EURUSD awaits the news, with the focus on the US presidential election

The EURUSD pair remains in a consolidation phase. A critical moment is approaching. Find out more in our analysis for 5 November 2024.

EURUSD forecast: key trading points

- The EURUSD pair is consolidating

- Initial, accurate data on the US presidential election will emerge a few days after the vote

- EURUSD forecast for 5 November 2024: 1.0950

Fundamental analysis

The EURUSD rate is hovering around the level of 1.0878 on Tuesday.

The stock market holds varied opinions on who will win the US presidential election. Over the weekend, Donald Trump was the favourite, and the US dollar was rising. Now, support has shifted to Kamala Harris.

The major currency pair will undoubtedly experience increased volatility this week. The only question is its direction. According to stock market consensus, the US dollar could decline by 1-2% if Harris wins, and it may rise significantly if Trump emerges victorious.

The election winner will only be known a few days after Tuesday’s vote. Trump will likely challenge any signs of defeat, as he did in 2020.

The EURUSD forecast is cautious.

EURUSD technical analysis

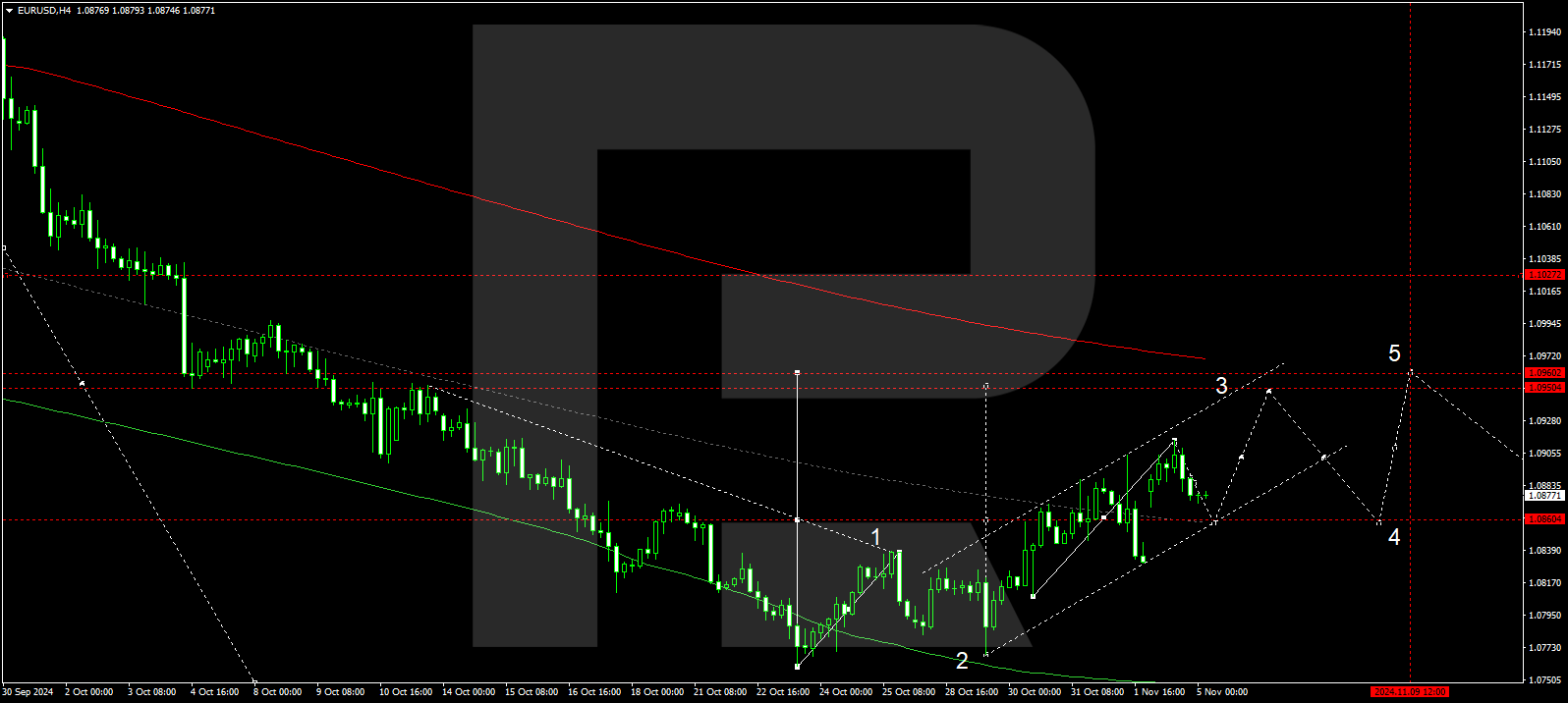

The EURUSD H4 chart shows that the market continues to develop the third growth wave, targeting 1.0950. A growth structure towards 1.0914 has been completed. A wide consolidation range has formed around 1.0860, with a potential technical pullback to 1.0860 (testing from above) today, 5 November 2024. After the price reaches this level, a new growth structure is expected to develop, aiming for 1.0950 as the local target. Subsequently, another downward wave could begin, targeting 1.0860.

The Elliott Wave structure and wave matrix, with a pivot point at 1.0860, technically confirm this scenario. This level is considered crucial for a corrective wave in the EURUSD rate. The market is forming a consolidation range around the central line of a price envelope. A potential breakout above the consolidation range towards 1.0950 may occur today. After reaching this level, the price could retreat to 1.0860 (testing from above). Subsequently, a growth wave could begin, aiming for the upper boundary of the price envelope, with the target at 1.0960.

Summary

The EURUSD pair is retaining strength ahead of a future increase in volatility. Technical indicators for today’s EURUSD forecast suggest that the growth wave could continue towards 1.0950.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.