EURUSD: the strong US economy and Fed caution exert downward pressure on the euro

The EURUSD rate is correcting after falling for three consecutive trading sessions. More details in our analysis for 24 October 2024.

EURUSD forecast: key trading points

Fundamental analysis

The EURUSD rate declined to a three-month low amid increased expectations that the Federal Reserve will proceed cautiously with interest rate cuts. The growing chances of Donald Trump returning to the White House provide additional support for the US dollar.

Earlier this week, Federal Reserve officials signalled that they would avoid abrupt monetary policy moves, adopting a gradual and balanced approach to further interest rate cuts. These statements strengthened the US dollar, adding pressure on the EURUSD rate and contributing to its decline within today’s forecast.

Meanwhile, US mortgage applications decreased by 6.7% in the third week of October compared to the previous week, marking the fourth consecutive drop and resulting in an overall monthly decline of 17.0%. On Thursday, the average 30-year mortgage rate was 6.44% per annum, up from last week’s reading of 6.32%.

Against this backdrop, US existing home sales fell by 1% in September compared to the previous month, reaching 3.84 million. Nevertheless, sales remain stable, hovering around 4.00 million over the past 12 months.

Overall, the elevated mortgage rate reflects the strength of the US economy, supporting the housing market. The more stable the country’s economic situation, the lower the odds of a further Federal Reserve rate reduction, which may exert pressure on the EURUSD in the short term.

EURUSD technical analysis

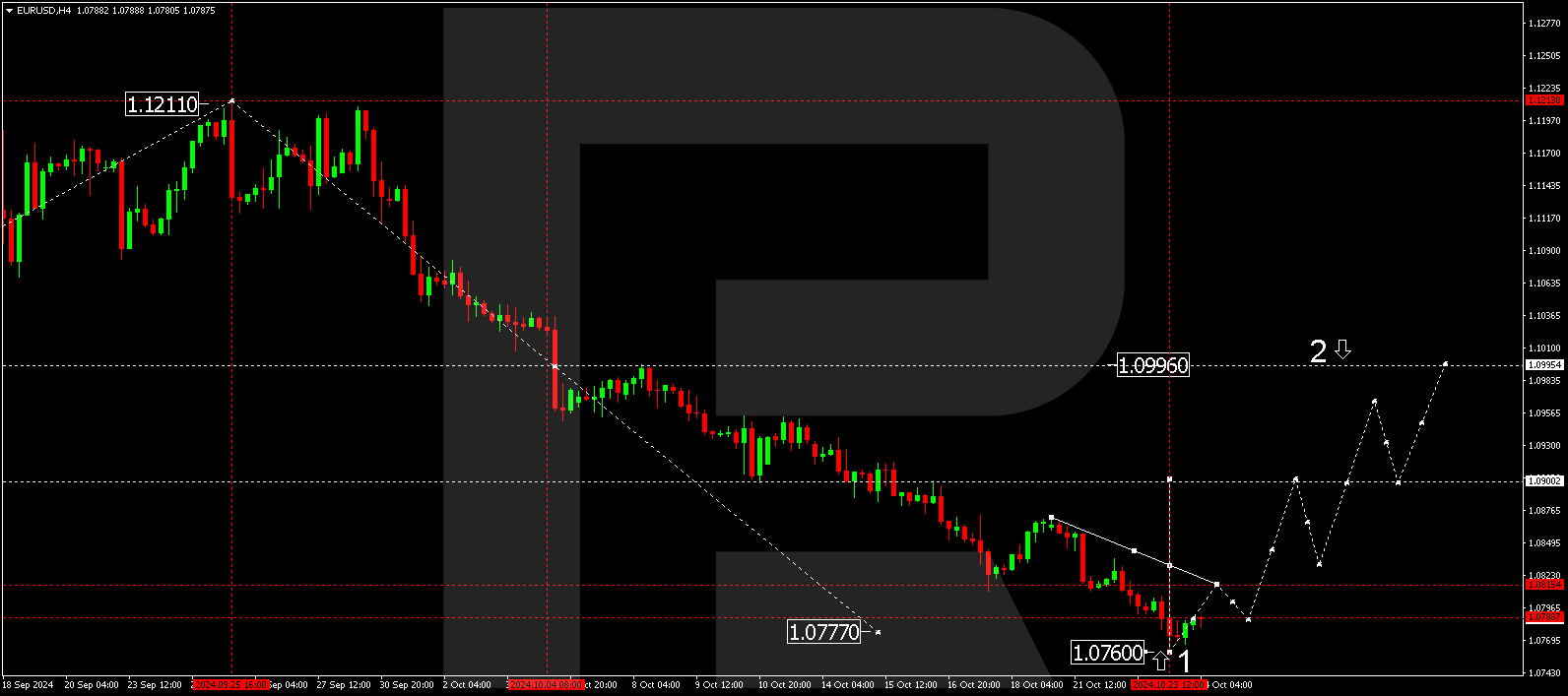

The EURUSD H4 chart shows that the market has completed a downward movement towards 1.0760, nearly reaching the target of the first downward wave. The first growth impulse in the EURUSD rate is forming today, 24 October 2024, aiming for 1.0815. Once the price hits this level, a correction of this impulse is expected, with the target for the correction at 1.0788. After this, the subsequent growth impulse may begin, targeting 1.0900 and potentially continuing to 1.0996.

Summary

The strong US economy and expectation of a cautious Federal Reserve policy continue to strengthen the US dollar, exerting pressure on the EURUSD rate. Technical indicators in today’s EURUSD forecast suggest a potential growth wave towards the 1.0815 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.