Easing US inflation expectations fuel EURUSD growth

The EURUSD rate is strengthening amid slower US inflation, which has reinforced expectations of Federal Reserve policy easing. The current quote is 1.1865. Discover more in our analysis for 16 February 2026.

EURUSD forecast: key takeaways

- Annual US inflation slowed to 2.4% last month

- Easing inflation reinforced expectations of Fed rate cuts in the second half of the year

- The US dollar remains under pressure following inflation data

- EURUSD forecast for 16 February 2026: 1.1930 or 1.1810

Fundamental analysis

The EURUSD rate is moderately strengthening. Buyers are holding quotes above the 1.1845 support level, retaining the initiative and aiming to test the 1.1890 resistance level.

The US dollar remains under pressure. The market reacted to more favourable US inflation data, which reinforced expectations that the Federal Reserve may cut interest rates in the second half of the year. Annual inflation slowed to 2.4% last month, down from 2.7% and below the 2.5% forecast, strengthening the case for monetary policy easing. The core Consumer Price Index, excluding food and energy, rose by 0.3% compared to December. The figure matched market expectations and confirmed a gradual cooling of inflationary pressures.

Against this backdrop, easing US inflation strengthens expectations of Federal Reserve rate cuts and weighs on the US dollar, supporting further attempts by the EURUSD pair to advance towards 1.1890.

Technical outlook

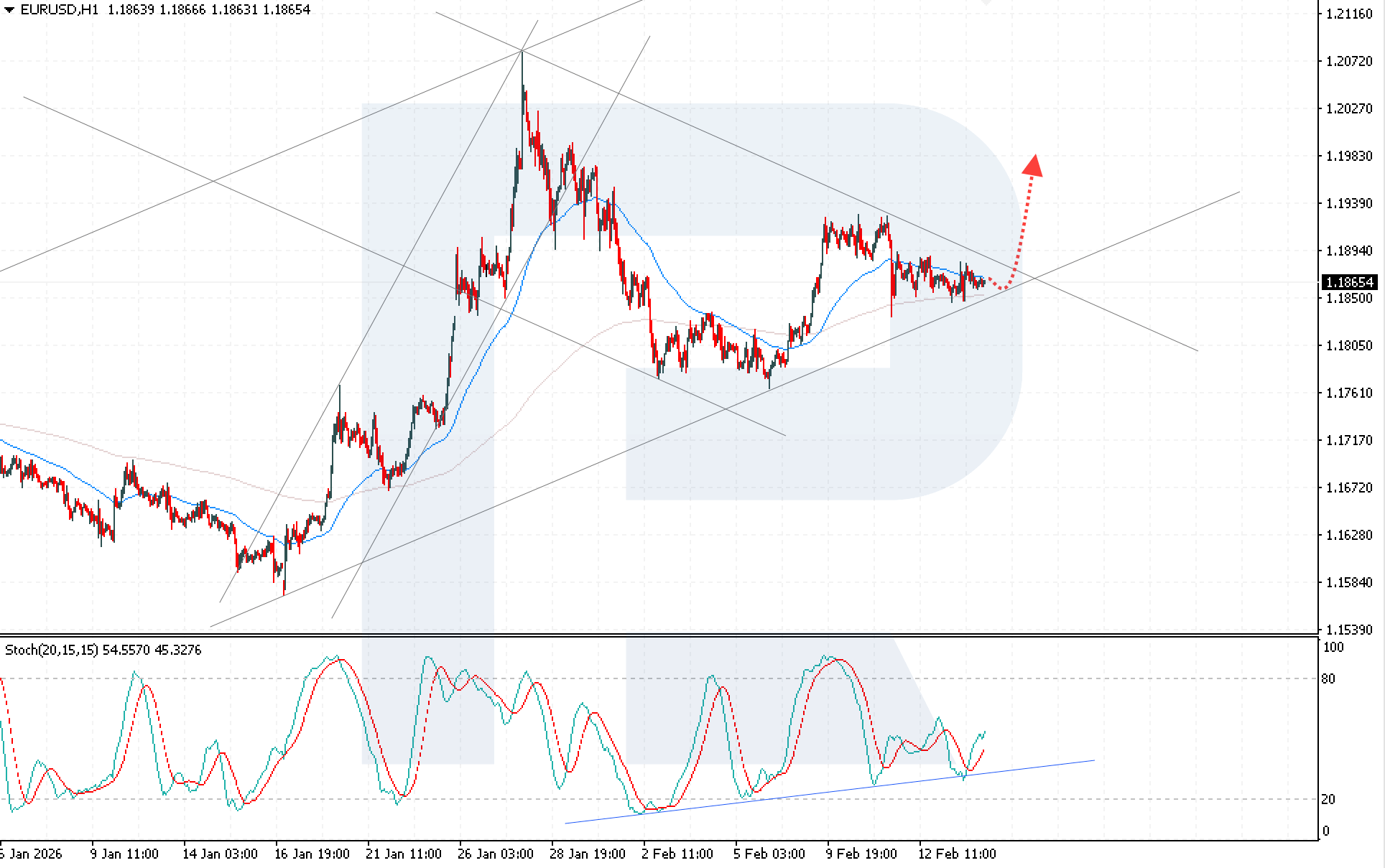

EURUSD quotes are rebounding from the lower boundary of the ascending channel. Buyers are holding the price above the key 1.1845 support level. The pair continues to trade within a range, with the upper boundary near 1.1890. Today’s EURUSD forecast expects renewed growth towards 1.1985.

The technical picture suggests the potential for a bullish scenario is forming. The Stochastic Oscillator reinforces upside signals. The signal lines have rebounded from oversold territory and formed a bullish crossover, confirming the likelihood of further upward movement.

The key condition for growth remains a consolidation above 1.1895. A confident breakout of this level will indicate an end to the consolidation phase and may accelerate bullish momentum towards 1.1985.

EURUSD overview

- Asset: EURUSD

- Timeframe: H1 (Intraday)

- Trend: moderately bullish

- Key resistance levels: 1.1895 and 1.1935

- Key support levels: 1.1845 and 1.1765

EURUSD trading scenarios for today

Main scenario (Buy Stop)

A breakout above the upper boundary of the consolidation channel and a confident consolidation above 1.1895 would create conditions for opening long positions, with an upside target at 1.1985. The risk-to-reward ratio exceeds 1:2. Upon reaching the take-profit level, potential profit may amount to around 90 pips, while potential losses are limited to 40 pips, making the trade attractive from a risk management perspective.

- Take Profit: 1.1985

- Stop Loss: 1.1855

Alternative scenario (Sell Stop)

A decline in the currency pair followed by a consolidation below 1.1840 would increase selling pressure and confirm a breakout below the lower boundary of the consolidation channel. This signal will indicate the loss of short-term support and may trigger a deeper correction with strengthening downward momentum.

- Take Profit: 1.1765

- Stop Loss: 1.1870

Risk factors

Risk factors for EURUSD growth include a potential resurgence of inflationary pressure in the US and a revision of market expectations regarding Federal Reserve rate cuts. An additional negative signal for the bullish scenario would be the pair’s failure to consolidate above 1.1895 or a breakout below 1.1845, which could trigger a corrective decline.

Summary

Technical analysis of EURUSD indicates potential growth towards 1.1985 if the price firmly consolidates above 1.1895. This view is supported by the fundamental backdrop: the slowdown in US inflation to 2.4% strengthens expectations of Fed policy easing and weighs on the US dollar.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.