EURUSD weekly forecast: market challenges intensify

The EURUSD pair closed the week stronger at 1.1537, recovering from the US dollar’s weakness following the release of poor US labour market data. According to the Challenger report, 153 thousand job cuts were announced in October, the highest in 22 years. These figures fuelled expectations of a Federal Reserve rate cut in December, despite cautious comments from Fed officials.

Additional support for the euro came from renewed interest in risk assets and rising eurozone bond yields. However, the potential for further strengthening is limited by weak regional economic performance. This week’s focus is on upcoming US employment components and signals regarding the Fed's monetary policy.

EURUSD forecast for this week: quick overview

- Market focus: the EURUSD pair ended the week higher, driven by dollar weakness after disappointing US labour market data. Signs of a cooling employment increased expectations for a December Fed rate cut, pushing the US Dollar Index below 100 points

- Current trend: the euro remains in a descending channel since late September and has yet to show signs of a sustained reversal. After testing the 1.1467 support level, a technical bounce occurred, but buyers failed to gain momentum

- Outlook for 10 – 14 November: the base case is consolidation within the 1.1470–1.1600 range. A breakout above the 1.1600 level would be the first signal of recovery, with potential growth to 1.1730. However, holding below this zone keeps the risk of a retest of 1.1470 alive. In the short term, the pair’s price behaviour will depend on Fed speeches and eurozone data. The overall trend remains moderately bearish

EURUSD fundamental analysis

The EURUSD pair finished the week stronger, settling near 1.1537 after the US dollar weakened on the back of poor labour market data. Signs of a cooling US labour market have heightened expectations for a Federal Reserve rate cut in December, leading to a drop in the US Dollar Index below the 100-point mark.

Due to the prolonged US government shutdown, official labour statistics are not being released, with market participants relying on private estimates. According to Challenger, 153 thousand job cuts were announced in October, marking a 22-year high. Such data bolstered expectations for Fed policy easing, despite cautious remarks from Fed officials.

The euro also gained support from renewed appetite for risk assets and rising eurozone bond yields. However, the potential for continued growth is limited by weak regional economic performance and the ECB’s cautious stance on easing policy.

EURUSD technical analysis

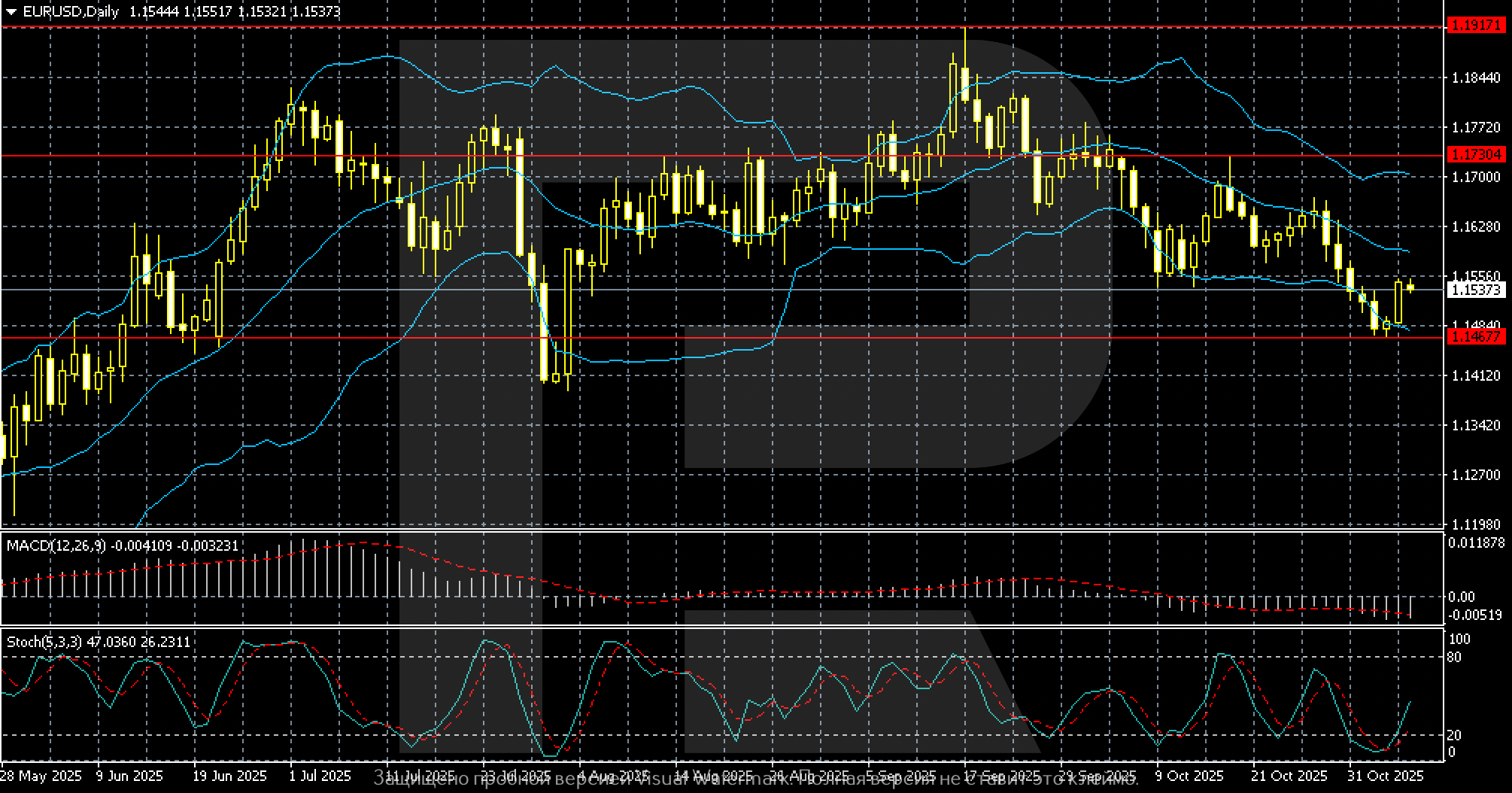

On the daily chart, the EURUSD pair remains under pressure in a descending channel formed since late September. The price is hovering near the lower boundary of the short-term range. After the recent drop, the euro is attempting to stabilise, but the bullish momentum remains weak and is not supported by volume.

The price has repeatedly tested the 1.1467 level, which remains key support. Although a technical rebound occurred from this mark, no sustainable upward reversal followed. Bollinger Bands are pointing downwards, reflecting the dominant bearish trend, and the current price near the lower band suggests continued selling pressure. MACD remains in negative territory, confirming downward momentum, although a narrowing histogram signals a gradual weakening of the move. The Stochastic Oscillator is exiting oversold territory, showing early signs of a local correction.

The technical structure indicates the market has entered a consolidation phase after a prolonged decline. For buyers to regain control, the price must break and hold above 1.1600, the first signal of a bullish reversal towards 1.1730. Until then, the base case remains bearish, with continued pressure on the euro and a high likelihood of another test of the support level around 1.1470.

EURUSD trading scenarios

The EURUSD pair closed the week near 1.1537, consolidating after a period of high volatility. Dollar weakness following poor US labour data allowed the euro to partially recover, but ongoing uncertainty surrounding the Fed’s December decision and the prolonged US government shutdown have limited upside potential.

On the chart, the pair remains pressured within the descending channel formed since late September. After testing the 1.1467 support level, a technical rebound occurred, but without volume confirmation. The MACD and Bollinger Bands indicators suggest sellers are still in control, although the Stochastic Oscillator points to a potential short-term upward correction.

- Buy scenario

Long positions become relevant if the price consolidates above 1.1600. In this case, growth towards 1.1680–1.1730 is possible, with a breakout higher likely to open the way towards 1.1800.

Stop-loss: below 1.1470

- Sell scenario

Short positions are preferable if the price breaks below 1.1470, confirming continued downward momentum.

Targets: 1.1380–1.1300

Stop-loss: above 1.1600

Conclusion: the baseline scenario suggests consolidation within the 1.1470–1.1600 range with a moderately bearish bias.

Summary

General sentiment on the EURUSD pair remains cautiously neutral. The dollar’s weakness after soft US labour data supported the euro, but uncertainty over the Fed’s December decision and the prolonged US government shutdown prevented a sustainable rally. At the same time, the ECB’s wait-and-see approach also limits buyer activity.

From a technical standpoint, the EURUSD pair is trading within the 1.1470–1.1600 range. MACD and Bollinger Bands confirm waning bearish momentum, while the Stochastic Oscillator suggests a potential short-term upward bounce. However, the price has so far failed to consolidate above the key 1.1600 level, limiting upside potential.

The baseline scenario for the week of 10–14 November suggests sideways trading. Weak US data may push the pair higher towards 1.1680–1.1730, while dollar strength and a hawkish Fed tone could trigger another test of the support level near 1.1470–1.1450. Overall market sentiment is moderately bearish.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.