EURUSD is at August 2024 lows

The EURUSD pair reached its lowest level since early August; market participants probably anticipated the ECB decision in advance. Find out more in our analysis for 18 October 2024.

EURUSD forecast: key trading points

- The ECB lowered the three key interest rates by 25 basis points, with the deposit interest rate down to 3.25%, the marginal lending rate down to 3.65%, and the main refinancing operations facility rate down to 3.40%

- The ECB management is committed to closely monitoring macroeconomic indicators further but does not provide clear guidance for future monetary policy targets

- EURUSD forecast for 18 October 2024: 1.0777

Fundamental analysis

Lower interest rates make investment in the euro less attractive to international investors as yields on deposits and bonds denominated in the European currency decrease. This may lead to capital outflows to countries with higher rates (for example, the US). Nevertheless, the current ECB rate creates difficulties in servicing the debt of the most economically vulnerable EU countries.

If interest rate cuts boost economic activity in the eurozone, this may create positive expectations for future economic growth, bolstering the euro rate in the long term. However, the short-term EURUSD forecast is currently negative.

EURUSD technical analysis

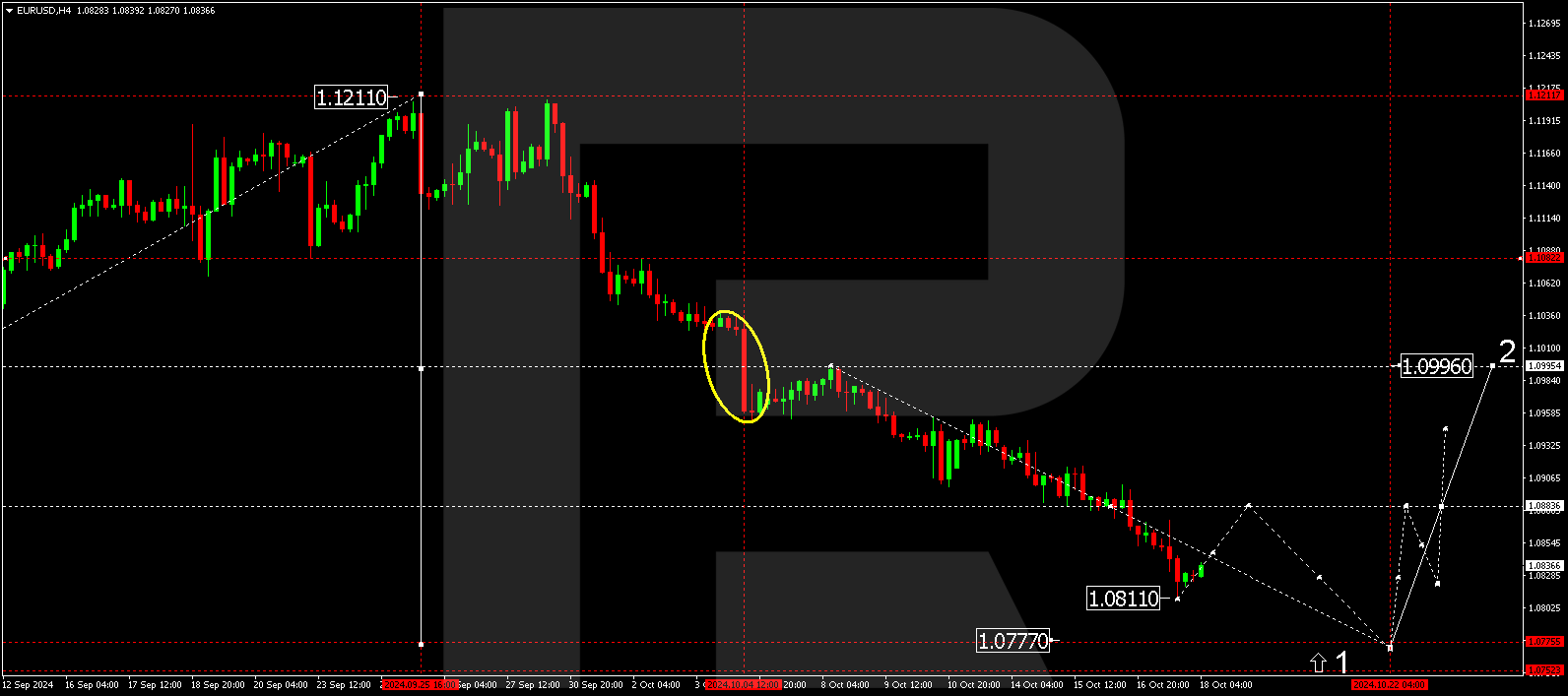

The EURUSD H4 chart shows that the market has completed a downward wave, reaching 1.0811. The price could rise to 1.0883 (testing from below) today, 18 October 2024. After reaching this level, the EURUSD rate is expected to fall to 1.0777, the first target. Subsequently, a corrective structure might form, aiming for 1.0966, with the first target for the correction at 1.0888.

Summary

The ECB interest rate cut makes euro-denominated assets less attractive to investors. For the ECB, this was a forced move as some countries in the eurozone have difficulty servicing their debt obligations. Technical indicators in today’s EURUSD forecast suggest a potential decline to the 1.0777 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.