EURUSD: the euro continues to strengthen after a decline

US economic forecasts could not significantly impact the strengthening of the US dollar yet due to the expectation of a US interest rate decision. Find out more in our analysis for 5 September 2024.

EURUSD forecast: key trading points

- A speech by a member of the Supervisory Board of the European Central Bank, Anneli Tuominen

- US services PMI for August: previously at 55.0, projected at 55.2

- US initial jobless claims: previously at 231,000, projected at 231,000

- US ADP nonfarm employment change: previously at 122,000, projected at 144,000

- EURUSD forecast for 5 September 2024: 1.1108 and 1.1040

Fundamental analysis

The speech by Anneli Tuominen, a member of the Supervisory Board of the European Central Bank, may provide some insights into EU monetary policy. Although no global announcements are currently expected, there may be some positive moments for the euro.

The US services PMI for August is projected to increase to 55.2. Since it has remained at approximately the same level over the past six months, investors have low expectations for the upcoming data. If the actual PMI is below the forecast, it will help the euro strengthen more rapidly against the US dollar.

US initial jobless claims show the number of people who filed for unemployment benefits for the first time over the past week. The indicator measures the state of the employment market, with an increase in jobless claims indicating growing unemployment. The previous reading was lower than expected by 1,000 claims; the claims are currently projected to remain flat at 231,000. While a decrease in jobless claims is a positive factor for the US dollar, as indicated by the analysis for 5 September 2024, this does not prevent the USD from continuing to lose ground against the euro.

According to the forecast for 5 September 2024, US ADP nonfarm employment change should increase to 144,000, but these are only forecasts and hopes. The number of employed people has gradually decreased over the past four months, and current figures may be no exception. If the actual reading is worse than forecasted, this will negatively pressure the US dollar.

The expectation of the Federal Reserve interest rate decision prevents positive economic indicators from strengthening the US dollar and drives growth in the EURUSD rate.

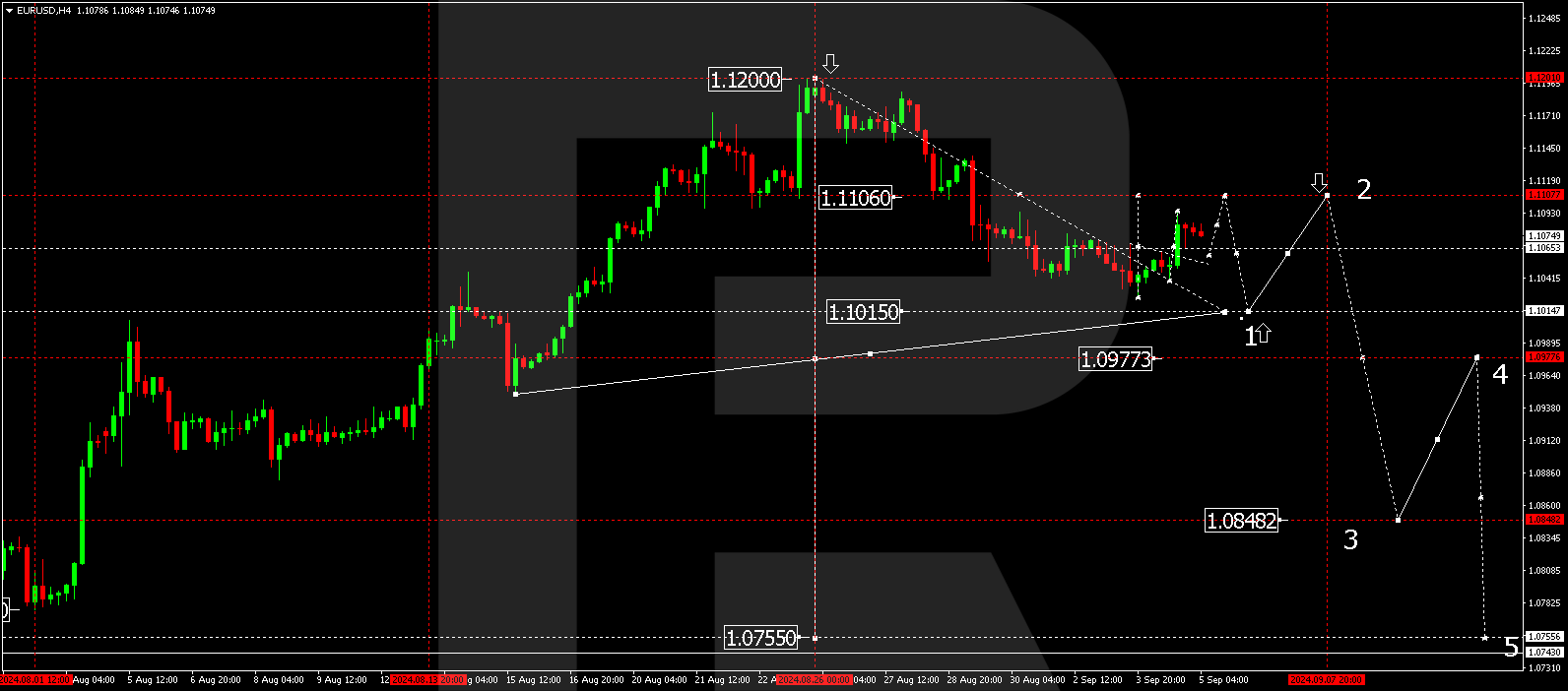

EURUSD technical analysis

The EURUSD H4 chart shows that the market has formed a consolidation range below 1.1065. The price has broken above this level, extending the range to 1.1094. The market suggests considering a breakout of the 1.1065 level as a signal for a correction. A decline to 1.1057 is expected today, 5 September 2024. Subsequently, the price could rise to 1.1108 (testing from below). This growth is considered a correction of the previous downward wave. Once the correction is complete, another downward wave is expected to follow, aiming for at least 1.1040.

Summary

The expectation of the Federal Reserve interest rate decision and the EURUSD technical analysis suggest a potential correction towards 1.1108, followed by a decline to 1.1040.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.