sell Stop)

A breakout and consolidation below 1.1760 will increase selling pressure and restore the risk of a deeper correction towards 1.1700.

- Sell Stop: 1.1755

- Take Profit: 1.1700

- Stop Loss: 1.1800

Risk factors

Risks to the bullish scenario are associated with the release of new strong US macroeconomic data and rising bond yields. This could support the dollar and shift Federal Reserve rate expectations towards a more hawkish trajectory.

Summary

The EURUSD pair has halted its decline, which accelerated after unexpectedly strong US data. The EURUSD forecast for 12 February 2026 suggests consolidation within the 1.1875–1.1900 range.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.